Housing Market Poised to Remain Stable Despite Foreclosure and Bankruptcy Spike

If you've been staying updated on the news lately, you might have come across articles discussing a rise in foreclosures and bankruptcies. This could be causing you some concern, especially if you're considering the prospect of buying or selling a house.

However, the reality is that despite the increasing figures, the data indicates that the housing market is not on the path towards a crisis.

Foreclosure Activity Rising, but Less Than Headlines Suggest

Over the past few years, foreclosure rates have remained remarkably low. This can be attributed to the implementation of relief measures such as the forbearance program and other assistance options in 2020 and 2021, which were instrumental in supporting numerous homeowners in retaining their residences during challenging times.

It was expected that foreclosures would increase after the moratorium ended. However, just because foreclosures are up, it does not mean that the housing market is in trouble.

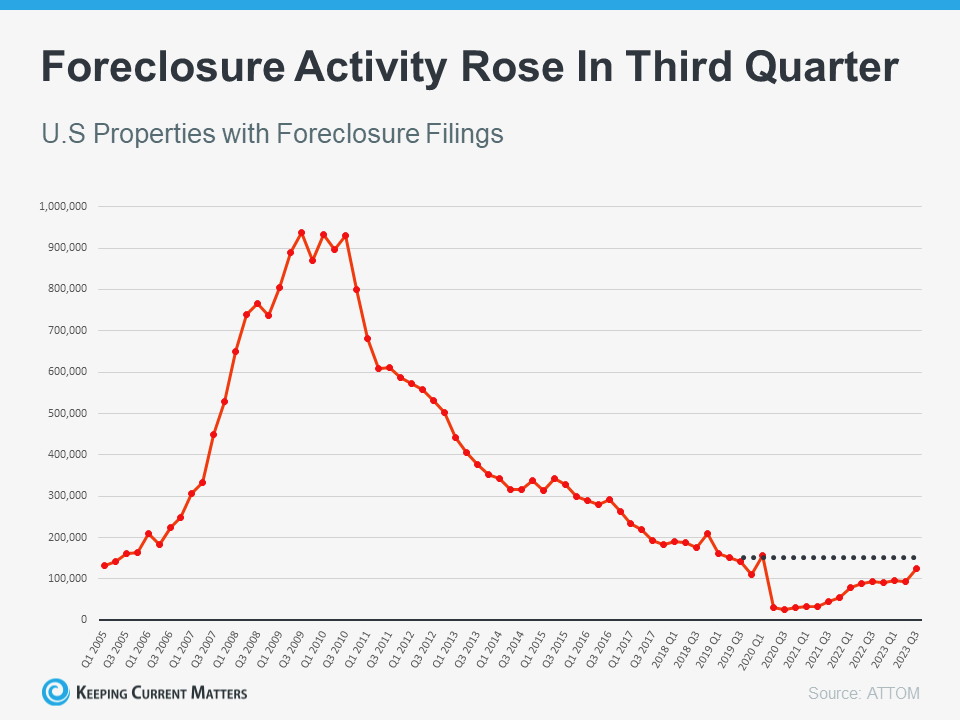

To illustrate how much the housing market has changed since the 2008 crash, take a look at the graph below, which uses data from ATTOM, a property data provider. The graph shows the number of properties with a foreclosure filing from 2005 to 2023. As you can see, there have been significantly fewer foreclosures since the crash.

Foreclosure filings are slowly approaching pre-pandemic levels, but they are still far below the levels seen during the 2008 housing crash. Additionally, the significant equity that American homeowners have in their homes today can help them sell their homes and avoid foreclosure.

The Increase in Bankruptcies Isn’t Dramatic Either

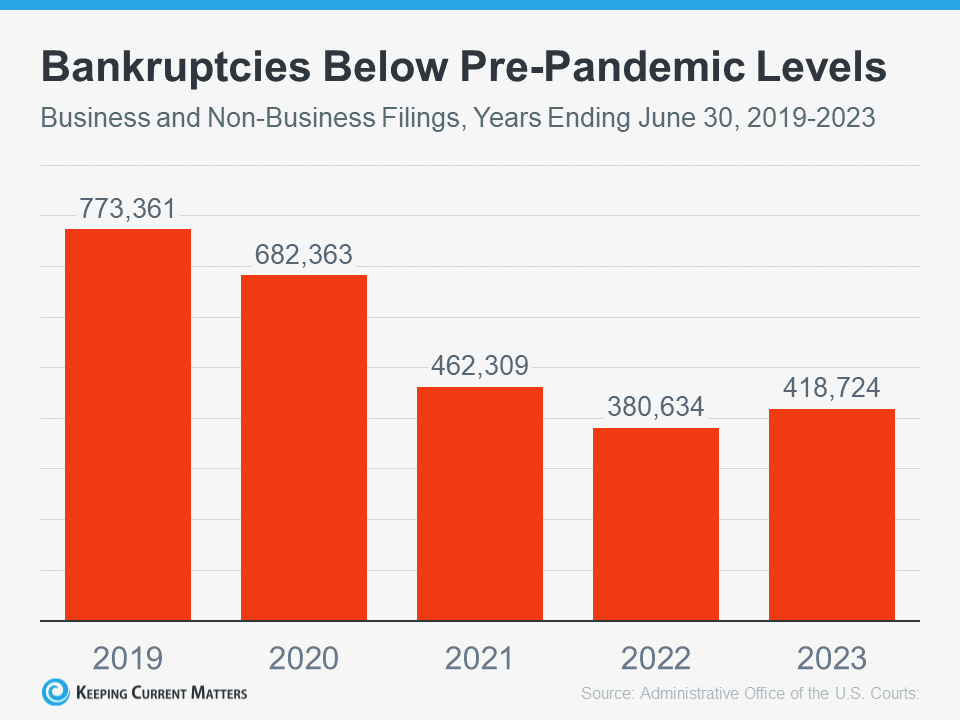

As shown below, the financial hardship that many industries and small businesses experienced during the pandemic did not lead to a significant increase in bankruptcies. However, the number of bankruptcies has increased slightly since last year, approaching 2021 levels. This is not a cause for concern.

Bankruptcy rates in 2021 and 2022 were lower than in normal years, partly due to the government's trillions of dollars in aid to individuals and businesses during the pandemic. Therefore, let's focus on the bar for this year and compare it to the bar on the far left (2019). It shows that bankruptcy rates today are still nowhere near pre-pandemic levels. These two factors are why the housing market is not in danger of crashing.

Bottom Line

It is essential to carefully analyze the data at this time. While foreclosures and bankruptcies are increasing, these leading indicators do not suggest that the housing market is on the verge of another crash.

Categories

Recent Posts

GET MORE INFORMATION