Your Home’s Current Value: What the Latest Market Says

We check our bank accounts regularly—but what about our biggest asset? If you’re a homeowner, your property might be building wealth for you quietly behind the scenes. The real question is: do you know how much it’s worth today?

For most people, a home is their largest investment. And if you’ve owned yours for a few years or more, chances are it’s gained serious value over time. You might be sitting on more equity than you realize.

So, What Exactly Is Home Equity?

Home equity is the difference between what your home is worth and what you still owe on your mortgage. It grows as you pay down your loan and as home values rise. For example, if your home is valued at $500,000 and you still owe $200,000, you have $300,000 in equity. That’s real, usable wealth.

And you’re not alone—according to Cotality (formerly CoreLogic), the average homeowner with a mortgage is sitting on around $311,000 in equity.

Why Is There So Much Equity Out There?

Here are the two main reasons homeowners like you have record amounts of equity right now:

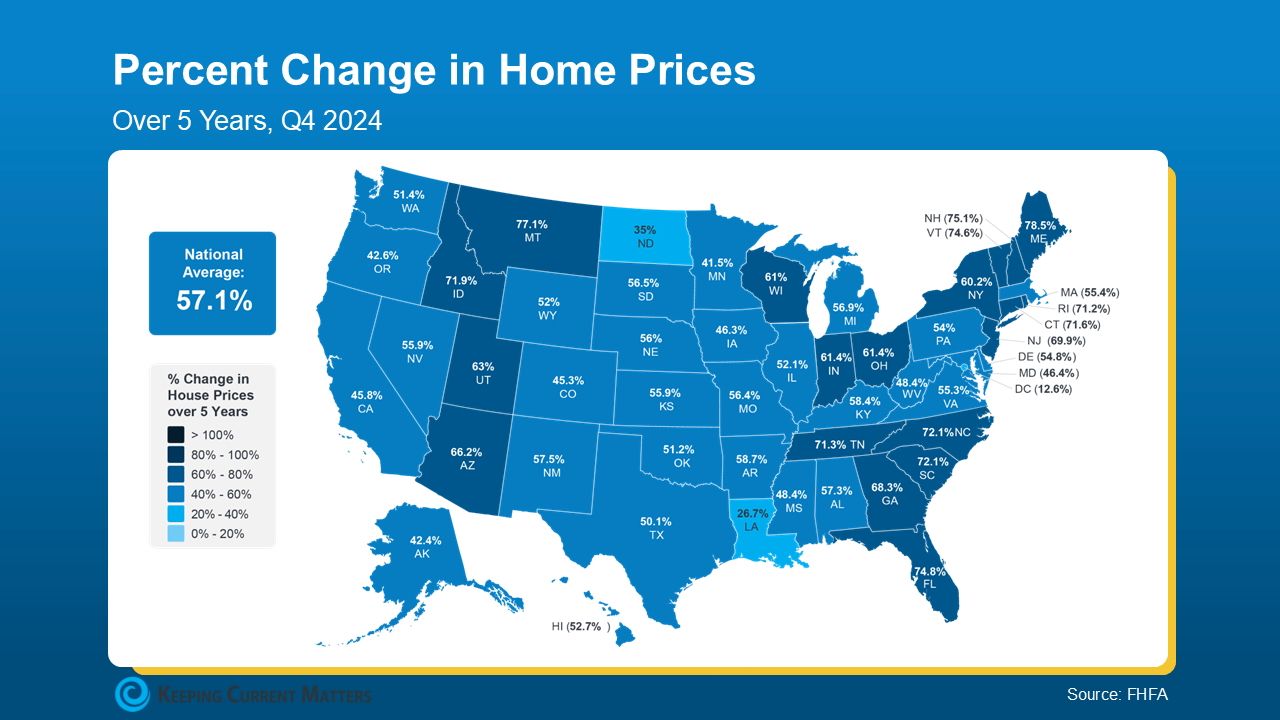

1. Home Prices Have Risen Sharply. According to the Federal Housing Finance Agency (FHFA), home prices have increased by over 57% nationwide in just the past five years.

So, if you bought your home a few years ago—or even longer—there’s a good chance it’s worth significantly more today. That kind of price growth means your home has likely gained value without you even realizing it.

