Common Questions About Selling Your House

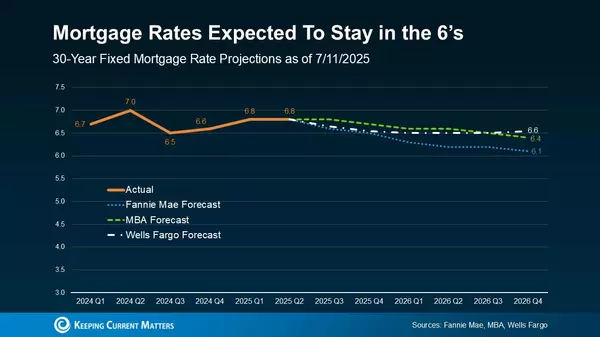

There's no doubt that mortgage rates are significantly impacting today's housing market. This might leave you wondering whether it still makes sense to sell your house and move.

Here are three key questions you might be asking, along with the data that provides answers.

1. Should I Hold Off on Selling?

If you're contemplating delaying the sale until mortgage rates decrease, it's essential to understand that many others are considering the same strategy. Although mortgage rates are projected to decrease later this year, waiting could result in facing heightened competition as both buyers and sellers re-enter the market. According to Bright MLS:

"Even a modest reduction in rates will attract more buyers and sellers to the market."

Consequently, if you choose to wait, you may encounter challenges such as faster price escalation and an increase in multiple-offer situations when purchasing your next home.

2. Is There Still Demand from Buyers?

However, this doesn't imply that the market is stagnant. Despite some individuals postponing their plans, there remains a significant number of active buyers. Here's the data to substantiate this.

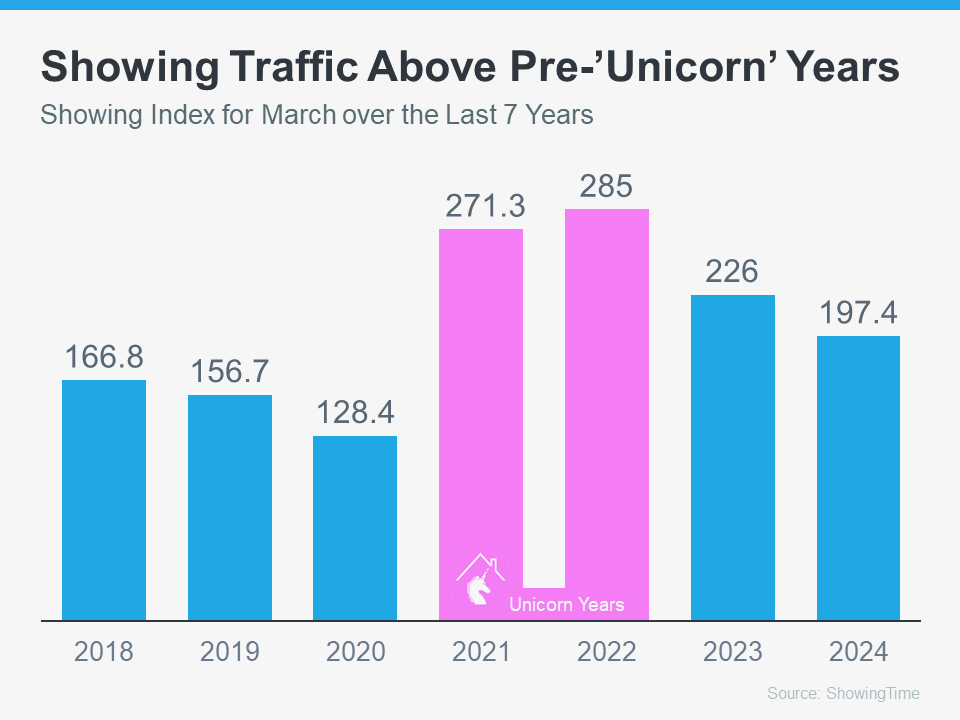

The ShowingTime Showing Index provides insight into the frequency of home tours by prospective buyers. The following graph utilizes this index to illustrate buyer activity for March (the most recent available data) over the past seven years:

You may observe a decline in demand since the 'unicorn' years (illustrated in pink). This decline can be attributed to various market factors such as higher mortgage rates, escalating prices, and limited inventory. However, to accurately gauge today's demand, it's essential to compare our current situation with the last typical years in the market (2018-2019), rather than the abnormal ‘unicorn’ years.

