Overcome These Two Factors, Sellers, and Unlock Your Full Potential

Numerous homeowners considering selling face two significant obstacles that deter them from taking action: the perception of being constrained by current higher mortgage rates and concerns about the limited supply hindering their ability to find a suitable purchase. In this discussion, we will delve into each challenge and provide valuable guidance on how to conquer these barriers.

Challenge #1: The Reluctance to Take on a Higher Mortgage Rate

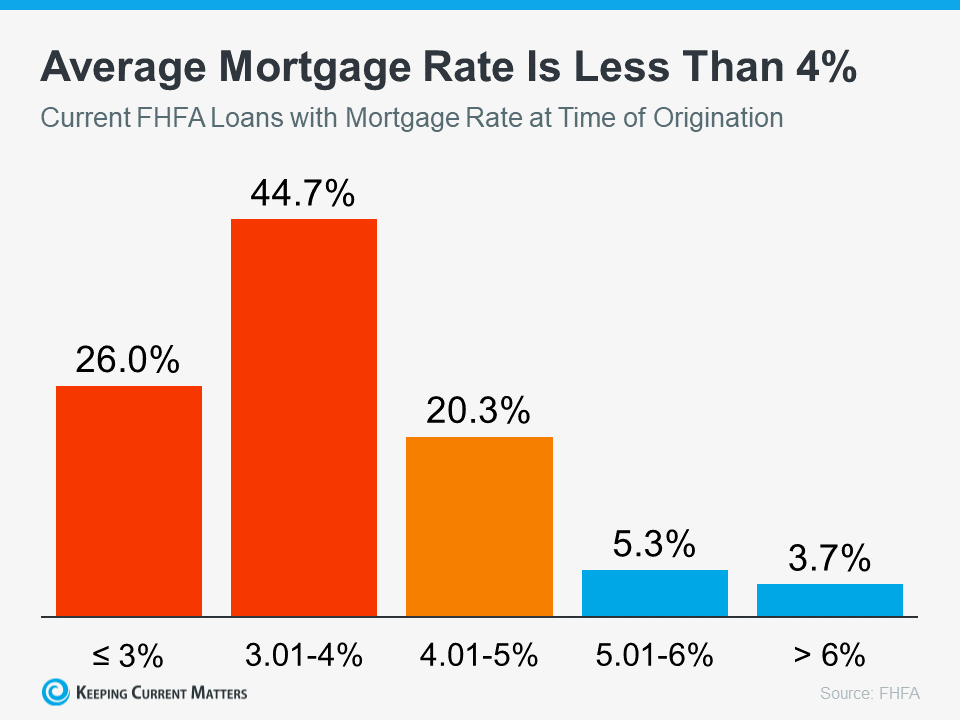

Based on data from the Federal Housing Finance Agency (FHFA), the average interest rate for existing homeowners with mortgages is below 4% (as shown in the graph below):

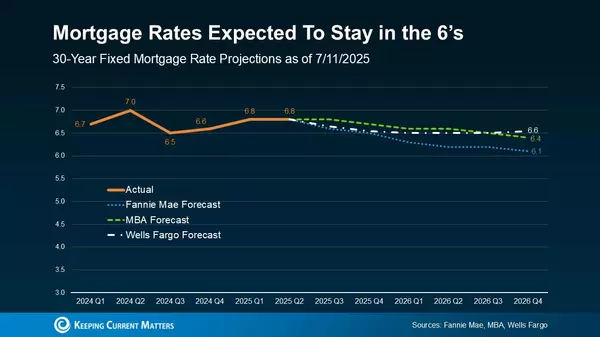

However, in the current market, the standard 30-year fixed mortgage rate available to potential buyers is closer to 7%. Consequently, numerous homeowners are choosing to remain in their current homes rather than relocating to a new property with increased borrowing expenses. This phenomenon is commonly referred to as the mortgage rate lock-in effect.

The Advice: Waiting May Not Pay Off

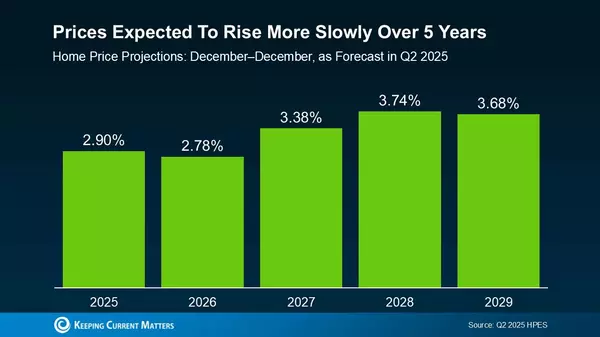

Although experts predict a gradual decline in mortgage rates this year due to cooling inflation, it's not advisable to wait indefinitely before selling. Mortgage rates are notoriously difficult to forecast accurately. Besides, current home prices are once again trending upward. By taking action now, you can at least avoid the risk of rising home prices when you decide to purchase your next home. Furthermore, if the experts' predictions come true and rates indeed fall, you have the option to refinance later if the opportunity arises.

Challenge #2: The Fear of Not Finding Something to Buy

Due to the reluctance of numerous homeowners to shoulder higher mortgage rates, there is a decrease in the number of homes being listed on the market. Consequently, this trend will contribute to keeping the inventory levels low. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), elaborates on this situation:

"Over the next few months and even for the following couple of years, the inventory is expected to remain limited. This scarcity is partly attributed to homeowners being hesitant to upgrade or downsize their homes after securing historically-low mortgage rates in recent times."

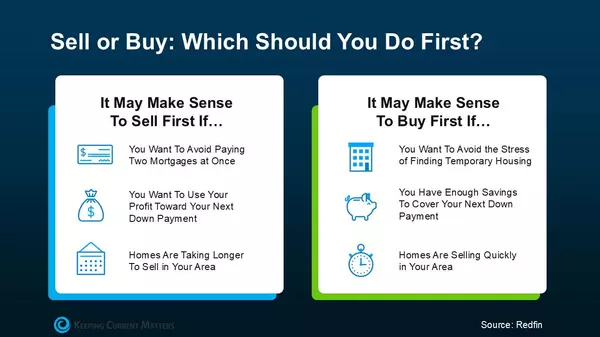

While you understand that the current limited housing supply can make your house more attractive to eager buyers, it might also create a sense of hesitation about selling because you are concerned about finding a suitable property to purchase.

The Advice: Broaden Your Search

If the main factor preventing you from taking action is the fear of not finding your next home, it's essential to explore all available options. Consider looking at various housing types, such as condos, townhouses, and newly built homes, to expand your choices. Additionally, if you have the flexibility to work fully remote or on a hybrid schedule, you might explore areas that were previously not on your radar. By considering locations farther from your workplace, you may discover more affordable housing alternatives.

Bottom Line

Rather than dwelling on the challenges, shift your focus to the aspects you can control. Take the proactive step of contacting a local agent, who can provide professional expertise and guide you through these uncertainties, ensuring that you find the ideal home for your needs.

Categories

Recent Posts