The Impact of Inflation on Mortgage Rates

When perusing news articles about the housing market, you may come across mentions of recent decisions taken by the Federal Reserve (the Fed). However, it's essential to understand how these decisions can influence your aspirations of purchasing a home. Here's everything you should be aware of.

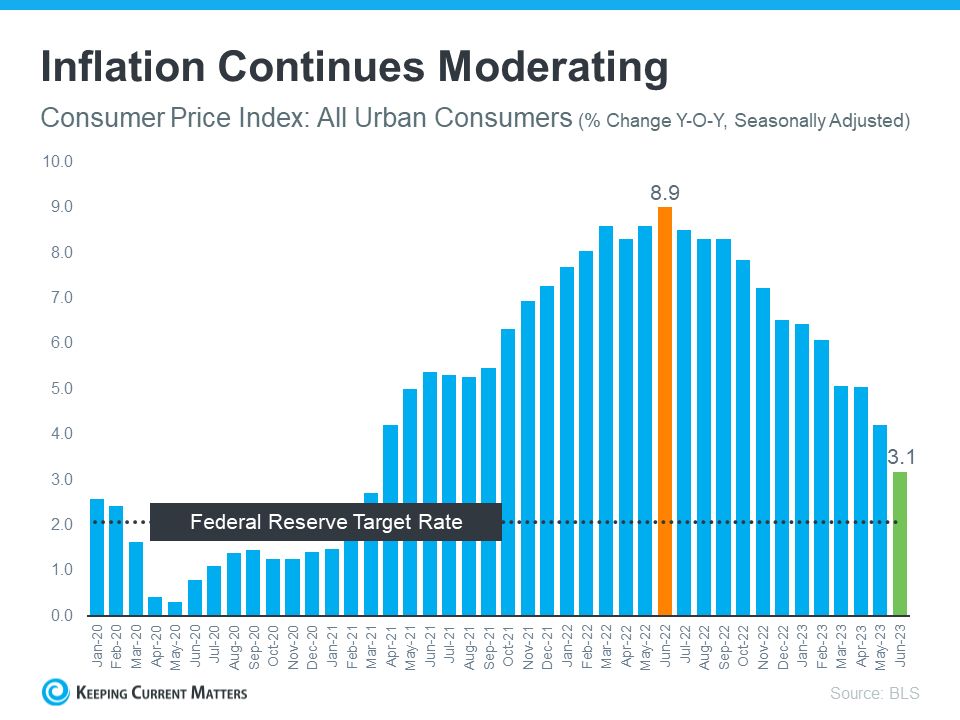

Despite the Federal Reserve's dedicated efforts to curtail inflation, recent data reveals that inflation remains higher than the Fed's target of 2%, even after experiencing 12 consecutive months of cooling (as depicted in the graph below).

Although many may have been anticipating the Federal Reserve to halt their rate hikes due to their progress in reducing inflation, they are cautious about stopping prematurely and risking a resurgence in inflation. As a result of this concern, the Fed chose to raise the Federal Funds Rate once more last week. In the words of Jerome Powell, Chairman of the Federal Reserve:

"We are steadfast in our commitment to achieving our 2 percent inflation target and ensuring that longer-term inflation expectations remain firmly anchored."

Greg McBride, Senior VP, and Chief Financial Analyst at Bankrate, elaborates on how elevated inflation and a robust economy factor into the Federal Reserve's recent decision:

"Inflation continues to persist at elevated levels. The economy has displayed remarkable resilience, with a robust labor market, but these factors might be contributing to the persistence of high inflation. Consequently, the Federal Reserve finds it necessary to exercise greater caution and apply further measures to control the situation."

While a Federal Fund Rate hike by the Fed doesn't directly dictate mortgage rates, it does exert an influence, as noted in a recent article from Fortune.

"The federal funds rate is an interest rate that banks charge each other for interbank lending. In times of elevated inflation, the Fed raises rates to heighten the cost of borrowing and temper economic growth. Conversely, when inflation is too low, the Fed reduces rates to stimulate the economy and promote economic activity."

How All of This Affects You

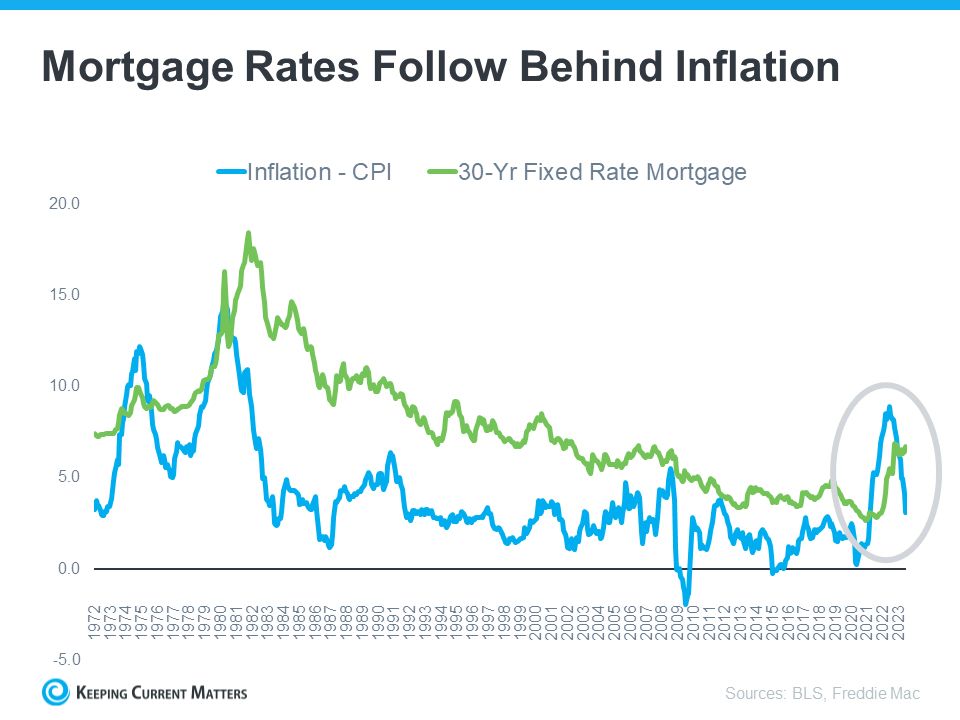

In the most straightforward terms, when inflation is high, mortgage rates tend to be high as well. However, if the Federal Reserve successfully curbs inflation, it may result in lower mortgage rates, ultimately increasing affordability for prospective homebuyers.

The graph provided below illustrates the correlation between inflation and mortgage rates. As inflation decreases, mortgage rates also tend to decline, as demonstrated in the graph.

As evident from the presented data, inflation, depicted by the blue trend line, is gradually decreasing. Drawing from historical patterns, it is probable that mortgage rates, indicated by the green trend line, will follow suit. McBride shares insights regarding the future trajectory of mortgage rates:

“With the backdrop of easing inflation pressures, we should see more consistent declines in mortgage rates as the year progresses, particularly if the economy and labor market slow noticeably.”

Bottom Line

The movement of mortgage rates hinges on the behavior of inflation. Should inflation subside, mortgage rates are likely to follow suit and decrease as well. For reliable guidance on how housing market changes may impact you, rely on the expertise of a trustworthy real estate professional.

Categories

Recent Posts

GET MORE INFORMATION