Home Prices Defy Predictions and Remain Steady

The last quarter of 2023, a number of housing experts made predictions that home prices would experience a crash in the following year. Here are a few of those forecasts:

Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at the Wharton School of Business:

“I expect housing prices fall 10% to 15%, and the housing prices are accelerating on the downside.”

Mark Zandi, Chief Economist at Moody’s Analytics:

“Buckle in. Assuming rates remain near their current 6.5% and the economy skirts recession, then national house prices will fall almost 10% peak-to-trough. Most of those declines will happen sooner rather than later. And house prices will fall 20% if there is a typical recession.”

“Housing is already cooling in the U.S., according to July data that was reported last week. As interest rates climb steadily higher, Goldman Sachs Research’s G-10 home price model suggests home prices will decline by around 5% to 10% from the peak in the U.S. . . . Economists at Goldman Sachs Research say there are risks that housing markets could decline more than their model suggests.”

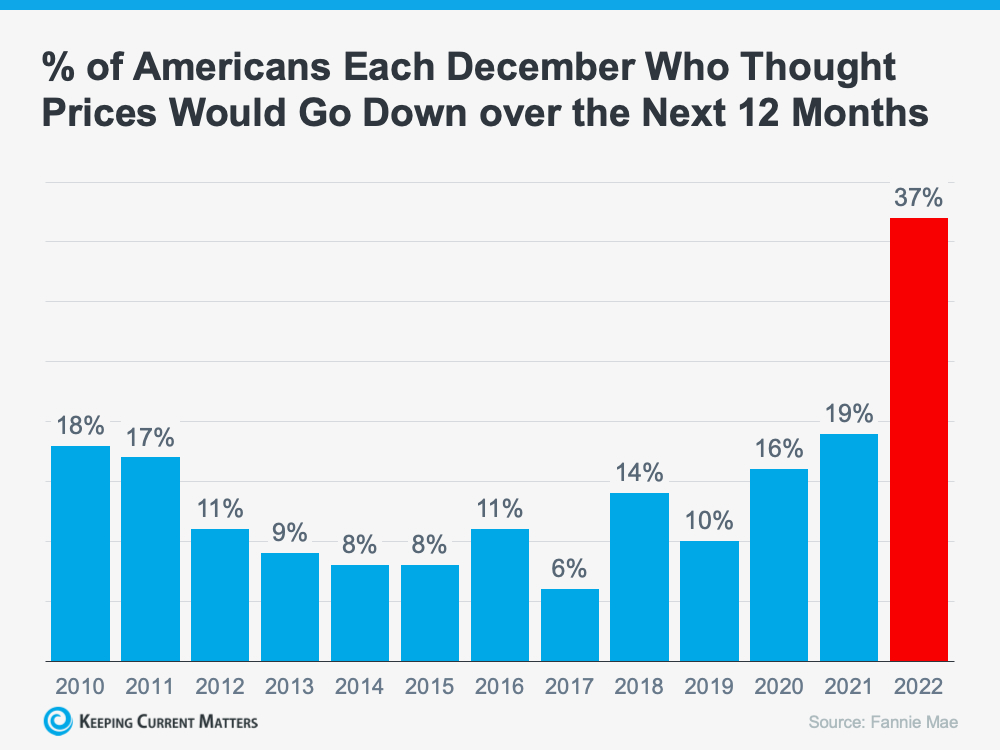

The Bad News: It Rattled Consumer Confidence

The predictions casted uncertainty among consumers regarding the stability of the residential real estate market, evident in the December Consumer Confidence Survey conducted by Fannie Mae. The survey indicated a higher percentage of Americans anticipating a decline in home prices over the next 12 months compared to any previous December, leading to hesitations in homebuying or selling plans as the new year commenced. This hesitation can be seen in the graph below.

The Good News: Home Prices Never Crashed

Contrary to expectations, home prices did not plummet and are showing signs of a swift recovery following the minor depreciation witnessed in the preceding months.

In a report just released, Goldman Sachs :

“The global housing market seems to be stabilizing faster than expected despite months of rising mortgage rates, according to Goldman Sachs Research. House prices are defying expectations and are rising in major economies such as the U.S.,. . . ”

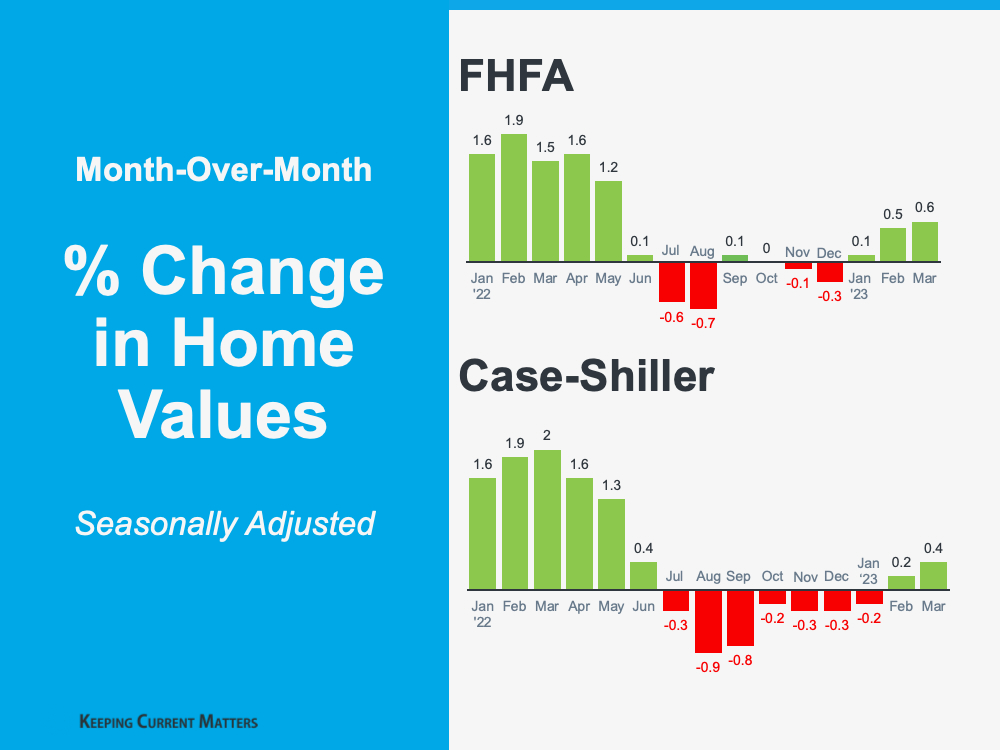

The assertions made by Goldman Sachs were substantiated by the recent publication of two home price indexes, namely Case-Shiller and FHFA, which disclosed the following figures:

It appears that home values have reached a turning point and are now on an upward trajectory.

Bottom Line

The housing market possesses a greater level of strength than what is commonly perceived. To obtain an accurate assessment of your local market, it is advisable to contact a reliable real estate professional.

Categories

Recent Posts

GET MORE INFORMATION