Fannie Mae's Latest Prediction: Anticipated Drop in Mortgage Rates Below 6% for 2024

Fannie Mae has unveiled its revised projection for the housing market in 2024, indicating a forecast of mortgage rates falling below 6% in the fourth quarter.

The year 2023 presented a varied scenario, characterized by unstable mortgage rates, diminished mortgage originations, and unprecedented lows in inventory. Despite these challenges, there was substantial growth in home prices and new home construction.

Fannie Mae economists anticipate the stabilization of housing and mortgage markets in 2024, moving away from the turbulence experienced in the past several years. Although their projection suggests the possibility of the Fed initiating rate cuts no earlier than May, a recession is no longer included in their baseline forecast for the year.

It foresees the persistence of several challenging dynamics from 2023, including restricted housing affordability, limited inventory, and the lock-in effect, into the year 2024.

However, there is also an observation of a potential rebound in existing home sales, coupled with a moderation in home price appreciation and a more consistent level of new home construction.

Mortgage Rates Head Back to Familiar Territory in 2024

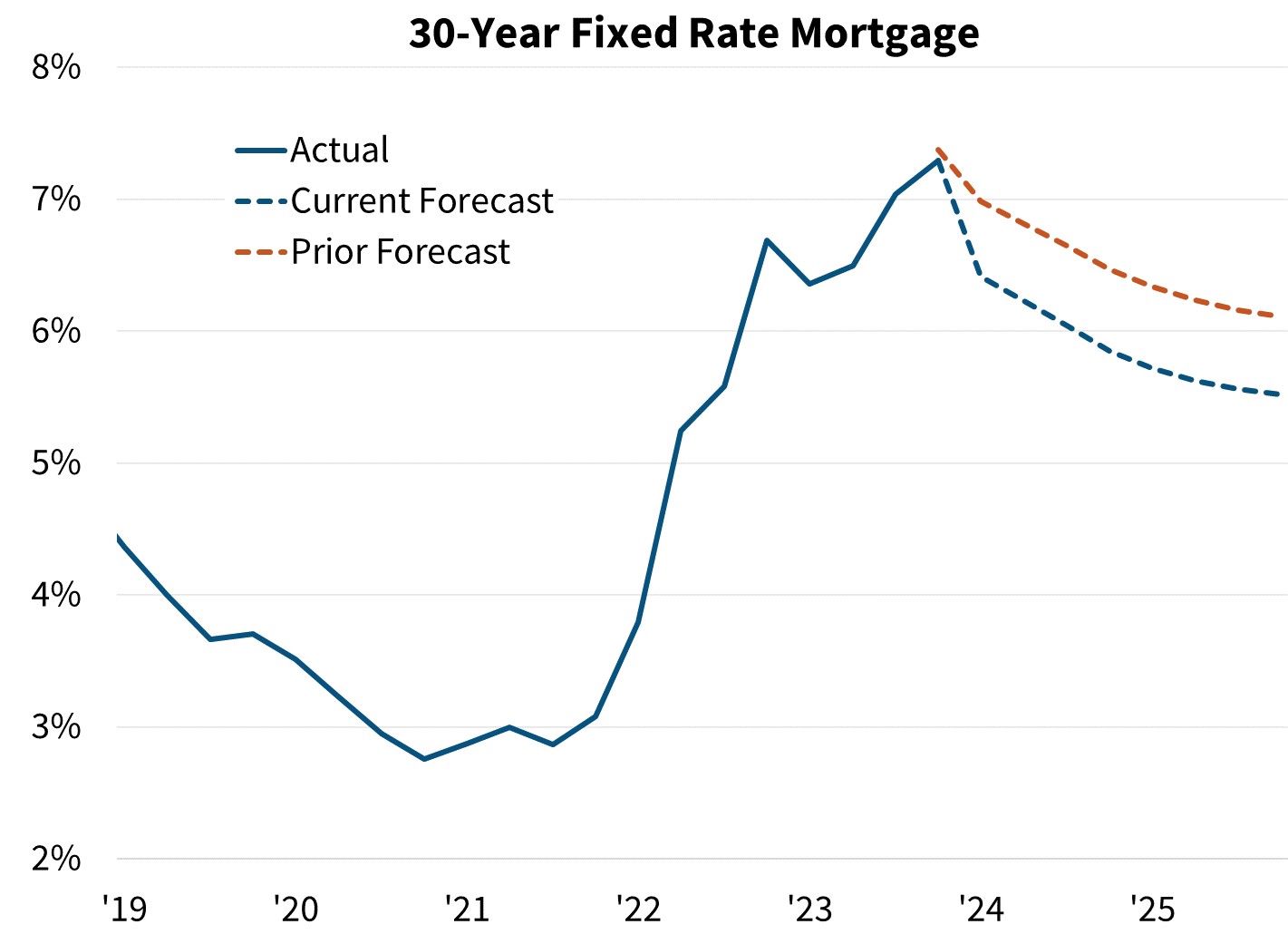

Although a return to mortgage rates of 2.5–3% is not foreseen in the near future, Fannie Mae economists do anticipate rates moving closer to more typical levels this year, potentially falling below 6% in the final quarter.

