Home Values Soar, Boosting Net Worths

When deciding whether to rent or buy a home, consider this key data point: The Federal Reserve Board releases a Survey of Consumer Finances every three years, which shows that homeowners have a significantly higher net worth than renters.

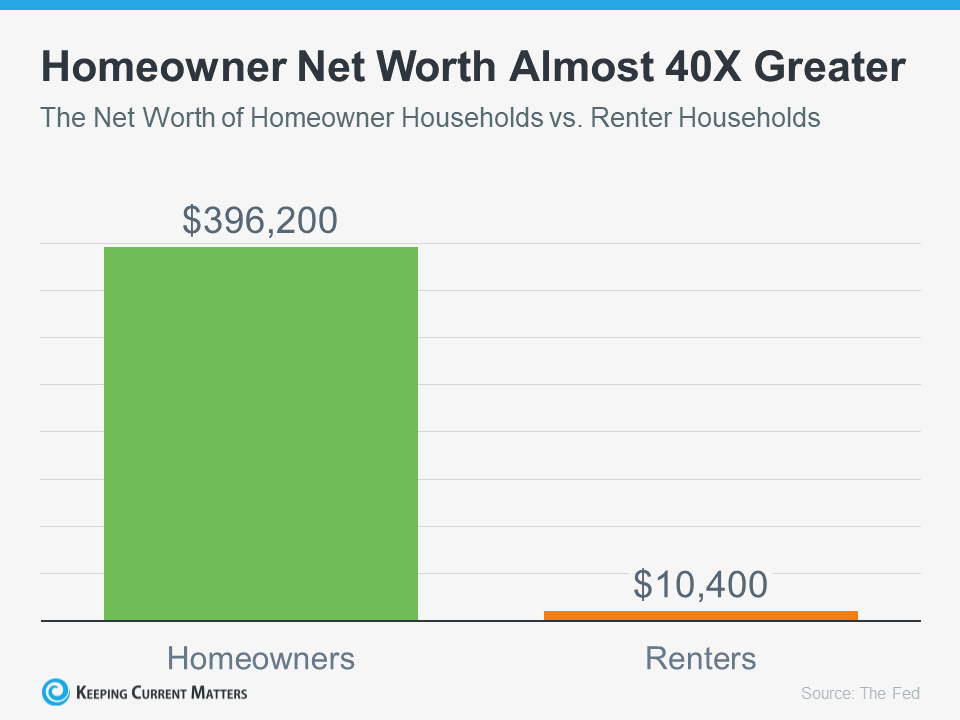

Homeowners have a net worth that is almost 40 times greater than renters, according to the Federal Reserve Board's Survey of Consumer Finances. And here’s the data to prove it (see graph below):

The Big Reason Homeowner Net Worth Is So High

The average homeowner's net worth in the previous Survey of Consumer Finances report was $255,000, while the average renter's net worth was $6,300. In the latest report, the gap between homeowners and renters widened significantly, with homeowner net worth climbing dramatically.

“The median net worth of U.S. households increased by more than double in the three years from 2019 to 2022 than in any other three-year period since the Federal Reserve Board began tracking this data in 1989.”

Home equity is one of the primary reasons for the dramatic increase in homeowner net worth.

Home prices surged in recent years, known as the ‘unicorn’ years for housing. This was due to a shortage of homes for sale and a surge of buyers eager to take advantage of record-low mortgage rates. The imbalance between supply and demand drove prices higher, resulting in significant equity gains for homeowners.

If you are still deciding whether to rent or buy a home, you may be wondering if you have missed the opportunity to significantly increase your net worth. However, it is important to remember that, as a recent article in The Ascent explains:

“Regardless of whether your net worth increased in recent years, buying a home can be a great way to grow your wealth in the coming years, as home values tend to rise over time.”

Home prices have historically risen over time, and even though mortgage rates are now closer to 7-8%, prices are still rising in many areas of the country due to low supply relative to demand. As a result, expert forecasts for the next few years call for continued home price appreciation, but at a more typical pace for the housing market.

While home price appreciation is likely to slow in the coming years, homeowners who buy now should still see their equity grow. This means that buying a home today can be a good investment for your long-term financial future.

Jessica Lautz, the Deputy Chief Economist at the National Association of Realtors (NAR), notes:

“When deciding whether to rent or buy a home, it is important to consider the total costs of homeownership, including maintenance, utilities, and commuting, as well as the potential financial benefits. According to new data from the Federal Reserve, the median net worth of homeowners is $396,200, compared to just $10,400 for renters. This data clearly shows that homeownership can provide significant wealth gains over time.”

Bottom Line

If you are undecided about whether to rent or buy a home, keep in mind that homeownership can significantly increase your net worth over time. If you would like to learn more about this or the other many benefits of owning a home, contact a local real estate agent.

Categories

Recent Posts

GET MORE INFORMATION