Unveiling the Reality of Down Payments

When preparing to purchase your first home, accumulating funds for the various expenses can seem overwhelming, particularly when considering the down payment. This perception may stem from the common belief that saving 20% of the home's value is mandatory for the down payment, but this isn't always true.

Unless your specific loan type or lender demands it, putting down 20% is usually not a necessity. This suggests that achieving your dream of buying a home may be closer than you think.

According to The Mortgage Reports:

"While putting down 20% to sidestep mortgage insurance is beneficial if manageable, the belief that it's universally necessary is unfounded. In fact, most buyers opt for a significantly smaller down payment."

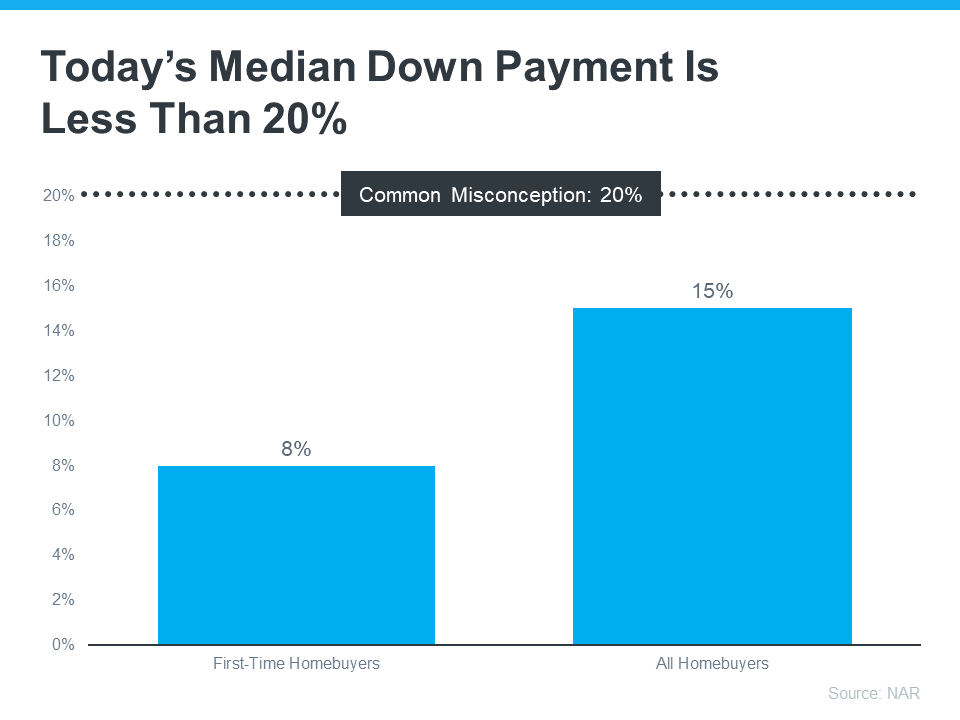

The National Association of Realtors (NAR) reports that the average down payment hasn't exceeded 20% since 2005. Currently, the median down payment for all homebuyers is just 15%, and for those purchasing their first home, it drops to a mere 8%, as illustrated in the graph below:

The key insight? Your savings target for a home purchase might be less than you initially believed.

Discover Resources to Assist You in Achieving Your Goal

Down Payment Resource highlights that there are more than 2,000 homebuyer assistance programs across the U.S., with many designed specifically to aid with down payments.

Additionally, certain loan programs can provide assistance as well. For instance, FHA loans allow for down payments as minimal as 3.5%, and both VA and USDA loans offer the possibility of zero down payment for those who qualify.

Moreover, specific loan programs can offer support. For example, FHA loans permit down payments as low as 3.5%, while VA and USDA loans present the opportunity for no down payment for qualifying individuals.

Given the abundance of assistance options for your down payment, the most effective strategy to discover what you're eligible for is to speak with your loan officer or broker. They are knowledgeable about local grants and loan programs that could be beneficial to you.

Don't be deterred by the false belief that you need to save up 20% before you can buy a home. If you're prepared to take the step towards homeownership, rely on professionals to identify resources that can turn your dreams into reality. Waiting until you've accumulated a 20% down payment could end up being more costly over time. As U.S. Bank points out:

"... numerous factors may make it impractical. For many, the effort to accumulate a 20% down payment could be excessively time-consuming. As you save for your down payment and continue to pay rent, the cost of your prospective home could increase."

It's anticipated that home prices will continue to rise over the next five years, which means the price of your future home is likely to increase the longer you delay your purchase. If you can leverage these resources to buy sooner rather than later, the upcoming appreciation in home values will contribute to your equity building, instead of leading to higher costs for you.

Bottom Line

Remember, a 20% down payment isn't a necessity for purchasing a home. If you're considering buying a home this year, it's wise to connect with a reliable real estate expert to discuss your homebuying aspirations.

Categories

Recent Posts

GET MORE INFORMATION