The Five-Year Rule: A Smarter Way to View Home Prices

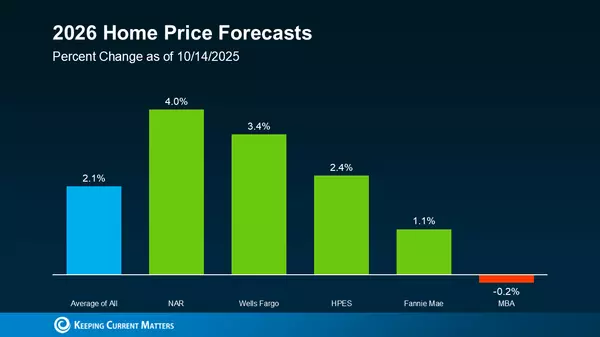

Headlines are pointing to slight home price drops in a few areas. And if that’s making you second guess your plans, here’s what really matters.

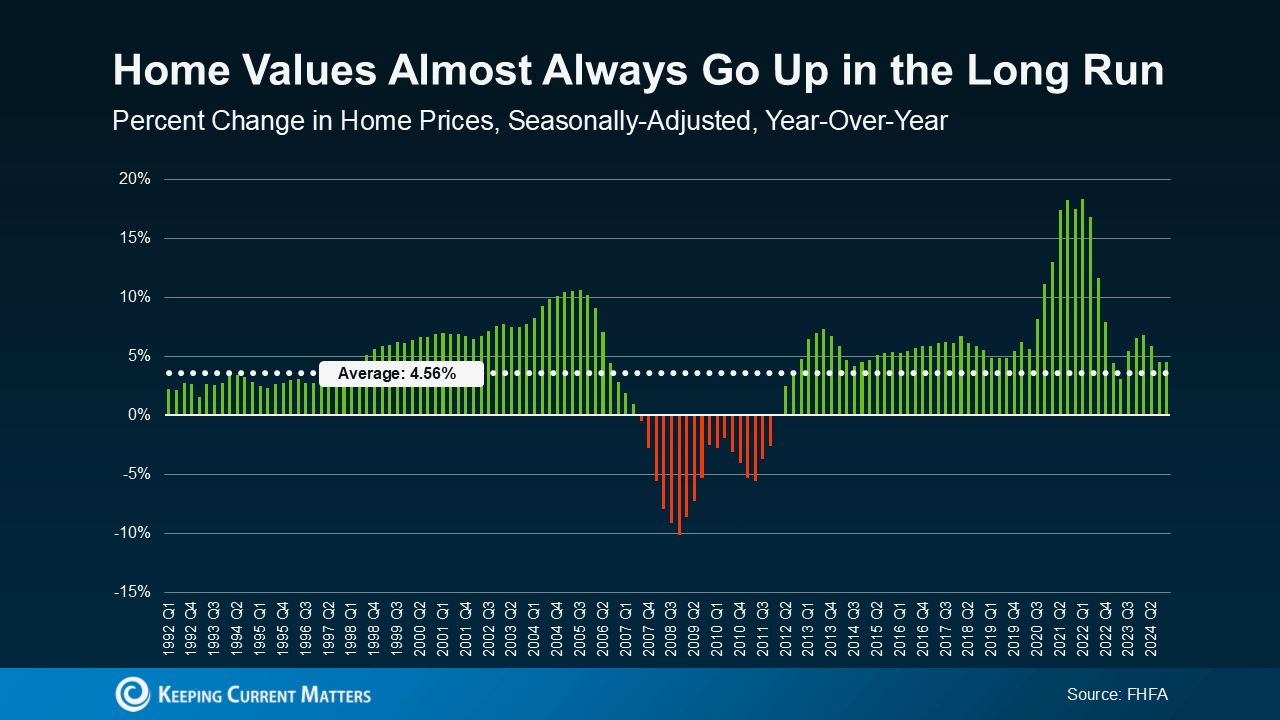

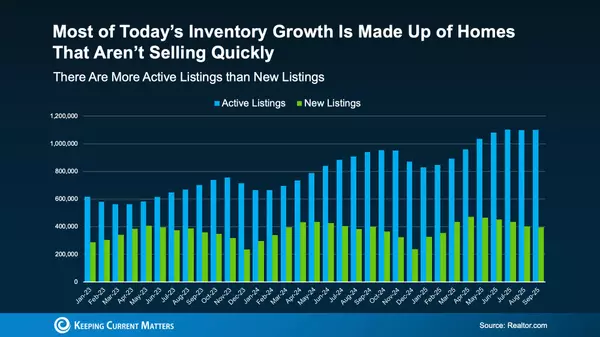

Yes, some metros are seeing minor declines. But don’t lose sight of the bigger trend: home values typically rise over time (just check the graph below).

