Leveraging Your Home Equity to Address Affordability Issues

Considering selling your house? Current mortgage rates might leave you unsure. Some homeowners hesitate to sell due to the prospect of securing a higher mortgage rate for their next property. If this concerns you, it's important to understand that while rates are currently elevated, so is your home equity. Here's what you should be aware of.

Bankrate provides a comprehensive explanation of what equity is and the factors contributing to its growth:

"Home equity represents the share of your home that you have fully paid for and now own outright. It is the distinction between the current market value of your home and the remaining balance on your mortgage. As your home's value appreciates over time and you reduce the principal balance of your mortgage, your ownership stake in the property expands."

To put it differently, equity is the current value of your home minus the outstanding balance on your home loan.

How Much Equity Do Homeowners Have Now?

Lately, the growth of your equity has been more rapid than you might have anticipated. To put into perspective the average homeowner's equity, according to CoreLogic:

"The typical American homeowner currently possesses approximately $290,000 in home equity."

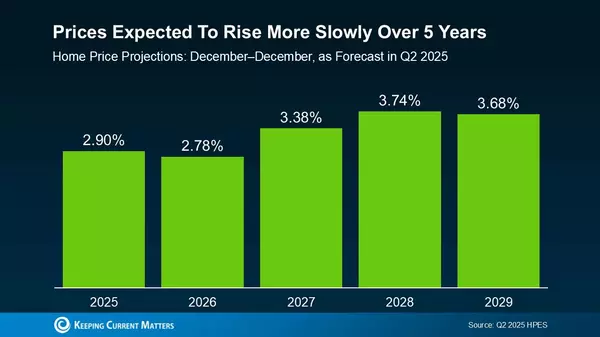

This is because, in recent years, there has been a substantial increase in home prices, and this upward trend has accelerated the accumulation of your equity. Although the market is beginning to stabilize, there remains a greater number of prospective homebuyers than available homes for sale. This heightened demand is once again driving home prices upward.

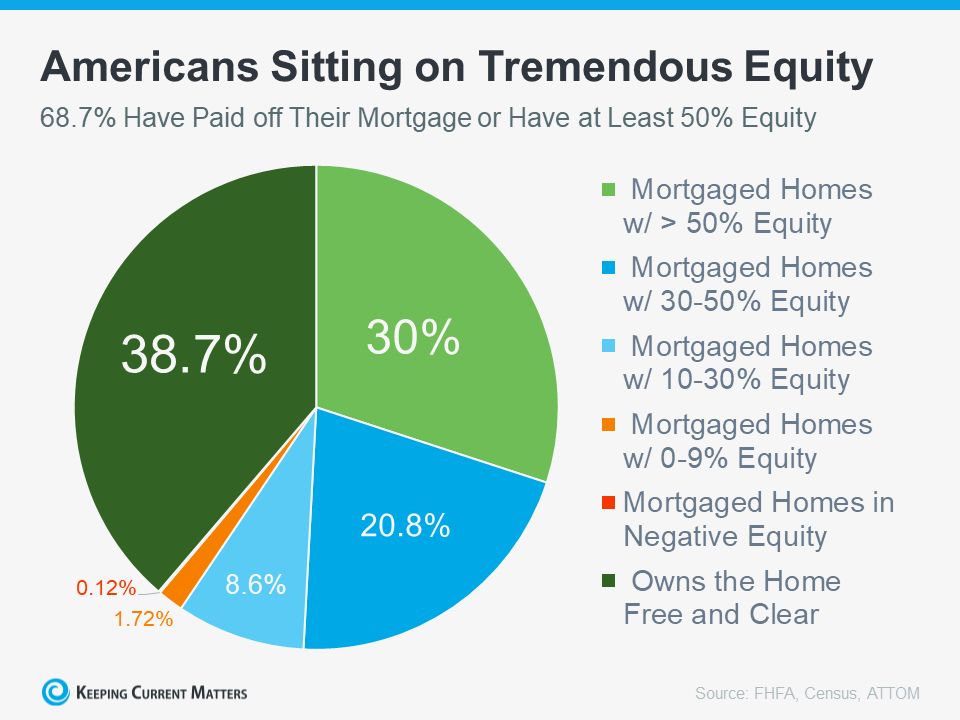

As reported by the Federal Housing Finance Agency (FHFA), the Census Bureau, and ATTOM, a provider of property data, a substantial majority, approximately 68.7%, of homeowners have achieved either complete mortgage repayment or possess at least 50% equity in their homes (refer to the chart below for details):

This implies that almost 70% of homeowners currently have a substantial amount of equity in their homes.

How Equity Helps with Your Affordability Concerns

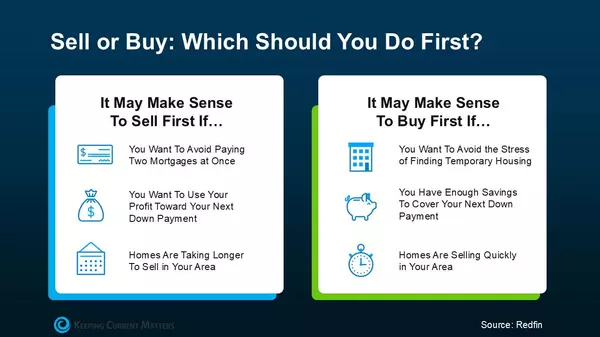

Amid the present affordability constraints, your accumulated equity can play a significant role in your relocation plans. Following the sale of your current home, you can leverage the equity you've established to facilitate the purchase of your next property. Here's a breakdown of how this process works:

- Become a cash buyer: If you've been residing in your present residence for an extended period, there's a possibility you've amassed sufficient equity to acquire a new home without the necessity of obtaining a loan. In such a scenario, there won't be a need for borrowing funds or concerning yourself with mortgage rates. The National Association of Realtors (NAR) affirms:

"These individuals purchasing homes with cash are joyfully evading the elevated mortgage interest rates. . ."

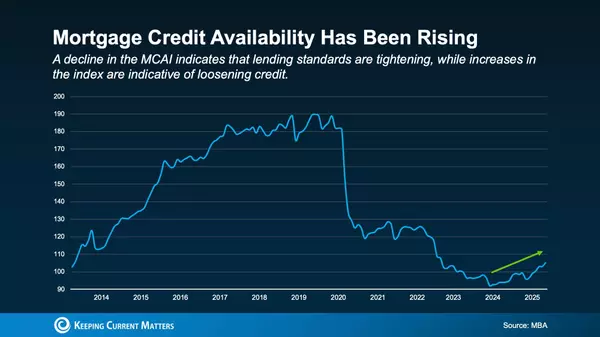

- Increase your initial payment: Your accumulated equity can be applied to augment your next down payment. It could potentially enable you to contribute a more substantial sum upfront, reducing the need for borrowing and thereby mitigating the impact of current interest rates, as outlined by Experian:

"Boosting your initial payment reduces the total loan amount and, consequently, your loan-to-value ratio, potentially resulting in a lender offering you a more favorable interest rate."

Bottom Line

If you're considering relocating, the equity you've accumulated can have a substantial impact, particularly in today's market. To determine the extent of your current home's equity and explore how you can leverage it for your next residence, reach out to a reputable real estate agent.

Categories

Recent Posts