Building Wealth Through Homeownership

Pause for a moment and envision your aspirations for the upcoming years. Perhaps you're contemplating your career, financial security, the pursuit of greater stability, or the achievement of your imminent objectives. Does the idea of owning a home play a role in this vision? If it does, it's important to understand that homeownership offers a multitude of financial advantages.

One of the main benefits of buying a home is that it can help you build wealth and gain financial stability. This is because the value of most homes increases over time, which increases your net worth.

Here is how home values are rising right now:

- According to Zillow, the average home value in the United States is $349,770, up 0.4% over the past year.

- Home values are rising in most US metropolitan areas. For example, home values in the San Francisco Bay Area have increased by 10% over the past year.

- There are a few factors driving the rise in home values, including low mortgage interest rates, a strong economy, and limited housing supply.

If you are considering buying a home, it is important to do your research and understand the factors that affect home values. You should also consider your financial situation and make sure you can afford to buy and maintain a home.

"The collective worth of the housing market in the United States, representing the cumulative estimated value of all American homes by Zillow, presently stands at just under $52 trillion, marking a notable increase of $1.1 trillion compared to the previous peak recorded in June."

In essence, owning a home serves as a substantial instrument for amassing wealth. Given the resurgence of home values throughout the country, this could be an opportune moment to contemplate whether homeownership aligns with your financial aspirations.

Let's take a look at some data that shows the impact of homeownership on wealth.

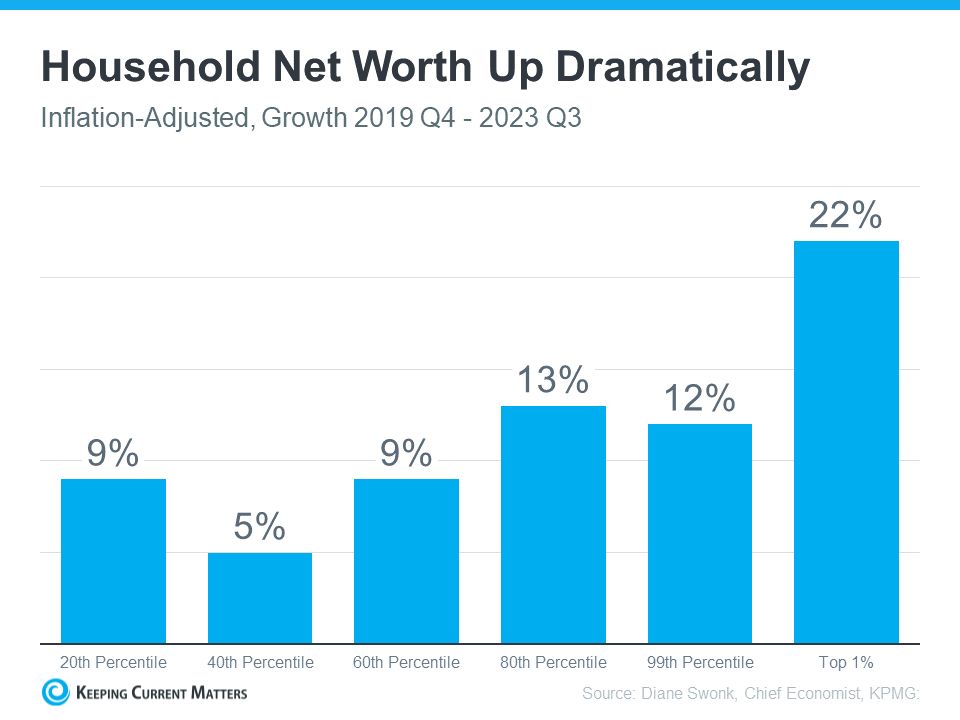

Household Net Worth Is Rising

According to the data, the top 1% experienced the greatest net worth increase, but people in all tax brackets have seen their wealth grow in recent years (see graph below).

For a substantial number of these individuals, the increasing value of their homes significantly contributes to this phenomenon.

Owning a Home Helps You Achieve Financial Success

The large gap in net worth between homeowners and renters suggests that homeownership played a major role in this wealth growth. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

“Owning a home is a great way to build wealth for people of all backgrounds. A monthly mortgage payment can be seen as a forced savings plan that helps homeowners build a net worth that is about 40 times higher than that of renters."

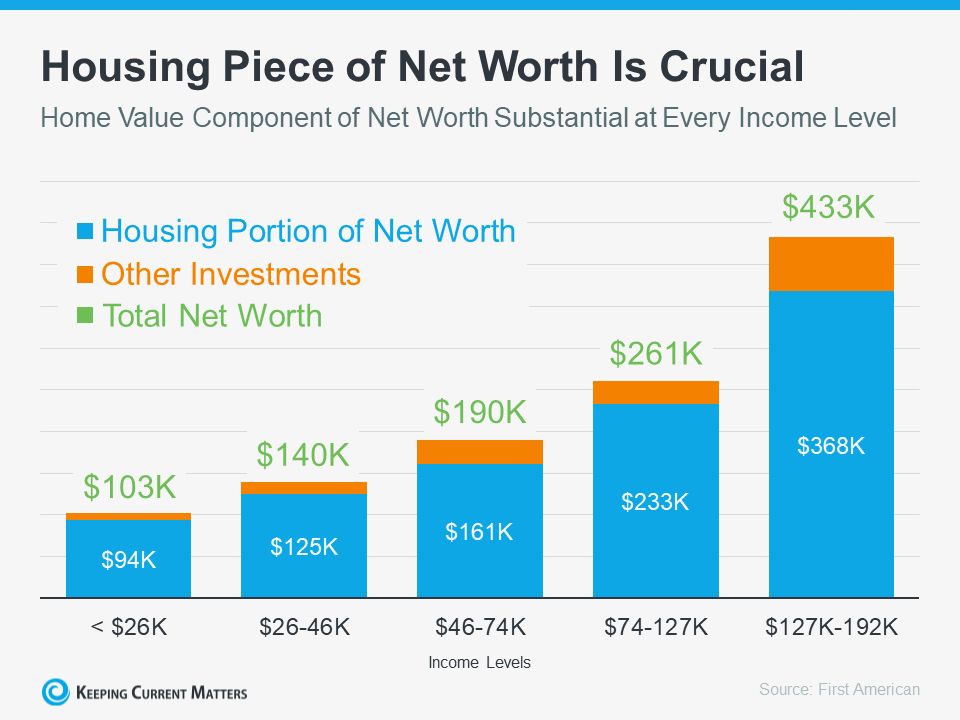

What's the primary driver behind this? Homeowners accumulate equity. Home equity represents the value of your home minus your outstanding mortgage balance, and for the majority of homeowners, it stands as the most significant component of their net worth. This fact is substantiated by data from First American (refer to the graph below).

The blue portion of each bar shows the share of net worth that is tied up in housing. It is much larger than the share tied up in other investments, such as stocks, gold, and cryptocurrencies. This shows that homeownership is the most important factor in building wealth for most households, regardless of income level.

Bottom Line

Homeownership is a great way to build wealth over time. Contact a local real estate agent to learn more about your options and get started on your homeownership journey.

Categories

Recent Posts

GET MORE INFORMATION