2 Key Pieces Shaping Your Mortgage Rate

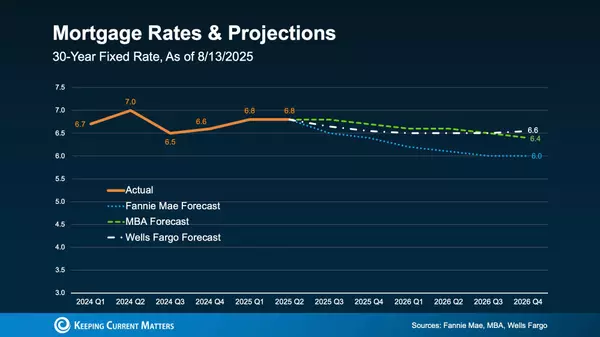

If you're in the market for a home, chances are you've been closely monitoring mortgage rates. In the past few years, they reached unprecedented lows, experienced significant increases, and are currently showing a slight decline. Have you ever pondered the reasons behind these fluctuations?

The explanation is complex as numerous factors can impact mortgage rates. Here, we shed light on a few of the most influential elements at play.

Inflation and the Federal Reserve

While the Federal Reserve (Fed) doesn't directly determine mortgage rates, it does adjust the Federal Funds Rate in response to factors like inflation, the economy, and employment rates. As these adjustments occur, mortgage rates tend to react accordingly, as explained by Business Insider.

"The Federal Reserve curbs inflation by increasing the federal funds rate, indirectly influencing mortgages. Elevated inflation and investors anticipating additional Fed rate hikes can lead to an upward push on mortgage rates. Conversely, if investors anticipate rate cuts from the Fed and a slowdown in inflation, mortgage rates usually trend downward."

In recent years, the Federal Reserve increased the Federal Funds Rate in an effort to combat inflation, causing a corresponding rise in mortgage rates. Fortunately, the expert consensus on the outlook for inflation and mortgage rates suggests improvement over the course of the year. According to Danielle Hale, Chief Economist at Realtor.com:

"Mortgage rates are expected to continue declining in 2024, with improvements in inflation being a contributing factor..."

There are discussions suggesting that the Federal Reserve might consider lowering the Fed Funds Rate this year due to a moderation in inflation, even though it hasn't yet reached their desired target.

The 10-Year Treasury Yield

Moreover, mortgage firms consider the 10-Year Treasury Yield when determining the interest rates for home loans. If the yield increases, mortgage rates typically follow suit. Conversely, the reverse holds true, as outlined by Investopedia.

"Mortgage lenders commonly align their interest rates with the 10-year Treasury bond yield, a frequently utilized government bond benchmark."

Traditionally, the margin between the 10-Year Treasury Yield and the 30-year fixed mortgage rate has displayed relative stability, but this pattern has shifted in recent times. This implies there is potential for a decrease in mortgage rates. Therefore, monitoring the direction of the treasury yield provides experts with insights into the potential trajectory of mortgage rates.

Bottom Line

As the Federal Reserve convenes later this week, industry experts will closely monitor their decisions and assess the potential impact on the economy. To adeptly navigate any shifts in mortgage rates and their implications for your relocation plans, it is advisable to enlist the support of a team of professionals.

Categories

Recent Posts