People often think back to the 2008 housing crash whenever home prices shift. But that event was the exception—not the norm. It was fueled by a perfect storm: overly loose lending practices, homeowners with little equity, and a massive oversupply of homes. That environment is nothing like today’s market. So if you’re seeing headlines about home prices slowing or dipping, don’t assume it means another crash is coming.

This is where the Five-Year Rule comes in.

In real estate, the five-year rule suggests that if you plan to stay in your home for at least five years, short-term price dips usually won’t affect you much. That’s because over time, home values tend to rise. Even if prices soften temporarily, history shows they generally rebound—and then some. As Lance Lambert, Co-Founder of ResiClub, puts it:

“. . . there’s the ‘five-year rule of thumb’ in real estate—which suggests that most buyers can buffer themselves from mild short-term declines if they plan to own a property for at least that amount of time.”

So what’s happening now?

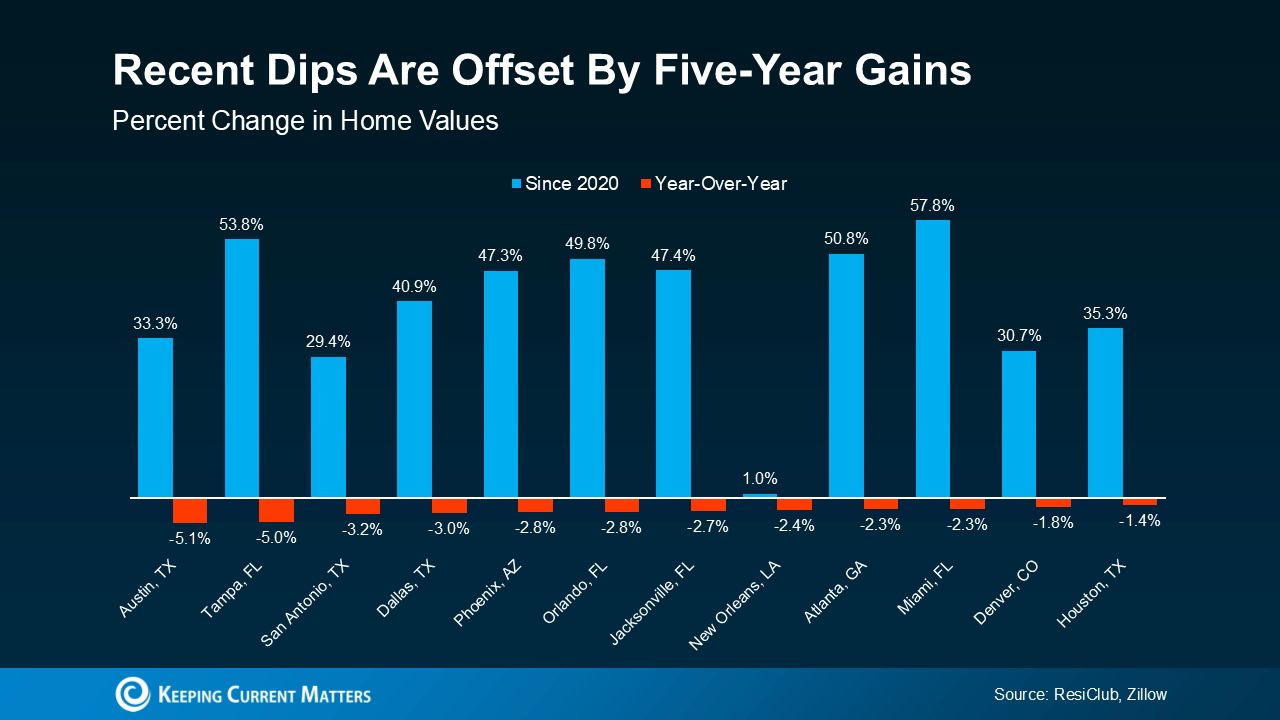

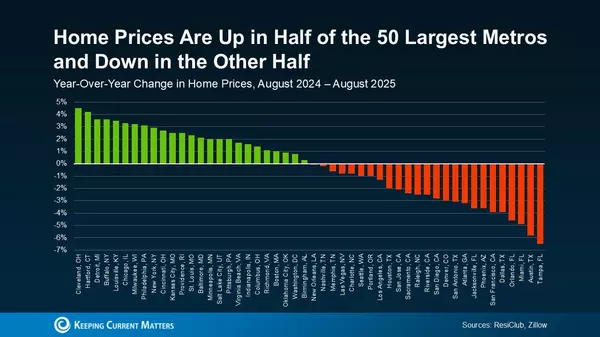

Most markets are still seeing price growth—just at a slower pace than the last few years. And in the major metros where prices are cooling a bit (those marked in red below), the average dip is just -2.9% since April 2024. That’s a far cry from the crash of 2008.

