Missed Out on 2012 Real Estate Gains? Discover Today's Multifamily Opportunity

After reaching an all-time high in 2007, single-family home prices crashed by 27.4%, eventually bottoming out in 2012. Since then, the Case-Shiller U.S. National Home Price Index has surged by an incredible 141.23%. Imagine if you could go back and buy real estate at 2012 prices — it would be a no-brainer, right? While we can’t turn back the clock, a similar opportunity is presenting itself today in a different corner of the real estate market.

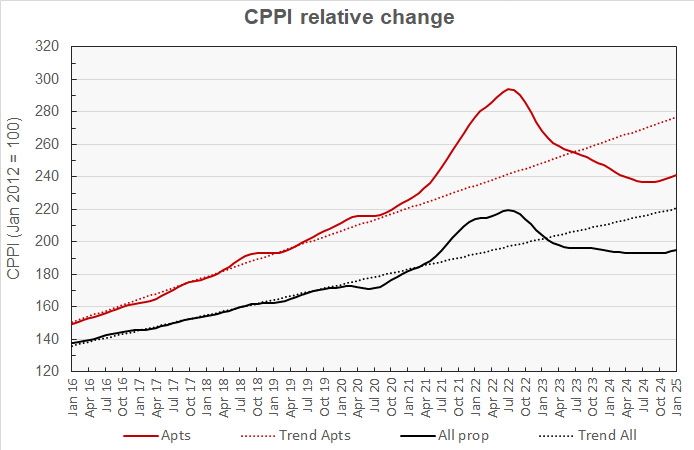

Multifamily apartment building prices have dropped by 23.5% since peaking in July 2022, according to CoStar, and the Freddie Mac Multifamily Apartment Investment Market Index (AIMI) saw a 28.1% decline before rebounding. This means multifamily real estate is currently offering a rare entry point — and the best part is, you don’t need millions to take advantage. With as little as $5,000, you can invest fractionally and benefit from the cash flow, appreciation, and tax advantages that come with property ownership.

Why Multifamily Real Estate Appears to Have Bottomed Out

Think back to the sentiment around real estate in 2011–2012 — it was grim. Headlines were filled with doom and gloom, and the market was clouded by fear. In short, there was "blood in the streets." Fast forward to today, and you’ll find a strikingly similar mood in the multifamily real estate sector. After three tough years of capital calls and distressed sales, many investors are running scared.

It’s during times like these that Warren Buffett’s famous advice rings loudest: "Be fearful when others are greedy, and greedy when others are fearful." But fear among investors isn’t the only reason multifamily real estate looks attractive right now.

Supply and demand fundamentals are shifting rapidly. After a surge in multifamily construction between 2021 and 2025, new housing starts have plummeted. After peaking at 614,000 units in late 2022, multifamily starts have dropped to just 370,000 as of February 2025 — a 25% fall in 2024 alone. That construction boom has ended, but the nation’s housing shortage persists.

According to a 2024 Zillow report, the U.S. remains short by 4.5 million housing units. Instead of facing a glut of apartments, most markets are struggling with an ongoing shortage — and that’s a powerful tailwind for multifamily investors.

At the same time, rental income — the key driver of multifamily property values — continues to climb. As of February, rents were up 4.2% year over year, even outpacing broader inflation. Rents are now one of the main contributors to overall inflation, underscoring strong tenant demand.

And importantly, multifamily prices themselves have started to turn the corner. After bottoming out in early 2024, the Commercial Property Price Index (CPPI) from MSCI Real Capital Analytics shows that multifamily property prices have stabilized and are now rising again. Despite the recent gains, prices remain well below their long-term trend line, suggesting there’s still significant upside potential ahead.

Why Now Could Be the Perfect Time to Buy Multifamily

Multifamily real estate has serious ground to make up — and that sets up today as a prime opportunity for investors. One major reason? Cap rates are starting to compress again. After reaching historic lows in 2021, multifamily cap rates expanded sharply through 2022 and 2023. But according to CBRE’s 2024 Cap Rate Survey, cap rates stabilized this year and began tightening again in the second half.

Quick refresher: in commercial real estate, you divide a property's net operating income (NOI) by the cap rate to determine its value. Lower cap rate mean higher property values. So, the recent compression in cap rates is already helping drive multifamily prices upward — a strong indicator that the market may have bottomed out.

How to Invest in Multifamily Without Overexposing Yourself

It’s understandable to feel cautious right now. Between tariff policies, trade tensions, and recession fears, there’s plenty of uncertainty in financial markets — real estate included. So how can you invest in multifamily while managing risk?

One approach is to invest smaller amounts. Traditional multifamily syndications often require minimum investments of $50,000 to $100,000, which isn’t ideal for everyone. That’s why I invest through a co-investing club, contributing $5,000 at a time. It’s a way to dollar-cost average into real estate, smoothing out risk over time.

Another key is choosing investments with recession resilience. For instance, I’ve invested in mobile home parks with tenant-owned homes. When facing the choice between paying $500 in lot rent versus $6,500 to move a mobile home, tenants almost always stay put. I’ve also invested in multifamily properties offering affordable housing with property tax abatements — properties that often have long waiting lists, and even higher demand during downturns.

Even though cap rates are showing signs of compression, I don’t bank on that to fuel returns. In my investing club, we prioritize strong cash flow — properties that produce steady income now, not just in the future. That allows investors to collect distributions and weather market fluctuations without relying on appreciation to make the investment work.

The Importance of Diversification

While multifamily is attractive right now, diversification remains essential. That includes spreading investments across different property types — industrial buildings, mobile home parks, raw land, hotels, and vacation rentals. No one can predict the next breakout asset class, so the goal is to build a portfolio that benefits from many sectors.

Geographic diversification is equally important. Personally, I have investments in more than 30 properties across 13 states. By investing across multiple markets, you’re more likely to catch a few rising stars without having to guess where the next hot spot will be.

Finally, diversify across different types of passive investments. Beyond syndications, you can also invest in private partnerships, private notes, secured debt funds, and real estate equity funds. These options allow you to mix shorter- and longer-term investments, helping you stay flexible no matter what the market brings.

Final Thoughts

From 2022 to 2024, multifamily properties went through a tough bear market, bringing with it significant losses and widespread fear. The reality is, the bottom of a bear market rarely feels optimistic — headlines stay negative, and investor sentiment remains cautious long after prices have hit their lows. But historically, that’s exactly when the best opportunities appear — before it becomes obvious to everyone that a new bull market has begun.

As someone who invests consistently month after month, I’m not a fan of trying to time the market. However, by looking at the data, it’s clear that many market indicators are pointing toward the bottom already being behind us, with the early stages of a new bull market taking shape. It may not feel like the explosive, euphoric environment of 2021 — and that’s exactly why it could be the smarter time to buy.

Categories

Recent Posts

GET MORE INFORMATION