Navigating the Impact of Inflation on the Housing Market: Insights for Homebuyers and Sellers

Have you ever pondered about the relationship between inflation and the housing market? Surprisingly, these two are intertwined, so any shifts in one inevitably influence the other. Let's delve into a broad perspective of how these two aspects are connected.

The Relationship Between Housing Inflation and Overall Inflation

Housing inflation, also known as shelter inflation, constitutes the gauge of price escalation that pertains to housing. This metric originates from a survey conducted by the Bureau of Labor Statistics (BLS), encompassing both renters and homeowners. Renters are queried about their rental expenditures, while homeowners are asked about the hypothetical rental value of their residences, if they were not residing in them.

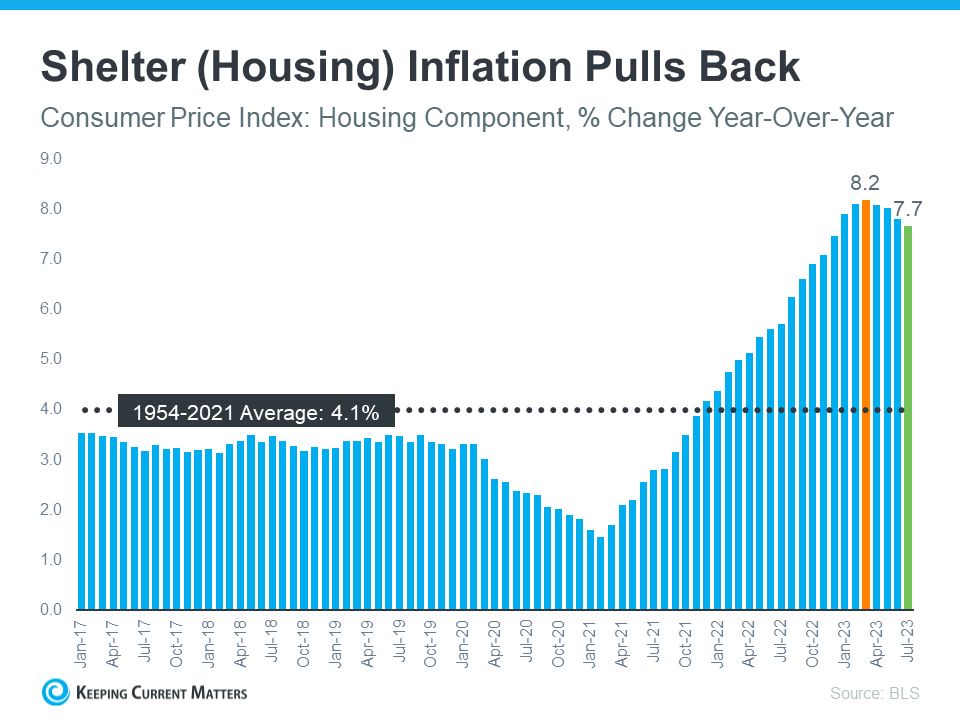

Similar to how general inflation gauges the expenses of common commodities, shelter inflation gauges housing expenses. According to the data from that survey, shelter inflation has been decreasing consistently for the past four months (as depicted in the graph below):

Why is this significant? Because shelter inflation contributes approximately one-third to the total measurement of inflation, as indicated by the Consumer Price Index (CPI). Consequently, when shelter inflation undergoes changes, it triggers noticeable fluctuations in overall inflation. This implies that the recent decline in shelter inflation might serve as an indication that overall inflation could decrease in the upcoming months.

Such moderation would be a favorable development for the Federal Reserve (the Fed), which has been striving to manage inflation since the beginning of 2022. Despite making certain progress (with a peak of 8.9% in the previous year), they are still endeavoring to achieve their 2% target (the most recent report indicates 3.3%).

Inflation and the Federal Funds Rate

How has the Federal Reserve been addressing inflation reduction? They've been raising the Federal Funds Rate. This particular interest rate affects the cost at which banks borrow funds from one another. In response to the rise in inflation, the Fed took action by increasing the Federal Funds Rate to prevent the economy from becoming overheated.

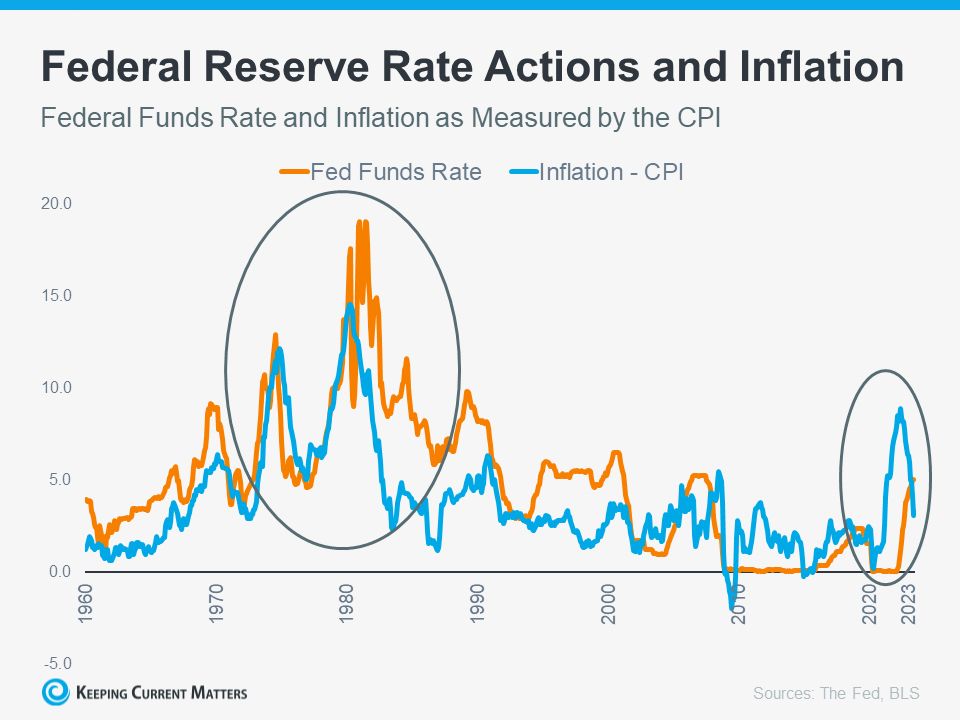

The provided graph illustrates the correlation between these two factors. Whenever inflation (depicted by the blue line) begins to rise, the Federal Reserve responds by increasing the Federal Funds Rate (represented by the orange line), aiming to bring it back to their desired 2% target (as depicted below):

The highlighted section on the graph illustrates the recent upsurge in inflation, the Federal Reserve's response of elevating the Federal Funds Rate to counter it, and the subsequent easing of inflation as a result of that adjustment. As inflation approaches the Federal Reserve's present 2% objective, the necessity for significant further increases in the Federal Funds Rate might diminish.

A Brighter Future for Mortgage Rates?

So, how does all of this translate to your situation? While the moves made by the Federal Reserve don't outright dictate mortgage rates, they do exert an influence. As highlighted by Mortgage Professional America (MPA):

". . . mortgage rates and inflation share a connection, albeit indirectly. As inflation increases, mortgage rates also climb to align with the value of the US dollar. Conversely, when inflation decreases, mortgage rates also decrease accordingly."

Although the future of mortgage rates remains uncertain, it is reassuring to observe indications of inflation moderating within the economy.

Bottom Line

Whether you're considering purchasing, selling, or simply aiming to stay updated on the housing market, reach out to a knowledgeable local real estate professional who can provide assistance.

Categories

Recent Posts

GET MORE INFORMATION