Revised 2023 Home Price Forecasts Show Optimistic Expert Predictions.

As the previous year drew to a close, numerous headlines predicted a significant decline in home prices for 2023. This generated widespread anxiety and raised concerns about the possibility of a housing market crash reminiscent of the 2008 recession. However, these headlines ultimately proved to be inaccurate.

Following the remarkable price surges in the ‘unicorn’ years, there was a minor correction in home prices. Nevertheless, on a national scale, there was no dramatic plummet in home values. In fact, prices displayed a remarkable level of resilience that exceeded the expectations of many.

Let's examine some of the expert predictions from the end of the previous year and compare them with their most recent forecasts to illustrate that even the experts acknowledge they were excessively pessimistic.

Expert Home Price Forecasts: Then and Now

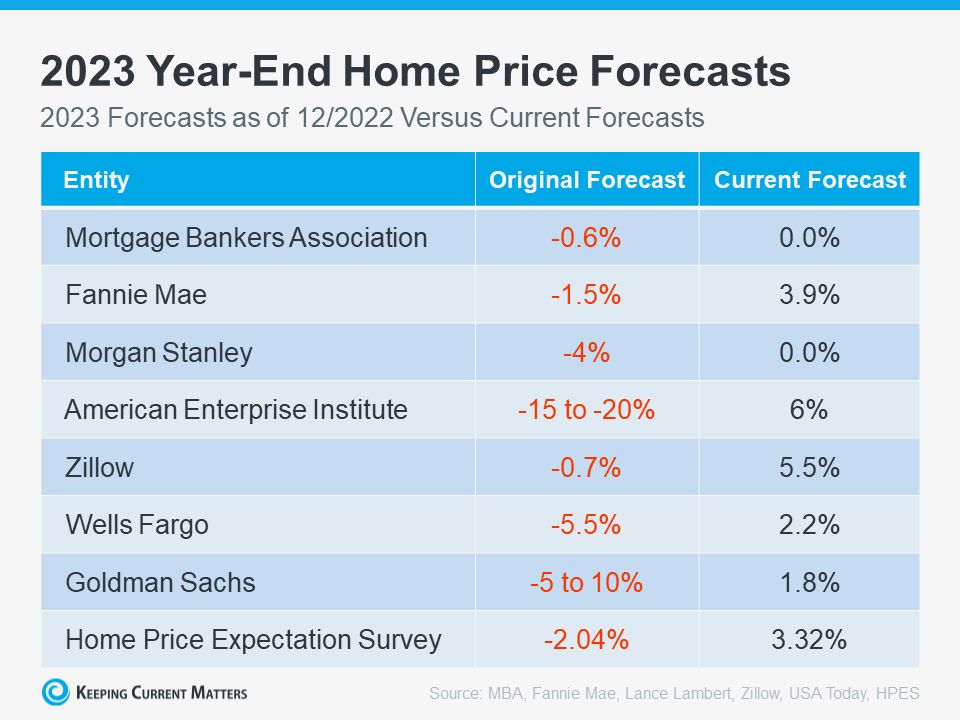

This graphic displays the 2023 home price projections from seven different organizations. It presents both the initial 2023 forecasts, which were released in late 2022, indicating expected developments in home prices by year-end, as well as their latest revised 2023 predictions (as shown in the chart below).

As indicated by the red data in the central column, in every case, their initial prediction anticipated a decrease in home prices. However, upon examining the right column, it becomes evident that all experts have revised their year-end projections to indicate either stability or anticipated positive growth in prices. This marks a substantial shift away from their initial negative forecasts.

Several factors contribute to the remarkable resilience of home prices against decline. In the words of Odeta Kushi, Deputy Chief Economist at First American:

“One thing is for sure, having long-term, fixed-rate debt in the U.S. protects homeowners from payment shock, acts as an inflation hedge – your primary household expense doesn’t change when inflation rises – and is a reason why home prices in the U.S. are downside sticky.”

"One thing is certain: long-term, fixed-rate debt in the U.S. shields homeowners from sudden payment increases, serves as a safeguard against inflation – your main household expenditure remains stable even as inflation climbs – and contributes to the resilience of home prices in the United States."

A Look Forward To Get Ahead of the Next Headlines

Expect the media to continue featuring inaccurate coverage of home prices in the upcoming months. This is due to the seasonal patterns in home price appreciation, which are often misunderstood. Here's what you should be aware of to stay ahead of the next wave of negative headlines.

As the housing market activity naturally decelerates toward the end of this year, a similar trend is expected in home price growth. However, it's important to clarify that this slowdown doesn't imply that prices are declining; rather, they are simply not rising as rapidly as they did during the peak homebuying season.

Fundamentally, a deceleration in the rate of appreciation should not be confused with home prices depreciating.

Bottom Line

Headlines wield influence, even when they lack accuracy. Despite the media's predictions of a substantial decline in home prices in their coverage at the close of the previous year, such a scenario did not materialize. It's advisable to establish a connection with a real estate agent who can serve as a reliable resource to assist you in distinguishing between factual information and fiction using dependable data.

Categories

Recent Posts

GET MORE INFORMATION