Take the Leap to Homeownership: Questions to Consider Before Buying

Buying a home is a big decision, and research is key. With so much information swirling around, it's easy to get caught up in the noise and lose sight of your priorities. Whether you're a first-time buyer or a seasoned homeowner, taking the time to carefully research the market, understand your financial situation, and consider your long-term goals is crucial.

Consider the following essential inquiries you should pose to yourself while navigating your decision-making process, along with pertinent data to sift through the information overload.

1. Where Do I Think Home Prices Are Heading?

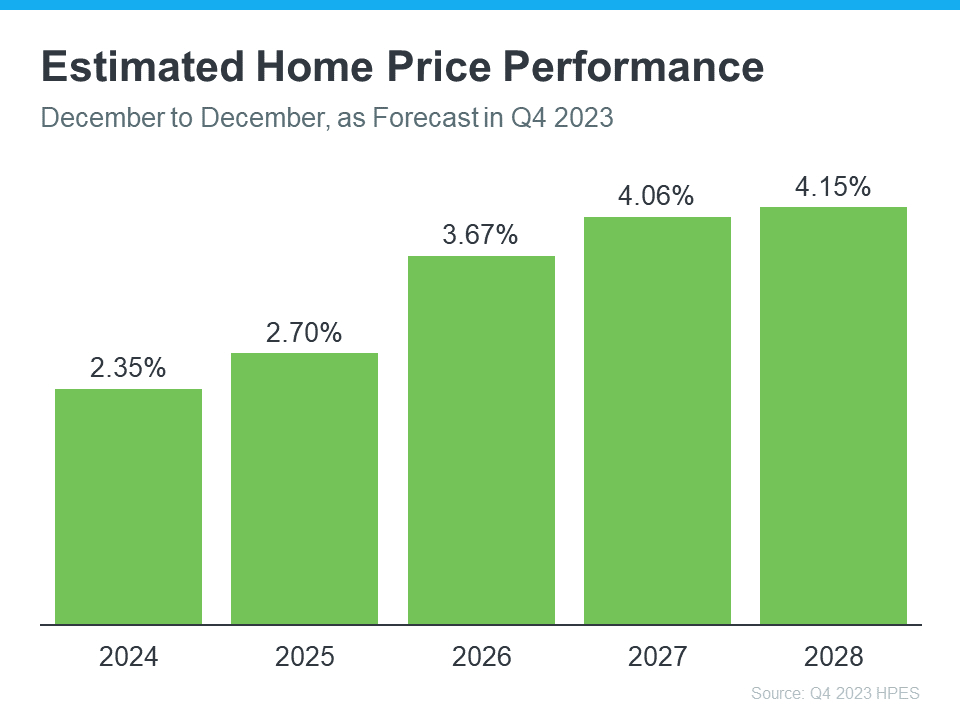

A trustworthy source for insights into home price projections is the Home Price Expectations Survey by Fannie Mae. This survey gathers input from more than a hundred economists, real estate professionals, as well as investment and market strategists.

As indicated in the latest publication, industry experts forecast that home prices will maintain an upward trajectory, extending at least until 2028 (refer to the graph below):

Why is this relevant to you? Although the rate of appreciation might not reach the levels seen in the past few years, the crucial point to emphasize is that the survey indicates a continued upward trend in prices for at least the next five years, rather than a decline.

The positive aspect of home prices increasing, even if at a more moderate rate, extends beyond the market itself – it's advantageous for you as well. Purchasing now suggests that your home is likely to appreciate in value, leading to the accumulation of home equity in the coming years. Conversely, delaying your decision, as per these forecasts, implies that the cost of the home will likely rise, resulting in a potentially higher expenditure later on.

2. Where Do I Think Mortgage Rates Are Heading?

In the last year, mortgage rates experienced an increase due to economic uncertainty and inflation. However, there is a positive development for the market and mortgage rates. The moderation of inflation is a significant development, and here's why it matters, especially for those in the market to purchase a home.

As inflation subsides, mortgage rates typically decrease in response, and this is precisely the trend observed in recent weeks. Moreover, with the Federal Reserve indicating a pause in Federal Funds Rate hikes and the possibility of rate cuts in 2024, experts are increasingly optimistic about the likelihood of mortgage rates declining.

Danielle Hale, Chief Economist at Realtor.com, provides insight:

". . . mortgage rates are anticipated to decrease in 2024 as inflation improves and the possibility of Federal Reserve rate cuts draws nearer. . . . a crucial factor in beginning to offer affordability relief to homebuyers."

As highlighted in an article from the National Association of Realtors (NAR):

"It is probable that mortgage rates have reached their highest point and are currently declining from the recent peak of nearly 8%. This is expected to enhance housing affordability and attract a greater number of homebuyers back to the market. . . ."

No one can assert with complete certainty the direction in which mortgage rates will head. Nevertheless, the recent decline and the Federal Reserve's choice to cease rate increases indicate a promising outlook. Though some fluctuations may occur, there is an anticipation that affordability will improve as rates continue to ease.

Bottom Line

If you're considering purchasing a home, it's crucial to be aware of the anticipated trends in home prices and mortgage rates. While it's impossible to predict their exact trajectory, staying informed with the latest information is essential for making well-informed decisions. Establish a connection with a reliable local real estate agent to stay updated on current developments and understand why this is advantageous for you.

Categories

Recent Posts

GET MORE INFORMATION