What To Do When Mortgage Rates Won’t Sit Still

Have you been keeping an eye on mortgage rates lately? One day they dip slightly, and the next they climb right back up. If you’re thinking about buying a home, the back-and-forth can feel confusing — even a little frustrating.

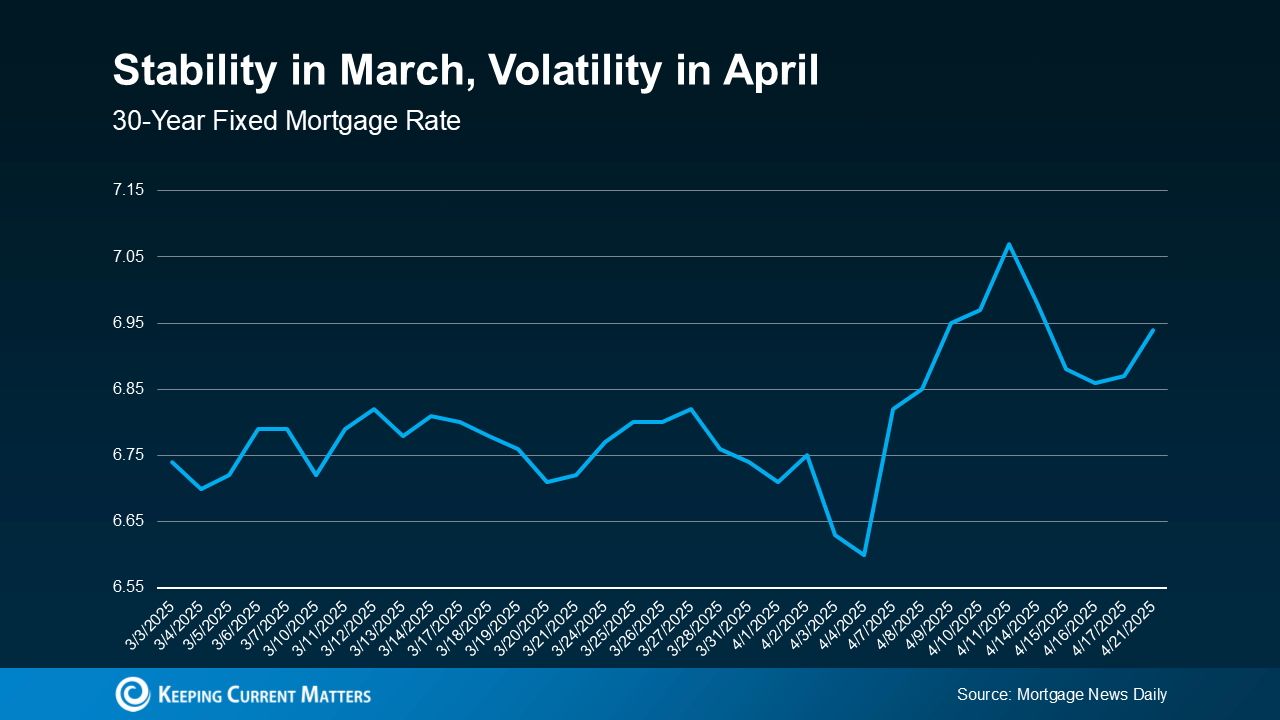

Check out the graph below. Using data from Mortgage News Daily, it shows how mortgage rates held fairly steady through March, only to start zig-zagging through April like a roller coaster.

Fluctuating mortgage rates? That’s no surprise. With the economy shifting, some volatility is expected — and it’s a big reason why trying to “time the market” can be risky. You can’t predict what rates will do next, but here’s the good news: you do have control over key parts of the home loan process that can help you secure a great rate.

Your Credit Score

Your credit score plays a huge role in determining what interest rate you qualify for. Even a small increase in your score can lead to real savings on your monthly mortgage payment. As Bankrate puts it:

"Your credit score is one of the most important factors lenders consider... typically, the higher your score, the lower the interest rates and better terms you’ll qualify for."

If you’re unsure where your score stands or how to boost it, a trusted loan officer can help guide you.

Your Loan Type

Not all loans are created equal. From conventional to FHA, VA, and USDA options, different loan types have different requirements — and they can offer very different rates. According to the Consumer Financial Protection Bureau:

"Rates can be significantly different depending on what loan type you choose."

That’s why shopping around and speaking with multiple lenders is smart. The right loan product can make a big difference.

Your Loan Term

You also get to choose how long you want to take to pay off your loan — and that choice can impact your interest rate and monthly payment. Freddie Mac explains it like this:

"Your loan term will affect your interest rate, monthly payment, and the total amount of interest you’ll pay over the life of the loan."

Whether it's 15, 20, or 30 years, the term you pick should align with your long-term goals and budget. Ask your lender to walk you through the options.

Bottom Line

While you can’t control the ups and downs of the economy or where mortgage rates are headed next, you can take proactive steps to position yourself for the best possible rate.

By connecting with a trusted local real estate agent and a knowledgeable lender, you’ll get expert guidance on what actions to take now — from improving your credit score to exploring your loan options — so you’re in a strong financial position when the right home comes along.

Categories

Recent Posts

GET MORE INFORMATION