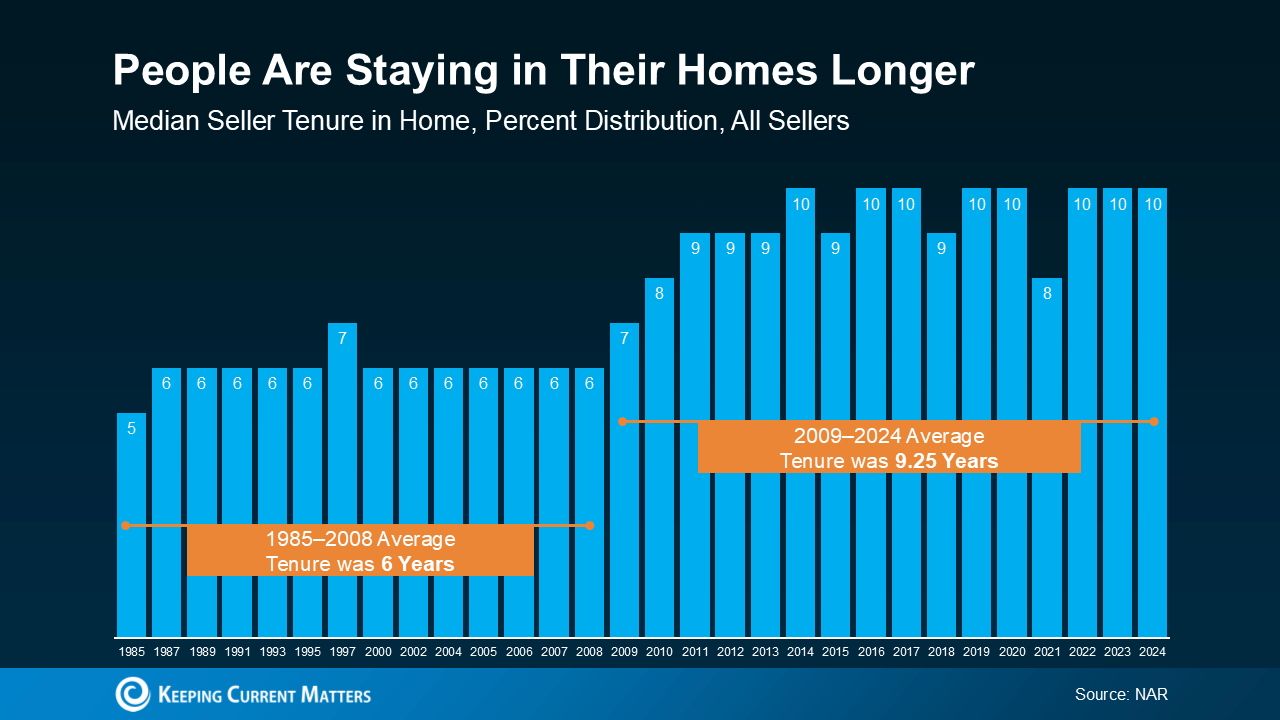

2. Homeowners Are Staying Put Longer. According to the National Association of Realtors (NAR), the typical homeowner now stays in their home for around 10 years—a noticeable increase from past decades. (See graph below.) This shift means more people are holding onto their homes longer, which often leads to greater equity growth over time.

That’s a Lot of Time—And a Lot of Equity Ten years in a home may feel like it flies by, but in that time, you’ve likely built up serious equity—just by paying your mortgage and benefiting from rising home prices. And the impact? It’s bigger than most realize.

According to the National Association of Realtors (NAR):

“Over the past decade, the typical homeowner has gained $201,600 in wealth from price appreciation alone.”

That’s real money—without needing to do anything but live in your home.

What Could You Actually Do with That Equity?

Your home is more than just a place to live—it’s one of your most powerful financial tools. And tapping into that equity could help you move forward in exciting ways:

- Buy your next home. Use your equity toward a down payment—or in some cases, buy your next place outright in cash.

- Upgrade your current space. Want to finally tackle those renovations? Equity can help fund improvements that boost both function and value.

- Fund a dream project or business. Your equity could be the launchpad for something big—whether that’s opening a business, investing, or funding a passion project.

Bottom Line

Chances are, your home is worth far more than you think. Whether you're considering selling, planning an upgrade, or simply exploring your financial options, remember—your equity isn't just a number on paper. It's a powerful financial tool that could help you take your next step with confidence.

Imagine selling your home and walking away with significant equity—what would you do with it? Would you invest in a new place that fits your lifestyle better, fund a passion project, or build long-term wealth?

Whatever your goals, don’t leave that potential untapped. Connect with a local real estate expert who can help you understand your home’s current value and explore how to turn that equity into your next big move.

Categories

Recent Posts

GET MORE INFORMATION