How the Current Housing Market is Stable and Unlikely to Experience a Crash

Recently, there has been apprehension about the possibility of a housing market crash. The concerns stem from the affordability issues in the market, coupled with the frequent discussions about an impending recession in the media, making it understandable why such worries have arisen.

The data provides clear evidence that the current housing market differs significantly from the market preceding the housing crash in 2008. It is important to note that history is not repeating itself. Here are the reasons why.

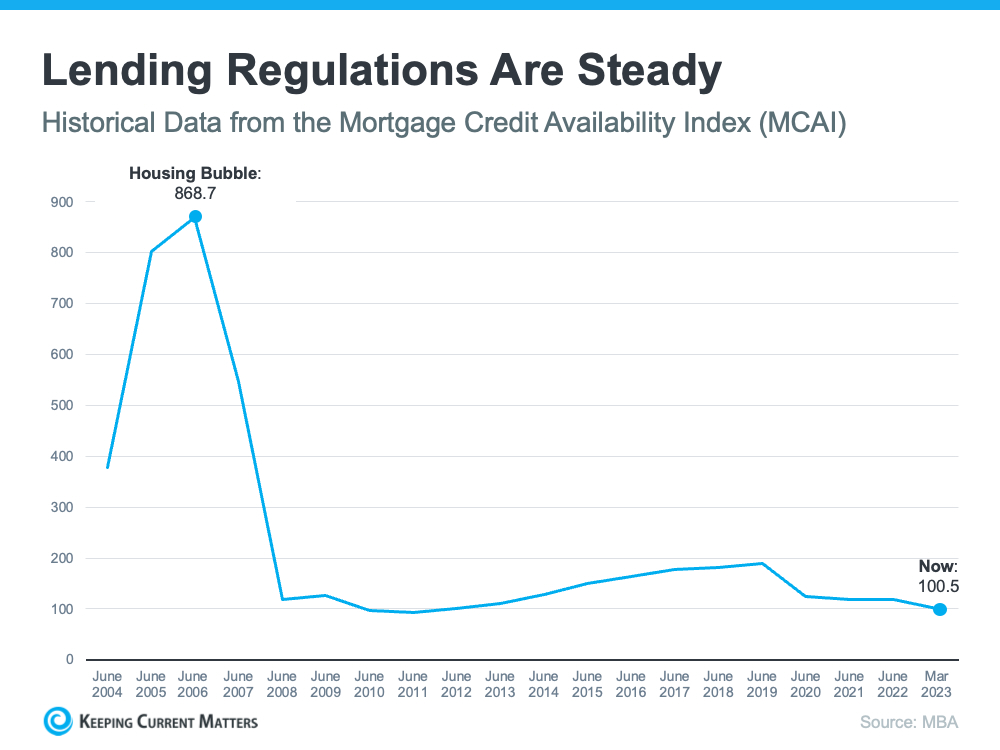

It’s Harder To Get a Loan Now

Obtaining a home loan was considerably easier in the period leading up to the 2008 housing crisis compared to the present day. Banks had looser lending standards, making it possible for nearly everyone to be eligible for a home loan or refinance their existing one. This resulted in lending institutions taking on significantly more risk with both the individuals and the mortgage products offered, leading to widespread defaults, foreclosures, and plummeting prices.

"Presently, homebuyers are subjected to more stringent requirements by mortgage companies. This is exemplified by the following graph, which employs data from the Mortgage Bankers Association (MBA) to demonstrate this contrast. A lower number indicates a more difficult mortgage application process, while a higher number denotes an easier one."

