Why Today’s Foreclosure Rates Won't Lead to a Market Crash

With everything feeling pricier lately, it’s natural to worry about how rising costs might impact the housing market. Many are concerned that high prices and tighter budgets could lead to more homeowners falling behind on their mortgage payments, potentially sparking a surge in foreclosures.

But before worrying about a housing market crash, let’s look at what’s really going on. The good news is: the latest foreclosure data shows no major wave on the horizon.

How Today’s Market Differs from 2008

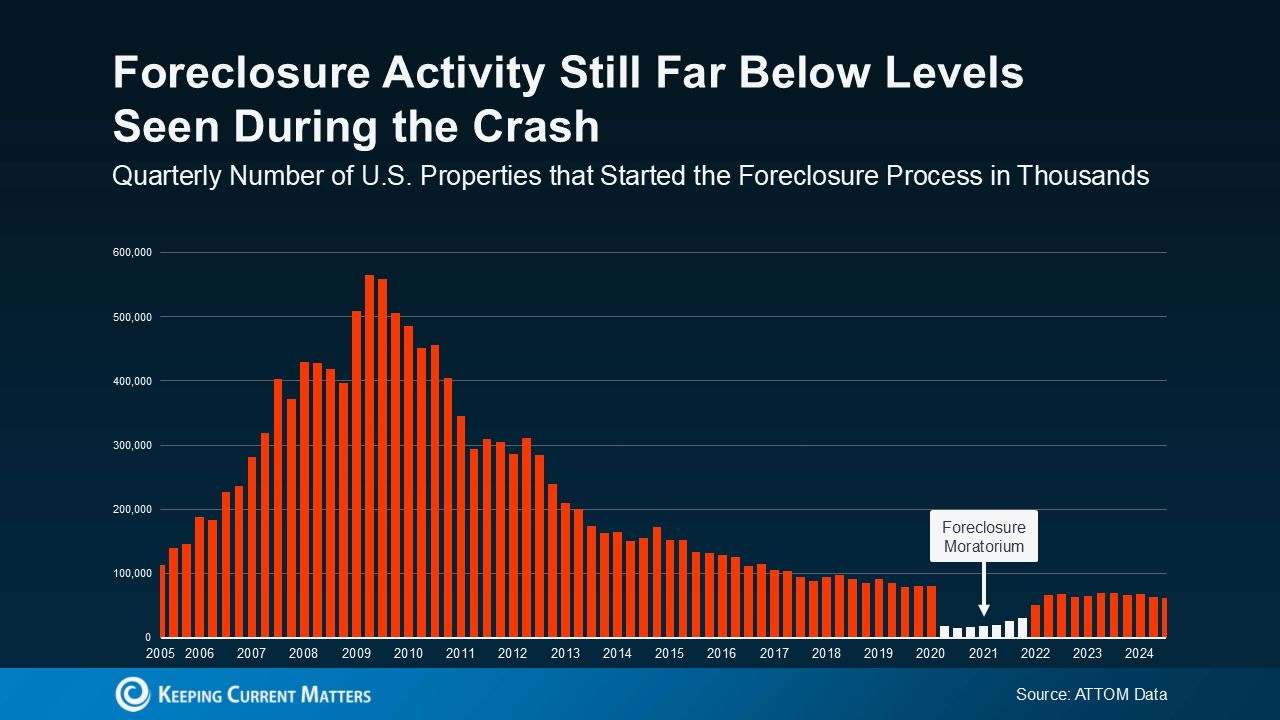

Let’s ease those concerns by zooming out for a clearer picture. The graph below uses research from ATTOM, a property data provider, to illustrate how the number of homeowners entering foreclosure today is far lower than in the aftermath of 2008. Back then, foreclosure rates spiked dramatically. Today, the numbers are much lower – and have even dropped in the latest report. The difference between now and the 2008 housing crash is significant (see graph below):

In case you're wondering why foreclosure filings have ticked up slightly since 2020 and 2021, here’s the scoop: during those years, a foreclosure moratorium (indicated in white) was put in place to help millions of homeowners avoid foreclosure during tough times. That’s why foreclosure numbers were unusually low then. If we look further back, it’s clear that filings have significantly decreased overall.

And if you’re curious how foreclosure rates remain low even with today’s higher cost of living, here’s why: homeowners now have much more equity built up in their homes compared to 2008. As a recent article from Bankrate puts it:

“After the housing crash, millions of foreclosures flooded the market, depressing prices. That’s not the case today. Most homeowners have a comfortable equity cushion.”

This equity serves as a safety net, allowing many homeowners to avoid foreclosure even if they face financial challenges. Homeowners struggling to make payments today often have the option to sell their homes and bypass foreclosure, a very different scenario from the 2008 crash when many owed more than their homes were worth.

Looking Ahead for the Housing Market

While higher living costs are challenging for many, they don’t point to an increase in foreclosures. The equity cushion many homeowners hold is keeping foreclosure filings low, offering today’s homeowners more ways to avoid foreclosure altogether.

Bottom Line

Yes, daily expenses like gas and food have become pricier—but that doesn’t signal an impending foreclosure crisis in the housing market. The data clearly indicates we’re far from a foreclosure wave. Unlike in 2008, today’s homeowners are in a much stronger financial position, largely due to substantial home equity.

Categories

Recent Posts

GET MORE INFORMATION