Zoom out, and the bigger picture is clear: in nearly all of these markets, home values are still way up compared to five years ago (shown in blue below). If you’ve owned your home for a few years, chances are you’re still ahead.

The Big Picture

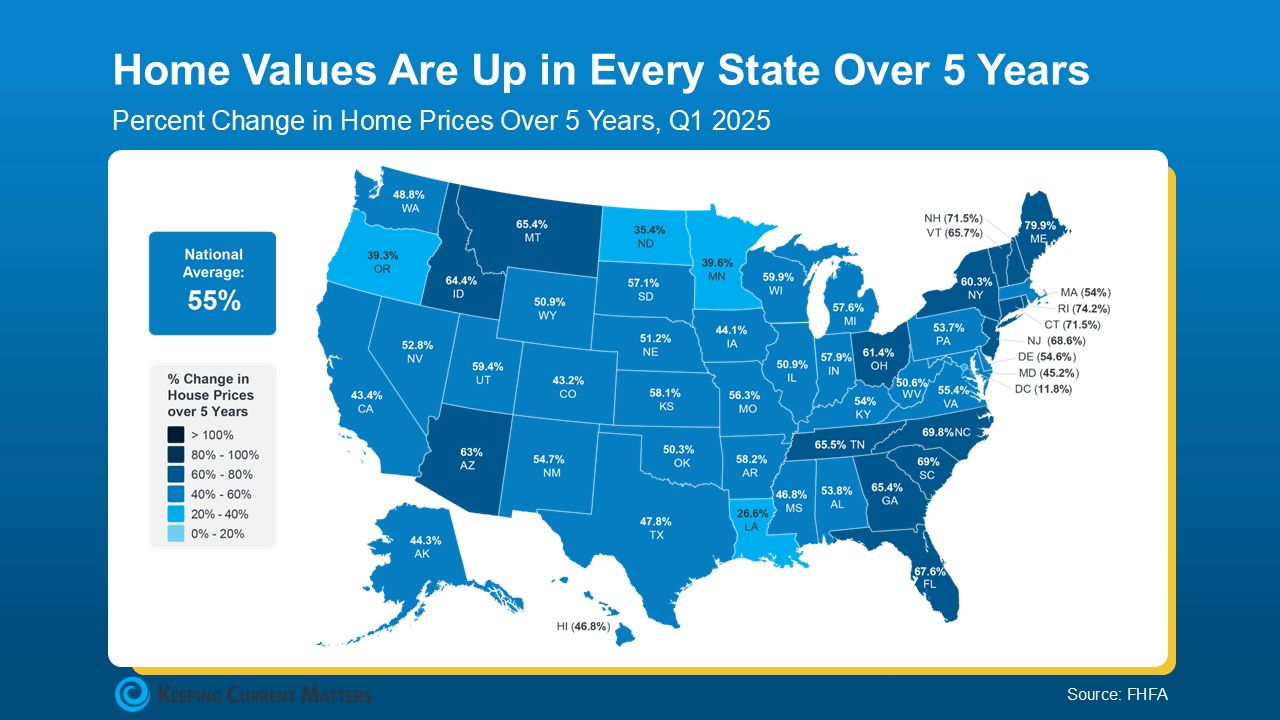

According to the Federal Housing Finance Agency (FHFA), home prices have jumped an impressive 55% over the past five years. So even if your local market has dipped slightly—say, 2%—you’re still likely sitting on major gains.

And when you break that five-year growth down state by state, the data shows home values have increased everywhere across the country (see map below).

That’s why it’s important not to stress too much about what’s happening this month, or even this year. If you’re in it for the long haul (and most homeowners are) your home is likely to grow in value over time.

Bottom Line

Yes, home prices may fluctuate in the short term—but over a five-year span, they almost always trend upward. That’s why the five-year rule is such a helpful guide, whether you’re buying or selling. It keeps the focus on long-term value, not short-term noise.

When you think about where you want to be in five years, how does owning a home fit into that picture?

So, where do you see yourself five years from now? And how could owning a home help you get there?

Let’s connect and map out the next steps together.

Categories

Recent Posts

GET MORE INFORMATION