By focusing solely on the blue bars, you can assess how 2024 compares. This offers a fresh perspective.

Nationally, demand remains robust compared to the last typical years in the housing market (2018-2019). Consequently, there is still a viable market for selling your house.

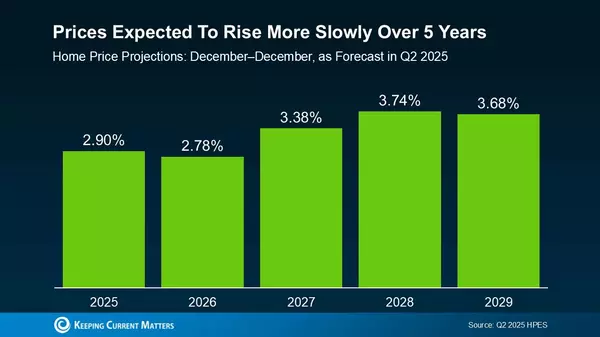

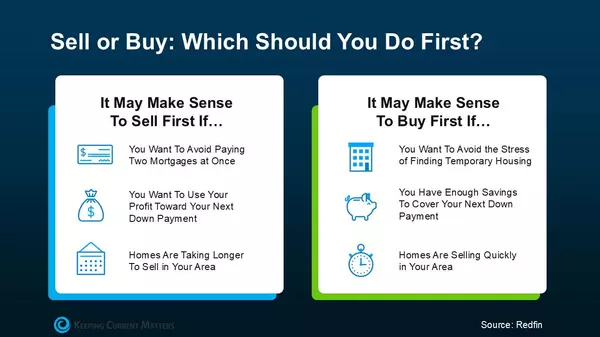

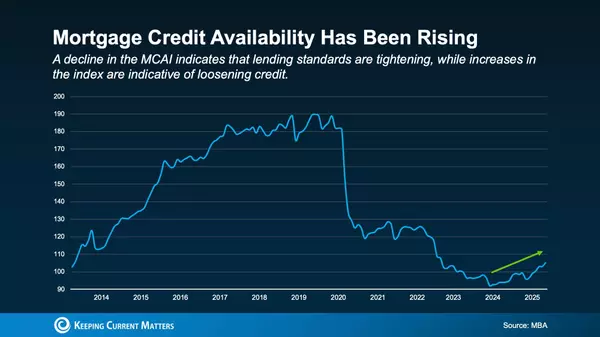

3. Will I Be Able to Afford Purchasing My Next Home?

If you're concerned about the affordability of your next move given today's rates and prices, consider this: you likely possess more equity in your current home than you realize.

Homeowners have accumulated unprecedented levels of equity in recent years, which can significantly impact your ability to purchase your next home. You might even have sufficient equity to become an all-cash buyer, eliminating the need for a mortgage altogether. According to Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR):

" . . . those who have accrued housing equity through home price appreciation are the current winners in today's housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions."

Bottom Line

If you've been grappling with these three questions and they've been impeding your decision to sell, hopefully, having this information now will be beneficial. A recent survey conducted by Realtor.com discovered that over 85% of potential sellers have been contemplating selling for more than a year, indicating that there are numerous sellers like you who are undecided.

However, the same survey also interviewed sellers who recently opted to list their properties. Surprisingly, 79% of these recent sellers expressed regret for not having sold sooner.

If you desire further discussion on any of these questions or require additional information, consider reaching out to a real estate agent.

Categories

Recent Posts