The Current Foreclosure Figures Bear No Resemblance to the 2008 Economic Crisis

If you've been staying informed with recent news, you've likely encountered articles suggesting an increase in foreclosures in today's housing market. This might evoke concerns about the future, particularly if you experienced homeownership during the housing crash of 2008.

The truth is, although on the rise, the data indicates that the market is not heading towards a foreclosure crisis.

Here's the most recent information compared to historical data to reassure you.

The Headlines Overstate the Increase – It's Not as Dramatic

The rise highlighted by the media is somewhat deceptive. This is because it's comparing the latest figures to a period when foreclosures were exceptionally low. This skewed comparison is exaggerating the significance of the situation.

In 2020 and 2021, a moratorium and forbearance program were in place, aiding millions of homeowners in avoiding foreclosure during difficult times. This is why foreclosure numbers from just a few years ago were remarkably low.

With the conclusion of the moratorium, foreclosures are resuming, leading to an increase in numbers. However, this rise is anticipated, not unexpected, and shouldn't cause alarm. An uptick in foreclosure filings doesn't necessarily indicate trouble in the housing market.

To demonstrate this, let's broaden the comparison further. In particular, we'll extend it all the way back to the housing crash in 2008, as that's what concerns people about a potential recurrence.

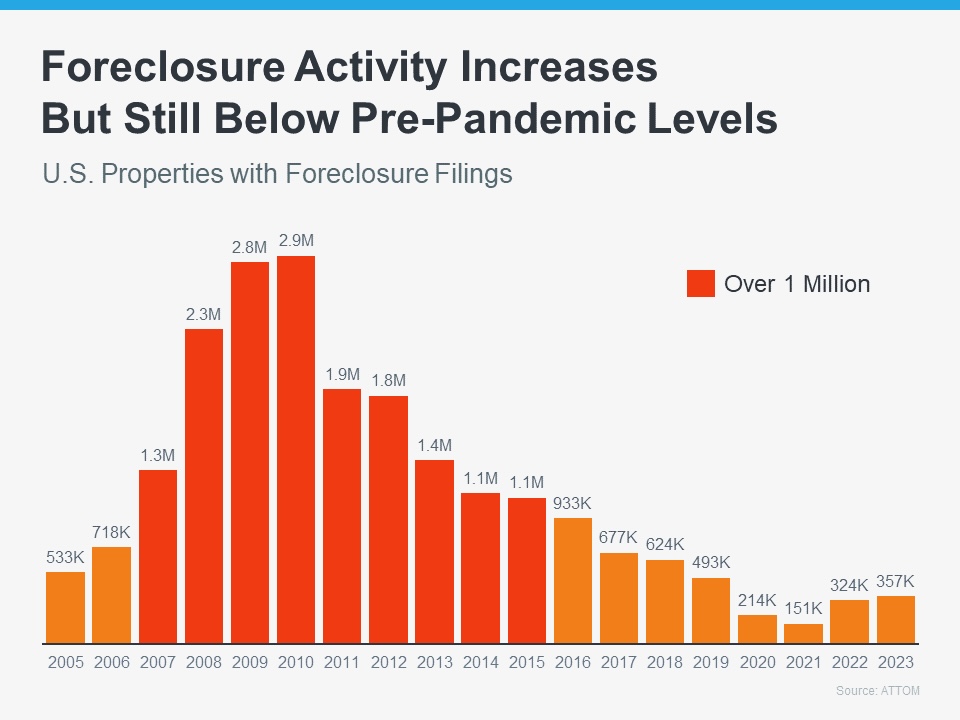

The graph below, utilizing research from ATTOM, a property data provider, illustrates that foreclosure activity has consistently remained lower since the 2008 crash:

The data indicates that the current situation bears no resemblance to the conditions surrounding the housing crash. The red bars represent years with over 1 million foreclosure filings annually. In 2023, there were approximately 357,000, highlighting a significant disparity.

A recent Bankrate article elucidates one of the reasons why the current situation differs from the past.

"In the aftermath of the housing crash, the housing market was inundated with millions of foreclosures, leading to price depreciation. However, that's not the situation today. The majority of homeowners have substantial equity in their homes."

Essentially, foreclosure activity bears no resemblance to the levels seen during the crash. This is largely due to the fact that most homeowners now possess sufficient equity to prevent foreclosure. This is highly beneficial both for homeowners and for the market as a whole.

In reality, the data demonstrates that the market is not currently in, nor is it heading towards, a foreclosure crisis.

Bottom Line

At present, placing the data into perspective is crucial. Despite the anticipated increase in foreclosures in the housing market, it remains far from the crisis levels witnessed during the housing bubble burst. Consequently, this rise is unlikely to precipitate a crash in home prices.

Categories

Recent Posts

GET MORE INFORMATION