Analysts Predict Continued Home Price Growth in Coming Years

Despite evidence indicating a continued upward trend in home prices across most of the country, a significant portion of the population remains apprehensive about an imminent market crash. A recent Fannie Mae survey reveals that 23% of consumers anticipate a decline in home prices over the next 12 months, highlighting the pervasiveness of this concern.

While a recent Fannie Mae survey indicates that nearly one in four consumers harbor concerns about a near-term home price crash, expert projections paint a more optimistic picture. Rather than a sudden decline, experts anticipate a gradual deceleration of price growth over the next five years, with annual appreciation rates expected to fall within the low to mid-single digits. This means that home prices are likely to continue rising, albeit at a less rapid pace than in recent years.

Experts Project Ongoing Appreciation

Despite the prevailing anxiety surrounding a potential home price crash, a growing consensus among expert suggests a more favorable outlook. Instead of a sudden market collapse, a gradual deceleration of price growth is anticipated over the next five years. This implies that home values will continue to rise, though at a less rapid pace than in recent years.

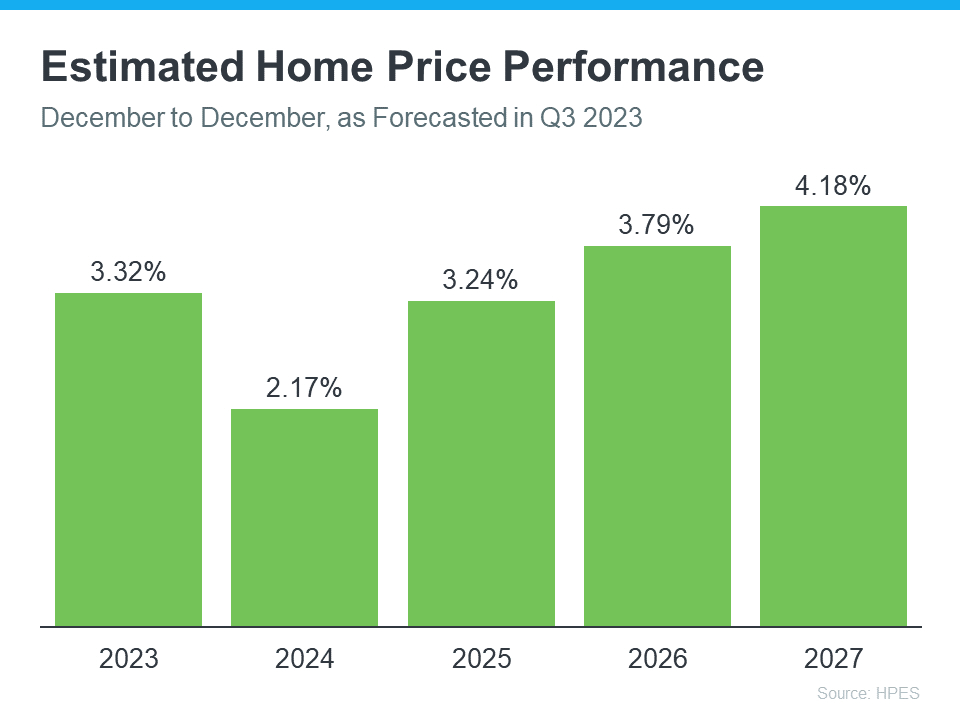

The Home Price Expectation Survey (HPES) conducted by Pulsenomics offers valuable insights into expert forecasts for home prices over a five-year horizon. Gathering projections from over 100 economists, investment strategists, and housing market analysts, the HPES provides a comprehensive overview of market expectations. The latest quarterly release of the survey indicates an upward trend in home prices, with anticipated growth each year through 2027 (illustrated in the accompanying graph).

While the projected home price appreciation in 2024 is slightly lower than in 2023, it's crucial to remember that home price appreciation is cumulative. This means that if expert projections hold true, following a 3.32% increase in home value this year, an additional 2.17% growth is anticipated next year. Over time, this cumulative effect can significantly impact your home's equity.

If you have concerns about a potential decline in home prices, here's the key message: Despite regional variations, experts anticipate a sustained nationwide increase in prices for the foreseeable future, aligning with a more typical market pace.

What Does This Mean for You?

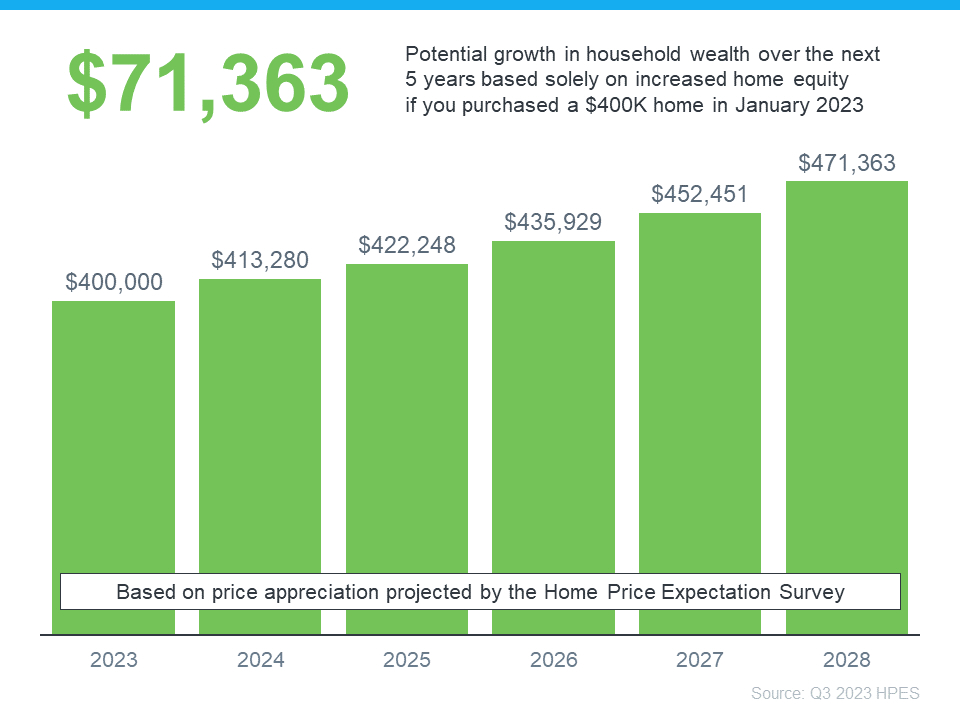

If you remain unconvinced, perhaps these figures will capture your interest. They illustrate the potential fluctuations in the value of an average home over the next few years based on the expert forecasts from the HPES. Refer to the graph below for a visual representation.

Consider this scenario: Suppose you purchased a $400,000 home at the start of this year. Taking into account the projections from the HPES, you have the potential to amass over $71,000 in household wealth over the next five years.

Bottom Line

Amidst concerns about a potential decline in home prices, a chorus of experts is projecting a sustained upward trajectory for the housing market. Contrary to fears of a market crash, home prices are expected to continue rising not just next year, but for years to come. This positive outlook is supported by strong demand, limited inventory, and favorable demographics. While the overall national trend points towards continued home price appreciation, it's important to consider the specific dynamics of your local market. For tailored insights and guidance, connecting with a trusted real estate agent can provide valuable information on the factors influencing home prices in your area.

Categories

Recent Posts

GET MORE INFORMATION