Strategies for Staying Updated on Mortgage Rate Developments

If you're considering purchasing a home, it's likely that mortgage rates are a key consideration. You're aware of their influence on your monthly mortgage expenses and want to ensure you're accounting for this factor as you strategize your relocation.

The challenge arises from the multitude of recent news headlines regarding rates, which can make it quite daunting to navigate through. Here's a concise summary of the essential information you need.

Recent Updates Regarding Mortgage Rates

Rates have exhibited volatility lately, indicating fluctuations. You might be curious as to why. The explanation is complex due to the multitude of factors influencing rates.

Factors such as the broader economic conditions, the state of the job market, the prevailing inflation rate, decisions taken by the Federal Reserve, and numerous other elements exert influence. Recently, all these factors have converged, contributing to the volatility we've observed. As Odeta Kushi, Deputy Chief Economist at First American, explains:

"Continued deceleration in inflation, a sluggish economy, and geopolitical uncertainties can lead to decreased mortgage rates. Conversely, data indicating potential inflationary risks may lead to higher rates."

Experts Can Aid in Understanding the Complexity

Although delving into each of these factors would provide a deeper understanding of their effects on mortgage rates, it would require substantial effort. Amidst the hustle of planning a move, undertaking such extensive reading and research might feel overwhelming. Rather than investing your time in that, rely on the expertise of professionals.

They routinely guide individuals through market conditions. Their emphasis is on providing you with a concise overview of any overarching trends, whether they're upward or downward, insights from experts regarding future developments, and how all of this affects you.

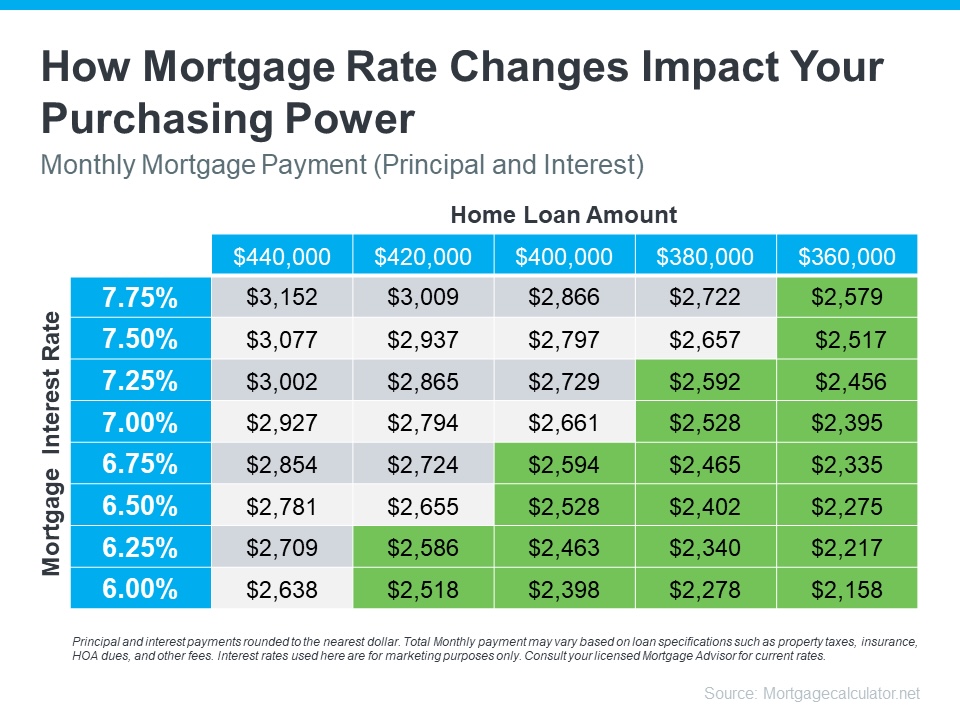

Consider this chart as an illustration. It provides insight into how mortgage rates influence your monthly payment when purchasing a home. Envision being able to manage a payment between $2,500 and $2,600 within your budget (principal and interest only). The green section in the chart displays payments within or below that range, depending on different mortgage rates (refer to the chart below):

As evident, even a minor fluctuation in rates can affect the loan amount you can comfortably afford while adhering to your desired budget.

It's tools and visuals like these that interpret ongoing events and illustrate their implications for you. Only a professional possesses the requisite knowledge and expertise to navigate you through them.

You don't have to be well-versed in real estate or mortgage rates; you simply need to have an expert in those fields by your side.

Bottom Line

Curious about the current state of the housing market? Reach out to a real estate professional who can help decipher its implications for you.

Categories

Recent Posts

GET MORE INFORMATION