The December FOMC meeting is viewed by many as a shift towards a more neutral monetary policy. Interpreting this, futures markets indicate an expectation of 125-150 basis points (bps) in fed rate cuts by the close of 2024, while Fannie Mae's present forecast incorporates a 100 basis point decline within this year.

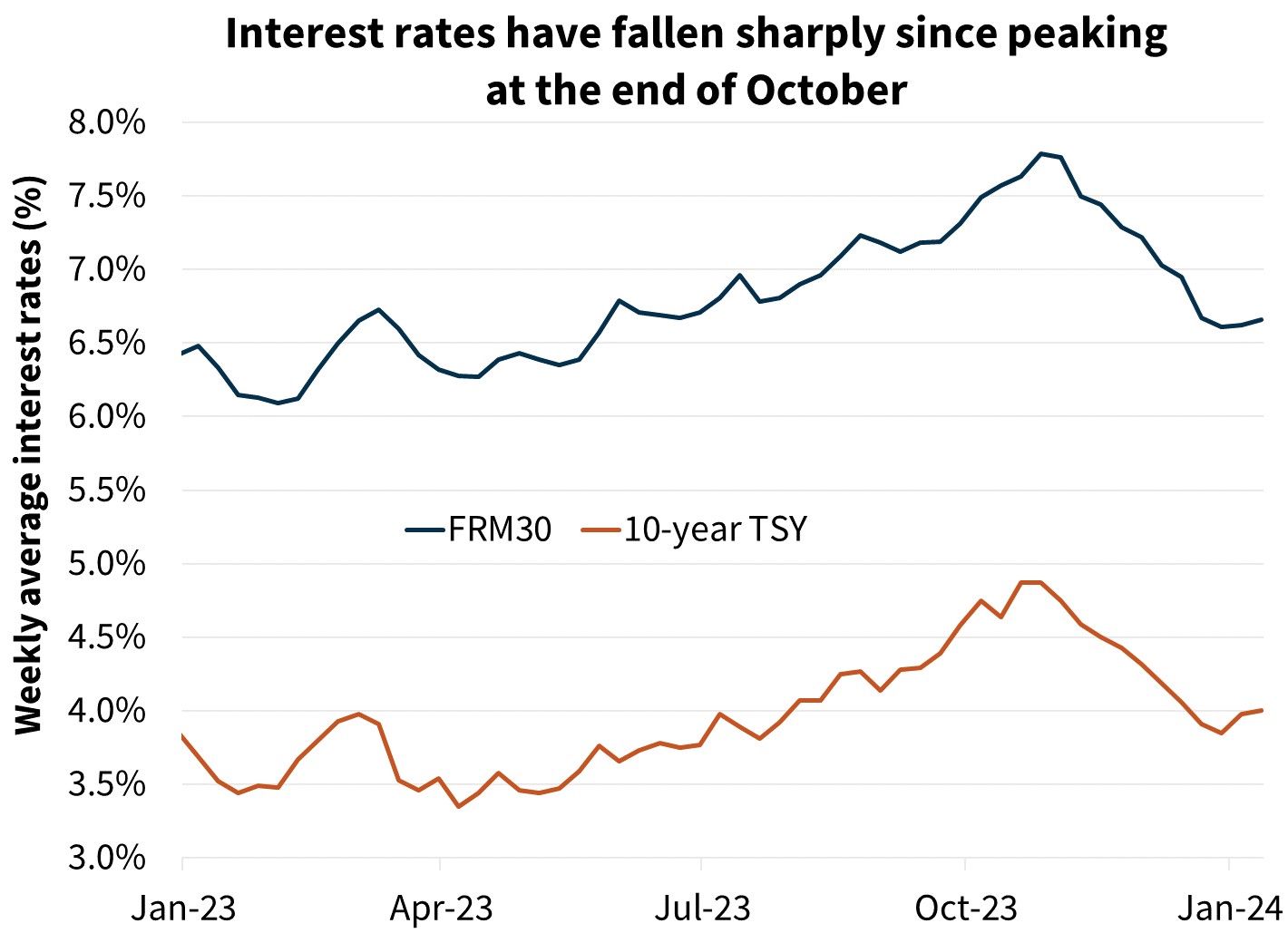

The 10-year Treasury Yield has seen a decline of approximately 100 basis points since its peak in October, and the 30-year fixed rate has mirrored this trend, reaching 6.60% as per Freddie Mac's weekly averages as of January 18th.