Unemployment Recovered Faster This Time

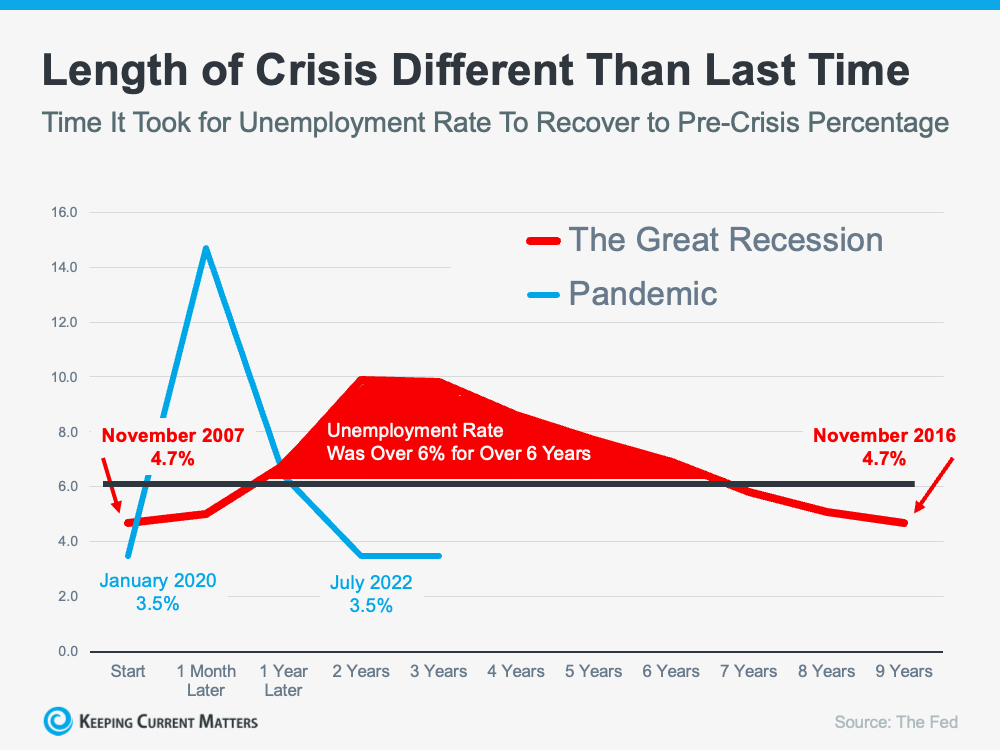

Although the pandemic resulted in a surge in unemployment in the last few years, the current jobless rate has already returned to its pre-pandemic levels (illustrated by the blue line in the graph below). In contrast, during the Great Recession, a significant number of individuals remained unemployed for a considerably longer duration (indicated by the red line in the graph below):

The swift rebound in employment rates has positive implications for the housing market. With a large number of individuals currently employed, the chances of homeowners encountering financial difficulties and defaulting on their mortgages are reduced. This improves the stability of today's housing market and minimizes the possibility of a surge in foreclosures.

