Today's Three Factors Affecting Home Affordability

There has been a lot of discussion about rising mortgage rates and how they are causing affordability issues for today's homebuyers. It's true that rates have risen considerably since the pandemic's all-time low. But housing affordability is driven by a mix of mortgage rates, property prices, and income, not simply mortgage rates.

Consider how each of these elements is evolving to get a complete picture of house affordability today. Here's the most recent.

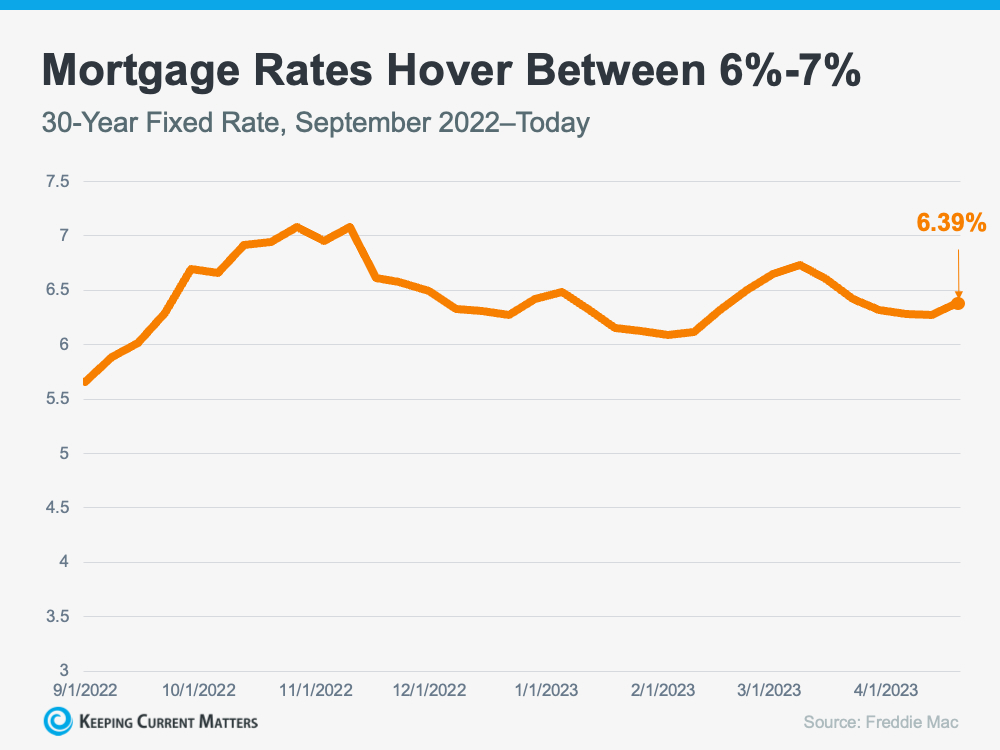

1. Mortgage Rates

While mortgage rates have risen since a year ago, they have remained mostly between 6% and 7% for about eight months (see graph below):

Mortgage rates, as seen in the graph, have been volatile over that time. Even little changes in mortgage rates have an effect on your purchasing power. That is why it is critical to rely on your team of real estate specialists for experienced assistance in order to keep current on market trends. While it's difficult to predict where mortgage rates will go from here, many analysts believe they'll stay around 6%-7% for the foreseeable future.

2. Home Prices

Home prices have risen quickly in recent years, owing to a spike in buyer demand caused by the pandemic's record-low mortgage rates. The increased buyer demand occurred at a time when the supply of available houses for sale was at an all-time low, putting upward pressure on home prices. However, today's higher mortgage rates have curbed price growth.

And, the truth is, home price appreciation varies by market. Some areas are seeing slight declines while others have prices that are climbing. As Selma Hepp, Chief Economist at CoreLogic, explains:

Furthermore, house price appreciation differs by market. Some locations are experiencing small price decreases, while others are experiencing price increases. According to Selma Hepp, Chief Economist of CoreLogic:

“The divergence in home price changes across the U.S. reflects a tale of two housing markets. Declines in the West are due to the tech industry slowdown and a severe lack of affordability after decades of undersupply. The consistent gains in the Southeast and South reflect strong job markets, in-migration patterns and relative affordability due to new home construction.”

To find out what’s happening with prices in your local market, reach out to a trusted real estate agent.

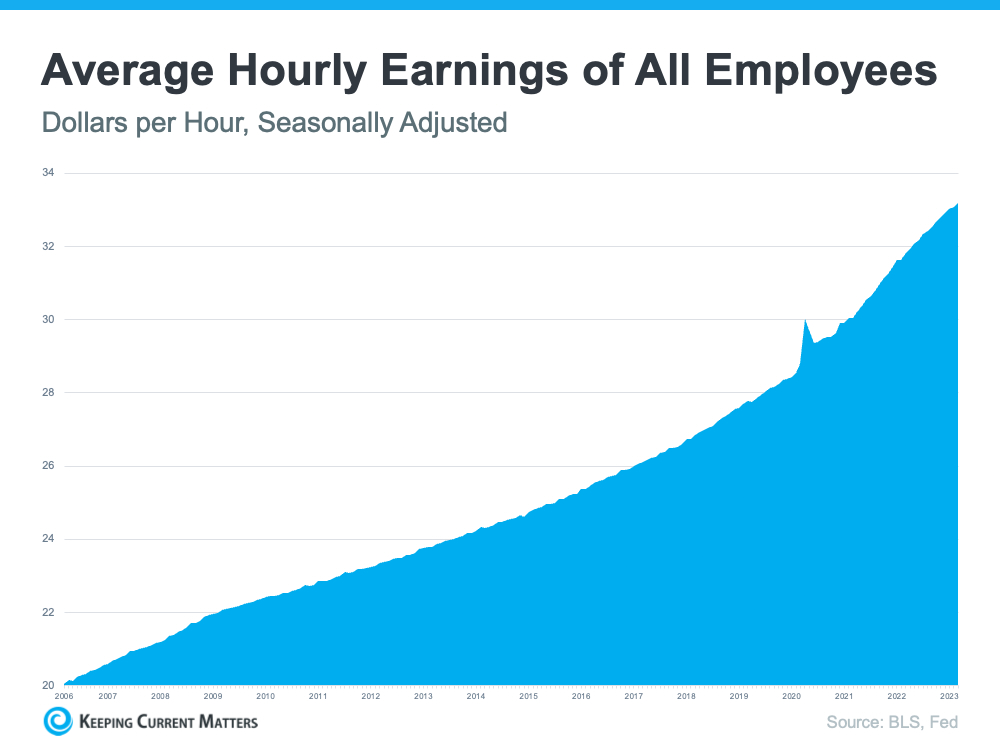

3. Wages

Rising income is now the biggest favorable aspect in affordability. The graph below depicts pay growth through time using data from the Bureau of Labor Statistics (BLS):

Higher salaries enhance affordability since they lower the proportion of your income required to pay your mortgage because you are not required to contribute as much of your salary to your monthly housing expense.

Home affordability is determined by a mix of interest rates, prices, and incomes. If you have any concerns or want to learn more, contact a real estate agent who can explain what's going on in your area and how these variables interact.

Bottom Line

If you want to buy a home, recognizing the primary elements that influence affordability can help you make an informed decision. Connect with a reputable real estate expert now to keep up to speed on the latest on each.

Categories

Recent Posts

GET MORE INFORMATION