Therefore, even though Fannie Mae economists anticipate a relatively moderate decrease in the federal funds rate this year, their projections for both the 10-year Treasury and the 30-year fixed mortgage rates are lower than their earlier forecasts for 2024.

Existing Home Sales Ready to Heat Up in 2024

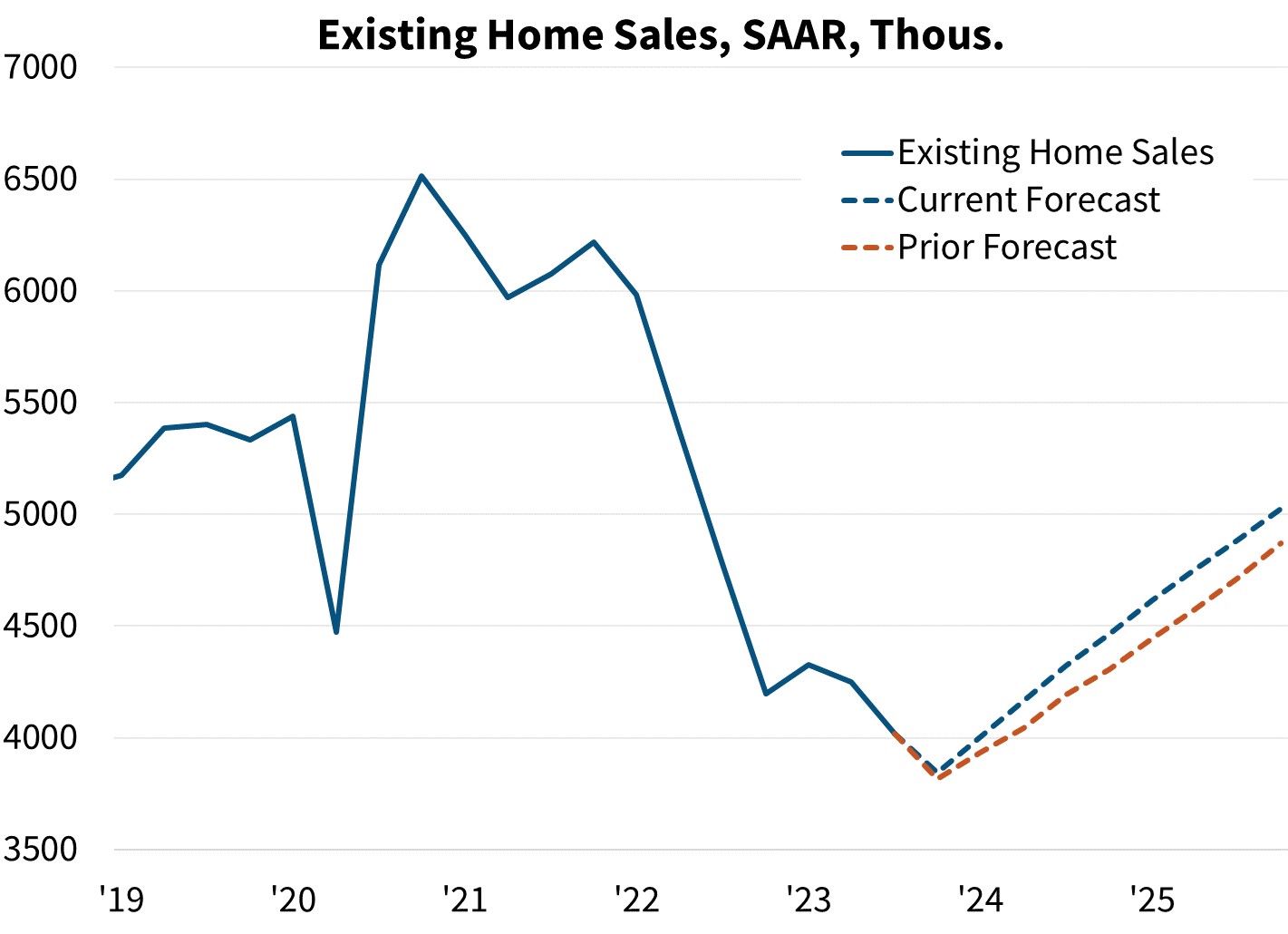

As per Fannie Mae's latest forecast, affordability challenges and a constrained supply of available inventory are expected to persist this year. However, economists anticipate that the relaxation in mortgage rates will invigorate the existing home sales market, which, throughout much of 2023, was hindered by a significant lock-in effect, as approximately 80% of homeowners were locked into lower mortgage rates.