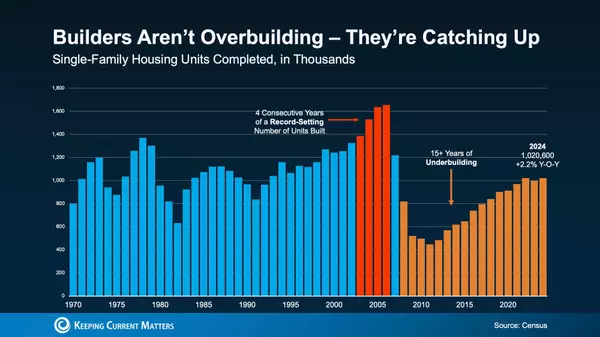

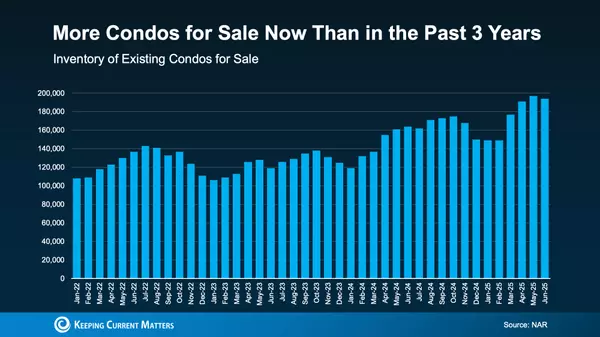

There Are Far Fewer Homes for Sale Today

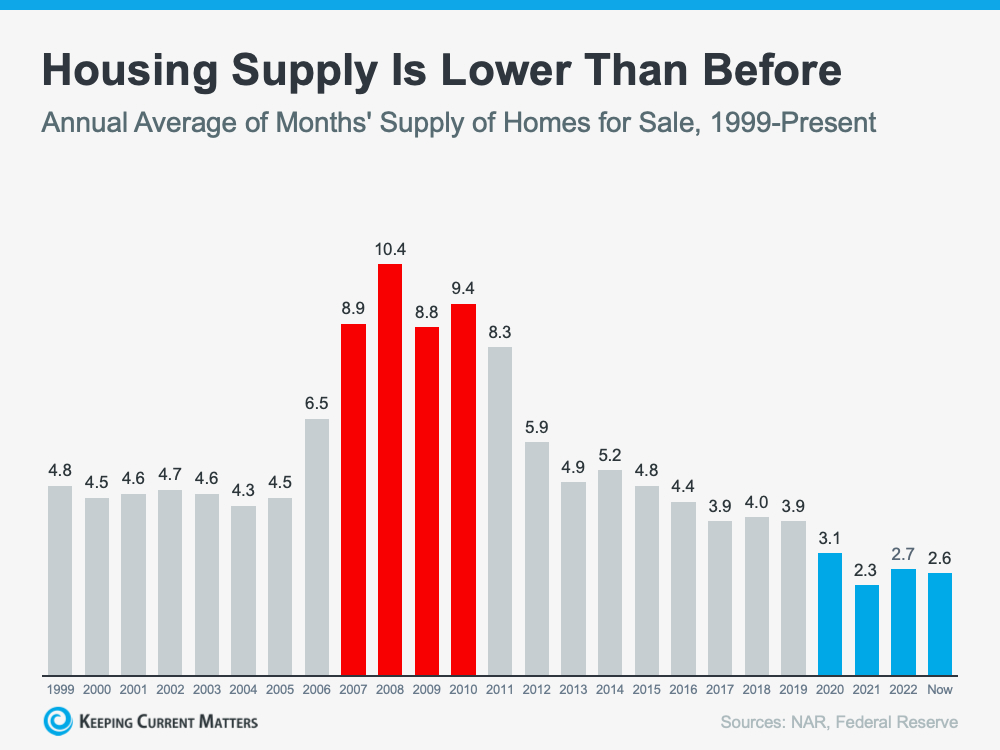

During the housing crisis, there was an excess of homes on the market, including many that were short sales or foreclosures, leading to a significant drop in prices. Conversely, today, there is a shortage of available inventory, primarily due to inadequate home construction over the years.

Referencing data from the National Association of Realtors (NAR) and the Federal Reserve, the following graph depicts a comparison of the months' supply of available homes presently with that during the housing crisis. Currently, the unsold inventory is at a 2.6-months' supply, which is significantly lower than the previous period. The limited inventory available indicates that the likelihood of a sharp decline in home prices, as witnessed in 2008, is greatly reduced.

Equity Levels Are Near Record Highs

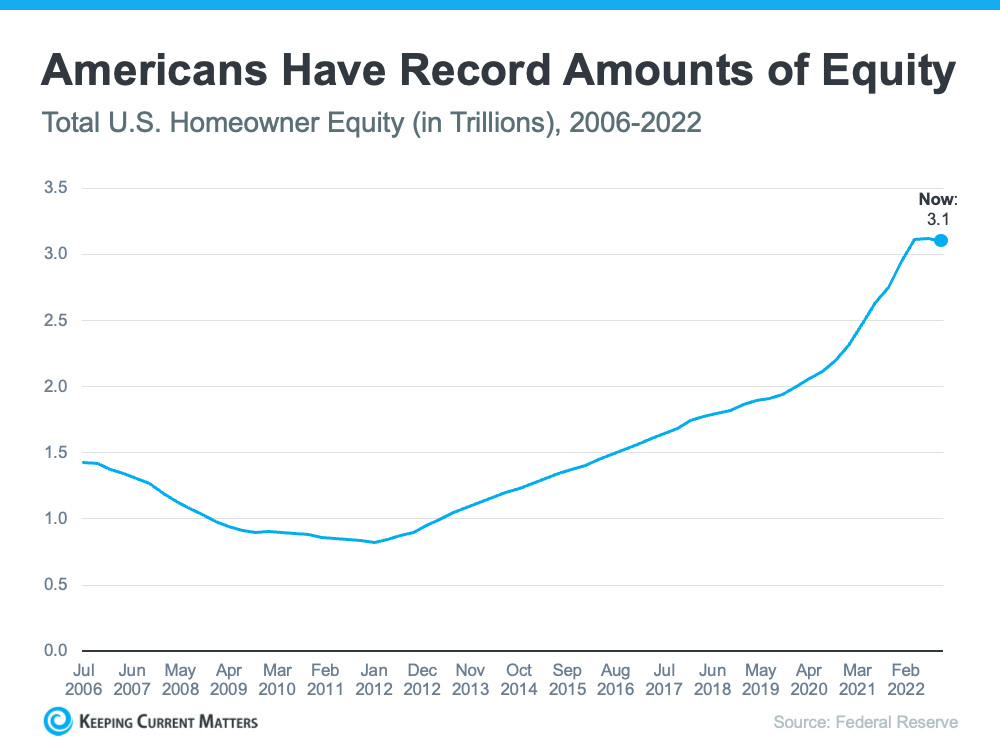

The shortage of available homes for sale contributed to the continued rise in home prices throughout the pandemic. Consequently, homeowners currently possess equity in their homes, which is close to the highest levels observed (refer to the graph below):

Moreover, in contrast to the Great Recession, the present equity levels place homeowners in a considerably more robust financial standing. According to Molly Boesel, Principal Economist at CoreLogic:

“Most homeowners are well positioned to weather a shallow recession. More than a decade of home price increases has given homeowners record amounts of equity, which protects them from foreclosure should they fall behind on their mortgage payments.”

Bottom Line

The aforementioned graphs should allay any concerns regarding a potential housing market crash. The most recent data indicates that the present market conditions are vastly different from those during the previous crisis.

Categories

Recent Posts