Is Wall Street Acquiring a Significant Number of Homes Across America?

Considering a home purchase? Stay informed with the latest real estate news to understand factors that may influence your decision. If you've come across discussions about investors, you might be curious about their current influence on the housing market. This may lead you to ponder questions such as:

- What is the number of homes owned by investors?

- Do institutional investors, such as major Wall Street firms, genuinely acquire a significant number of homes, making it challenging for the average person to find one?

To address these inquiries, here's the factual account of the current events based on the data.

To begin, let's determine the total number of single-family homes (SFHs) and the percentage of those that are rentals owned by investors. According to SFR Investor, an organization specializing in the study of the single-family rental market in the United States, there are eighty-two million single-family homes in the country. Now, the question arises: how many of these homes are actually rentals?

As indicated in a recent post, data reveals that sixty-eight million (82.93%) of these homes are owner-occupied, signifying that the person who owns the home resides in it. Subtracting this figure from the total number of single-family homes (82 million) leaves approximately fourteen million homes, which are designated as single-family rentals (SFRs).

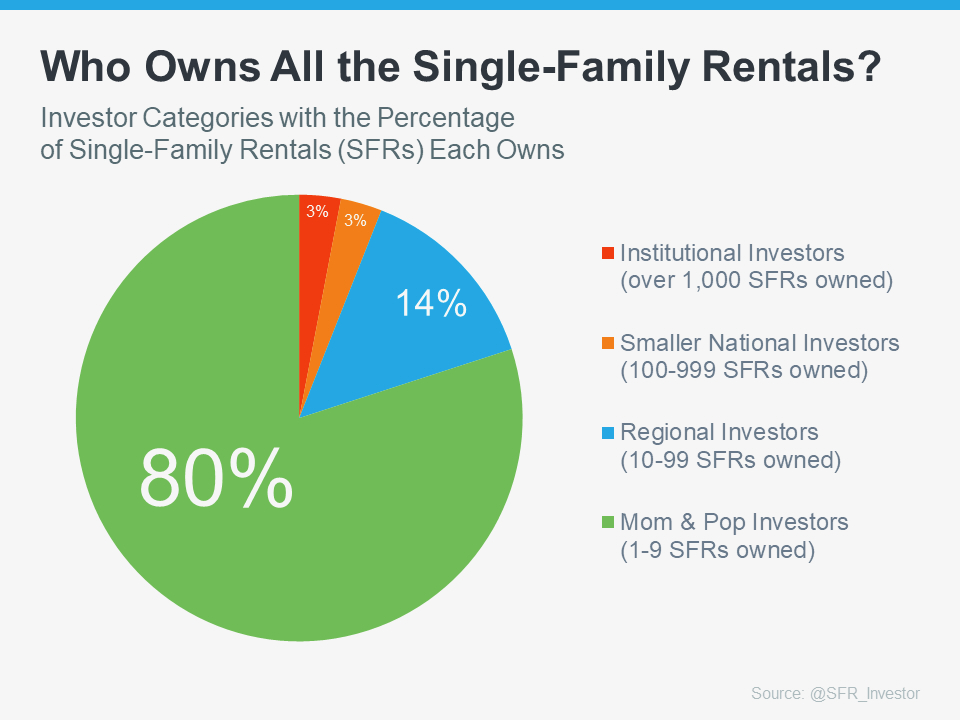

While institutional investors have gained prominence in the single-family rental (SFR) market, they are not the sole players. The landscape of SFR ownership encompasses four distinct categories of investors:

- Mom-and-Pop Investors: These individuals own between 1 and 9 SFRs, often managing their properties themselves. They typically have a personal connection to the real estate market and their tenants.

- Regional Investors: These investors possess a portfolio of 10 to 99 SFRs, often concentrated within specific geographic regions. They often have a deeper understanding of local market dynamics and tenant preferences.

- Smaller National Investors: With holdings of 100 to 999 SFRs, these investors operate across broader geographic areas. They may specialize in specific property types or target specific tenant demographics.

- Institutional Investors: These large-scale entities, such as Wall Street firms and private equity funds, own over 1,000 SFRs. They bring significant capital and expertise to the market, often employing professional property management companies.

The Significance of Investor Diversity

The diverse range of investors in the SFR market contributes to its resilience and adaptability. Each category brings unique perspectives, investment strategies, and local insights to the table. This diversity helps maintain a balance between investor interests and the needs of tenants and communities.

As evident in the chart, despite the narrative often portrayed in news and social media, the green section indicates that the majority of homes are not in the possession of large institutional investors. Instead, most are owned by smaller, individual investors—people like your friends and neighbors.

In reality, there are individuals, much like yourself, who value homeownership and consider purchasing a home, whether it's a primary residence or a second property, as a sound investment. Perhaps they identified a chance to acquire a second home in recent years, intending to use it as a rental and generate extra income. Alternatively, some may have opted to retain their initial home instead of selling it when upgrading.

Therefore, it's important not to unquestioningly accept everything you come across regarding institutional investors. They are not acquiring all the homes, rendering it unattainable for the average person to make a purchase. The data doesn't support that narrative; in fact, institutional investors constitute the smallest segment in the pie chart.

Bottom Line

Although institutional investors play a role in the single-family rental market, it's accurate to say they aren't acquiring the entirety of available houses. If you have additional inquiries about information circulating in the housing market, consider reaching out to a reliable real estate professional. Having an expert by your side can provide the necessary context to better understand the situation.

Categories

Recent Posts

GET MORE INFORMATION