During 2020 and 2021, numerous homebuyers and sellers likely accelerated their plans to capitalize on historically low mortgage rates and the rise in remote work opportunities. However, by 2023, there was a decrease in the number of homeowners planning to relocate.

Over time, Fannie Mae anticipates a growing number of homeowners, who postponed moving in 2023 due to elevated mortgage rates, to seize the opportunity presented by declining rates. This is expected to result in a rise in home sales this year.

Sales of Newly Constructed Homes

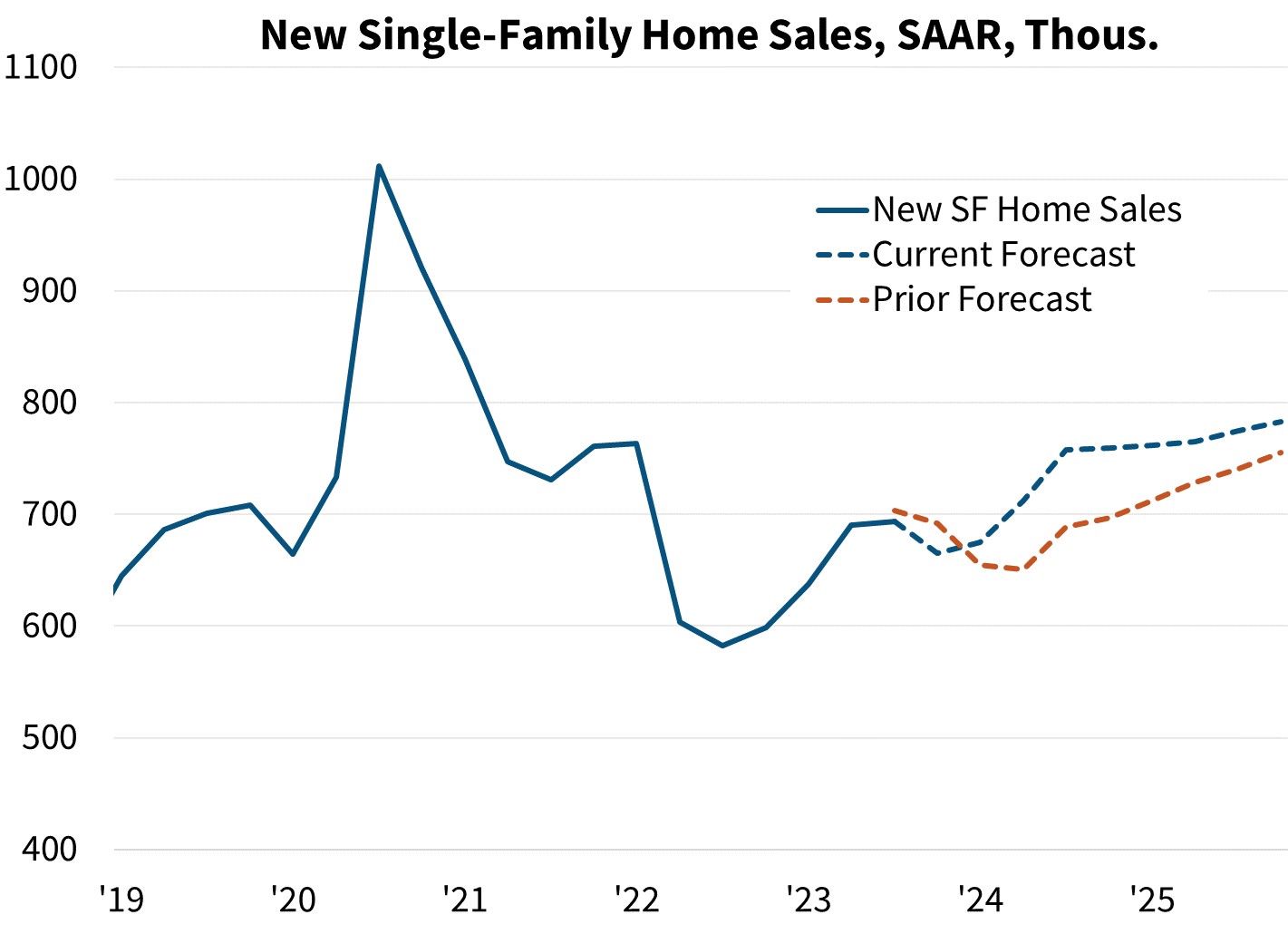

In November 2023, the sales of new single-family homes experienced a 12.2% decline, reaching a seasonally adjusted annualized rate of 599,000.

