Foreclosures Still Far from Historical Norms

Have you come across headlines discussing the rise in foreclosures in today's real estate market? If you have, it might leave you feeling somewhat unsettled about what the future holds. However, it's important to keep in mind that these sensationalized titles don't always provide the complete narrative.

In reality, when you compare the present figures to the typical market trends, you'll observe that there is no cause for concern.

Gaining Perspective on the Headlines

The rise highlighted by the media is deceptive since it solely contrasts the latest statistics with a period when foreclosures were at historically low levels. This exaggeration is making it appear more significant than it truly is.

Throughout 2020 and 2021, millions of homeowners benefited from the moratorium and forbearance program, enabling them to retain their homes and recover from a particularly challenging period.

Following the conclusion of the moratorium, an anticipated increase in foreclosures occurred. However, a rise in foreclosures does not necessarily indicate trouble for the housing market.

Historical Data Suggests No Surging Wave of Foreclosures

Rather than contrasting current figures with the abnormal trends of the past few years, it is more prudent to compare them to long-term trends, especially those related to the housing crash, as that is the concern people have about potential recurrence.

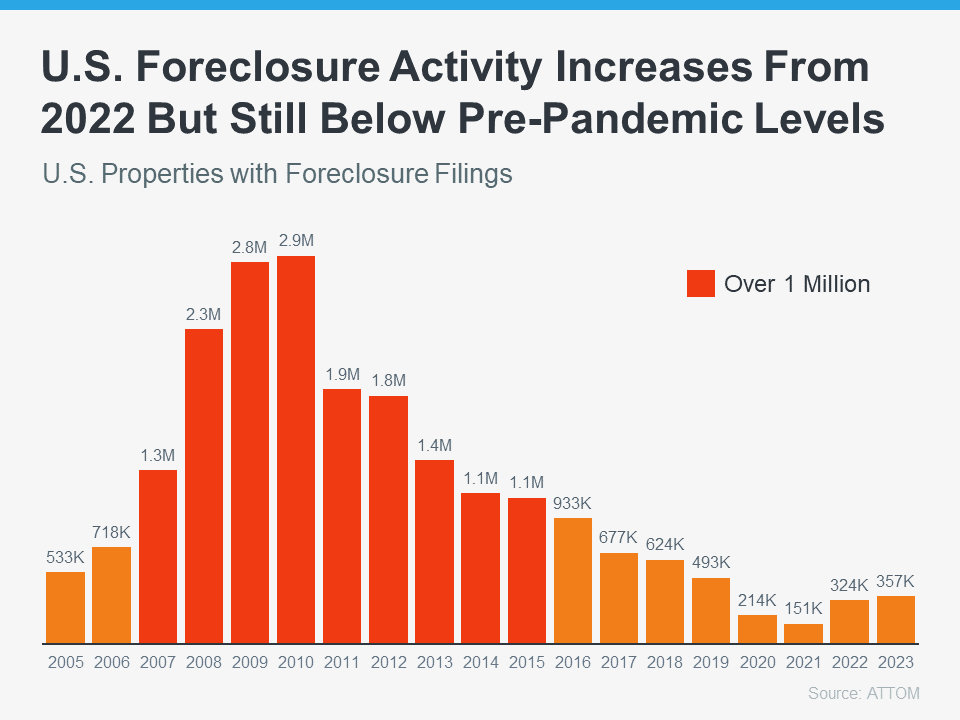

Examine the chart provided below, utilizing foreclosure data sourced from ATTOM, a property data provider. It illustrates a consistent decrease in foreclosure activity (depicted in orange) since the 2008 crash (highlighted in red).

Therefore, although there is an increase in foreclosure filings in the latest report, it is evident that the current situation is far from resembling the past.

Indeed, we haven't even returned to the levels typical of more standard years, such as 2019. As explained by Rick Sharga, Founder and CEO of the CJ Patrick Company:

"Foreclosure activity is currently at approximately 60% of levels observed before the pandemic. . ."

This is primarily due to the fact that present-day buyers are more financially qualified and exhibit a lower likelihood of loan default. Delinquency rates remain low, and the majority of homeowners possess sufficient equity, preventing them from falling into foreclosure. As stated by Molly Boesel, Principal Economist at CoreLogic:

"In October, mortgage delinquency rates in the United States remained favorable, with the overall delinquency rate showing no change from the previous year and the serious delinquency rate maintaining a historic low. Borrowers in advanced stages of delinquency are exploring alternatives to avoid defaulting on their home loans."

In truth, although on the rise, the data indicates that the market is not currently experiencing or heading towards a foreclosure crisis.

Bottom Line

Despite the anticipated increase in foreclosures in the housing market, it is far from reaching the crisis levels witnessed during the housing bubble burst. If you have any inquiries or uncertainties regarding the information you hear or read about the housing market, consider reaching out to a real estate agent.

Categories

Recent Posts

GET MORE INFORMATION