However, the revised trajectory for mortgage rates, coupled with Fannie Mae excluding a recession from their baseline forecast, prompted them to enhance their projection for new home sales. This is particularly significant as this metric has a historical sensitivity to shifts in the economy.

The adjustment in the forecast is notably substantial when compared to the alteration in Fannie Mae's projection for existing home sales.

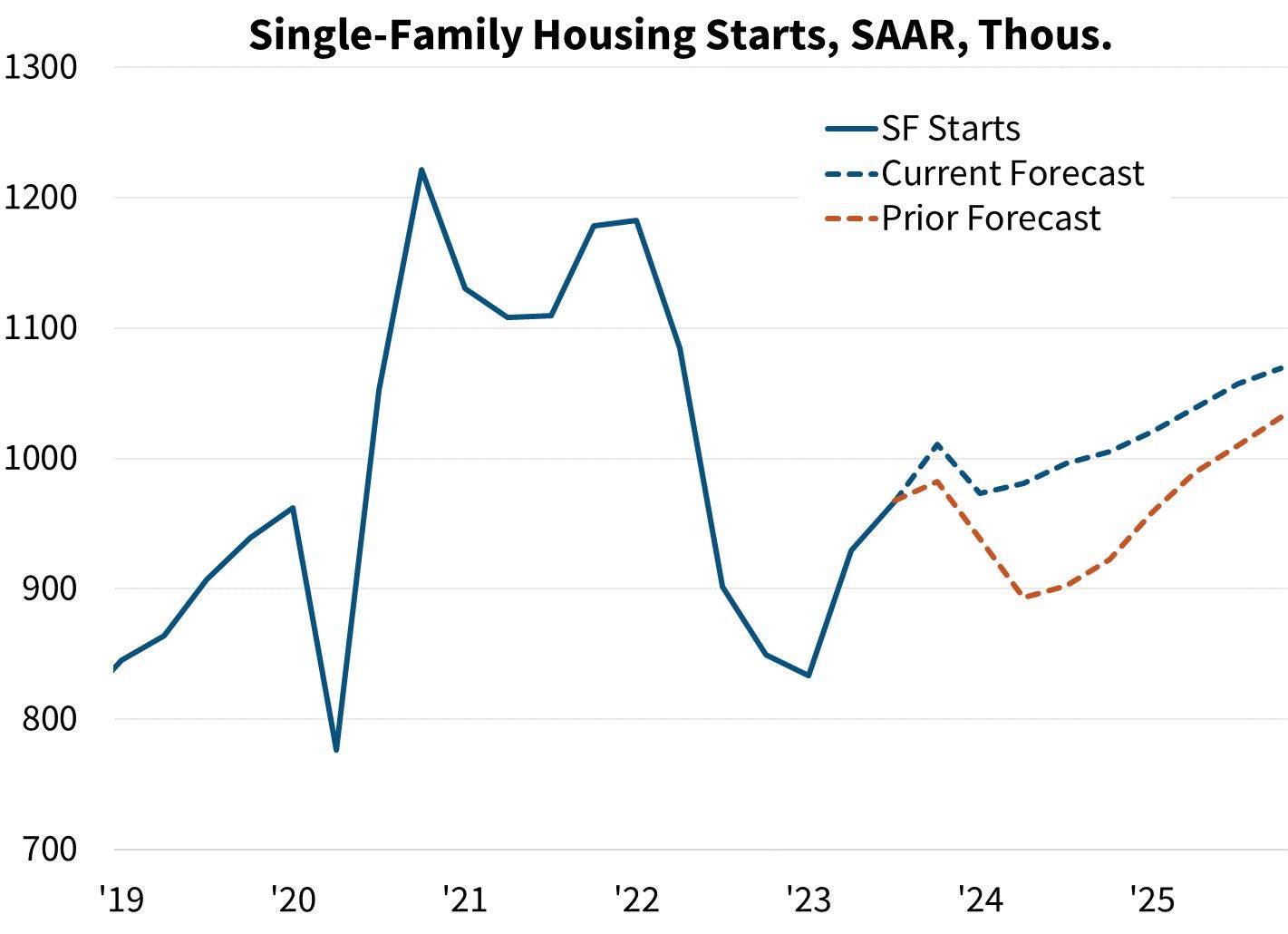

Robust Single-Family Construction Amid a Continued (Relative) Pause in Multifamily

As of November 2023, the annualized rate of single-family housing starts rose to 1.14 million on a seasonally adjusted basis. However, this level may not be sustainable, considering the incoming data on permits.

The latter, known for its lower volatility, was reported at a reduced seasonally adjusted annualized rate (SAAR) of 977,000.

Although Fannie Mae economists anticipate a short-term decline in housing starts, they have adjusted their annual forecast upwards. This adjustment is attributed to the anticipated lower trajectory of interest rates and the elimination of their prediction for a recession.

Their anticipation remains that the shortage of available existing homes for sale will propel the growth in new home construction.

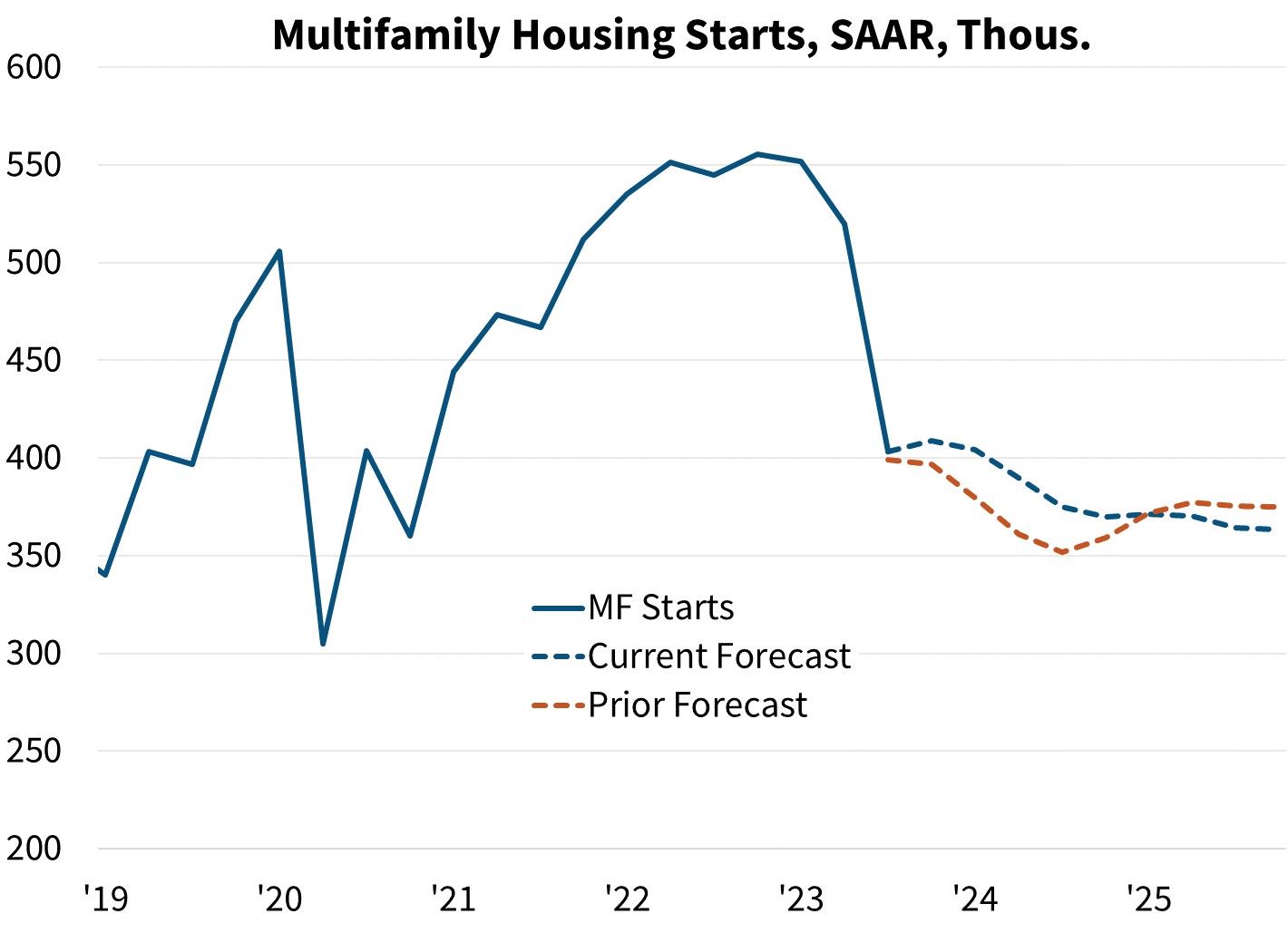

As of November 2023, the seasonally adjusted annualized rate (SAAR) for multifamily housing starts rose to 417,000, whereas multifamily permits declined to a SAAR of 490,000.

Fannie Mae's revised forecast includes a minor improvement in multifamily housing starts, influenced by recent data. However, the forecast for these figures remains restrained due to modest rent growth and a rise in supply deliveries.

The adjusted forecast for mortgage rates and the comprehensive macroeconomic outlook for 2024 have played a role in the marginal enhancement of Fannie Mae's previous projections for multifamily starts. Nevertheless, they still anticipate an annual decline of 18.3% in 2024 compared to 2023.

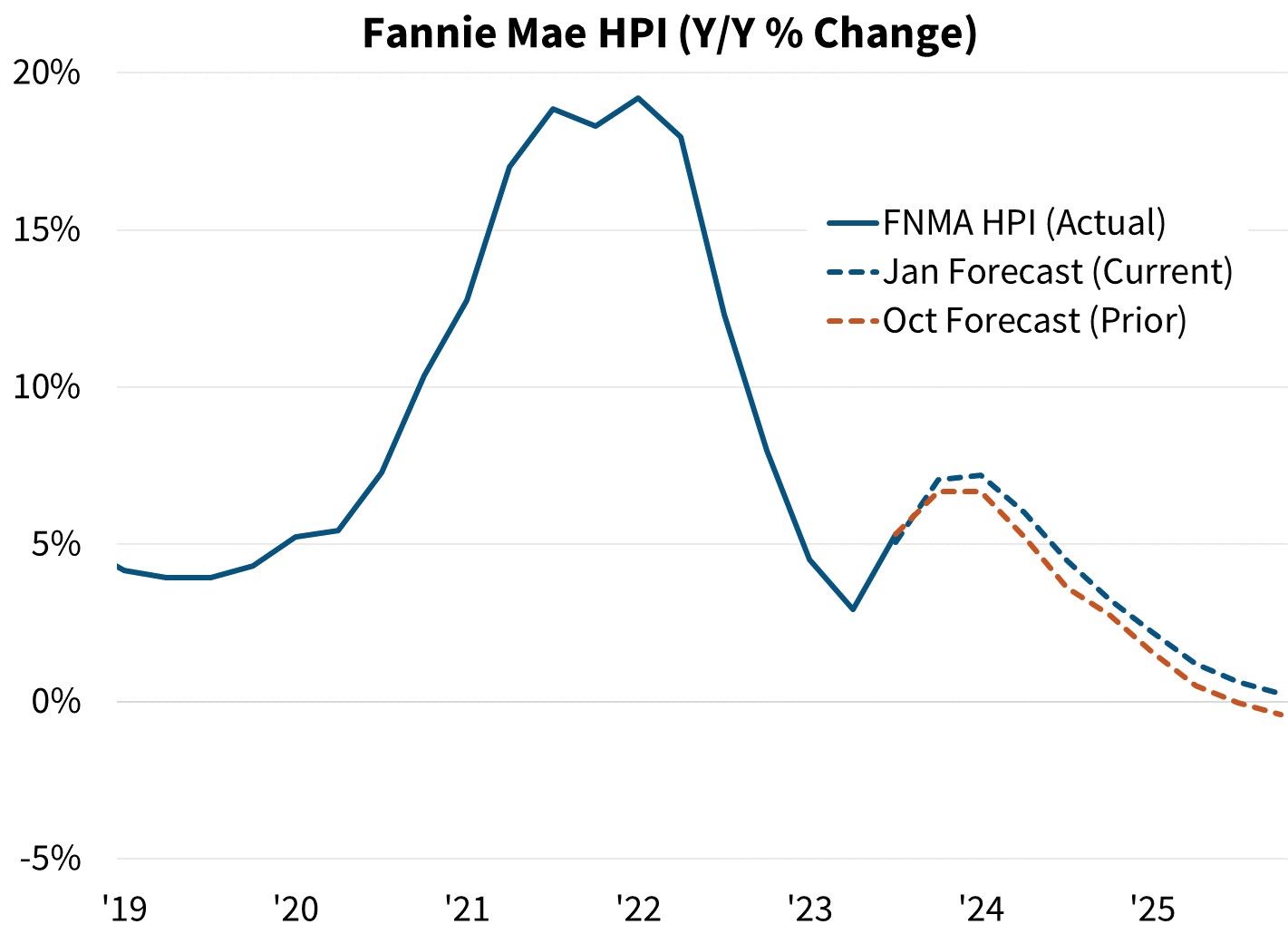

Prices of Single Family Homes

As per the latest non-seasonally adjusted Fannie Mae Home Price Index (HPI), there was a 7.1% increase in home prices from Q4 2022 to Q4 2023, surpassing previous forecasts.

Considering this, along with their adjusted perspectives on mortgage rates and macroeconomic conditions, Fannie Mae has raised its forecast for the growth of single-family home prices in 2024.

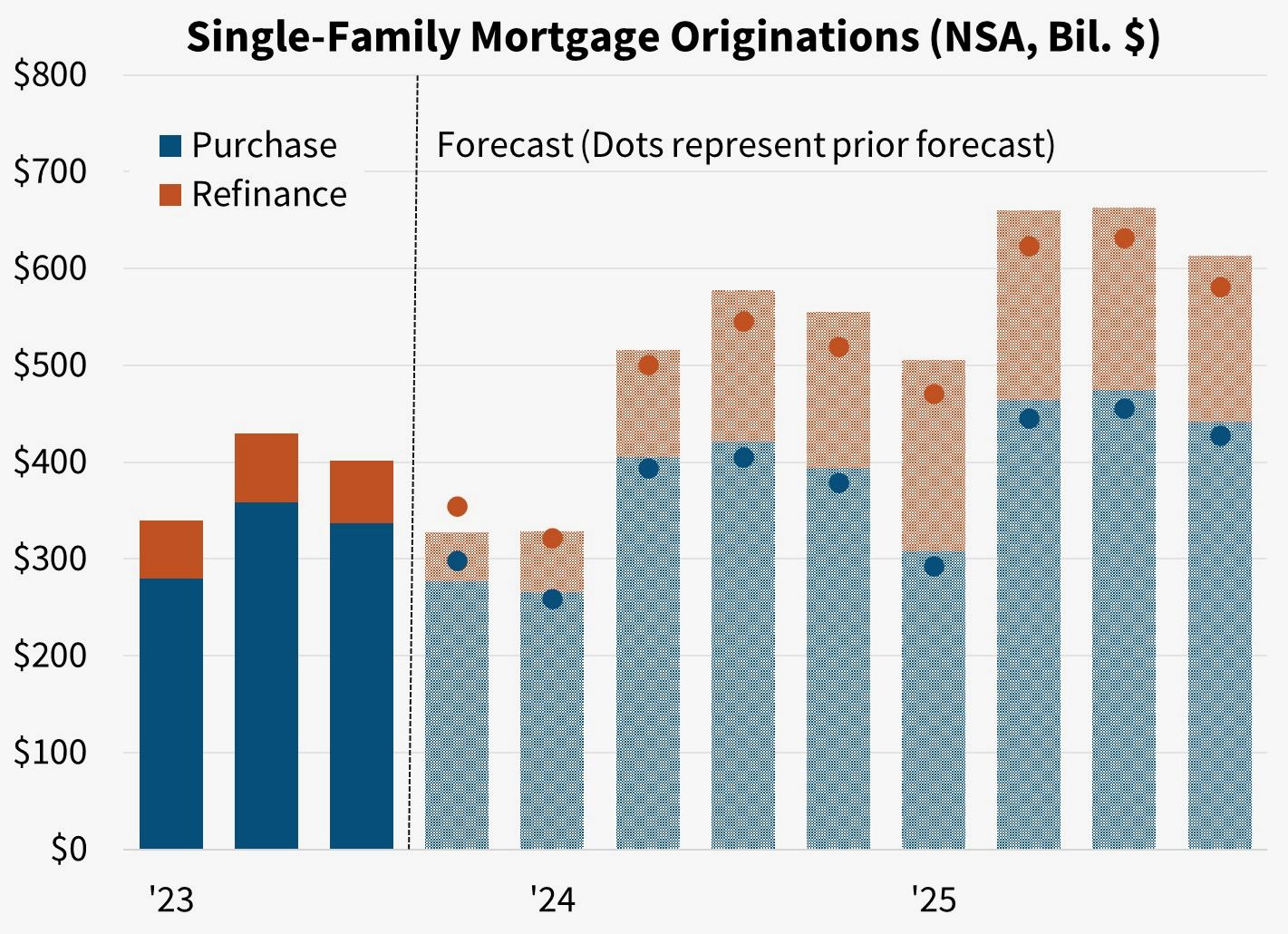

Mortgage Originations for Single-Family Homes

In Fannie Mae's revised forecast, there is consistent growth anticipated in single-family mortgage originations, with a particular increase expected in the refinance segment.

Their current projection indicates that total single-family mortgage originations will reach $1.98 trillion in 2024 and $2.44 trillion in 2025, marking an increase from $1.50 trillion in 2023.

Categories

Recent Posts

GET MORE INFORMATION