Why Falling Rates Could Unlock the Housing Market

When exploring the housing market, you're likely to come across information related to inflation or recent decisions by the Federal Reserve (the Fed). But how these two factors influence your homebuying plans is a key aspect you should be aware of. Here's what you need to understand.

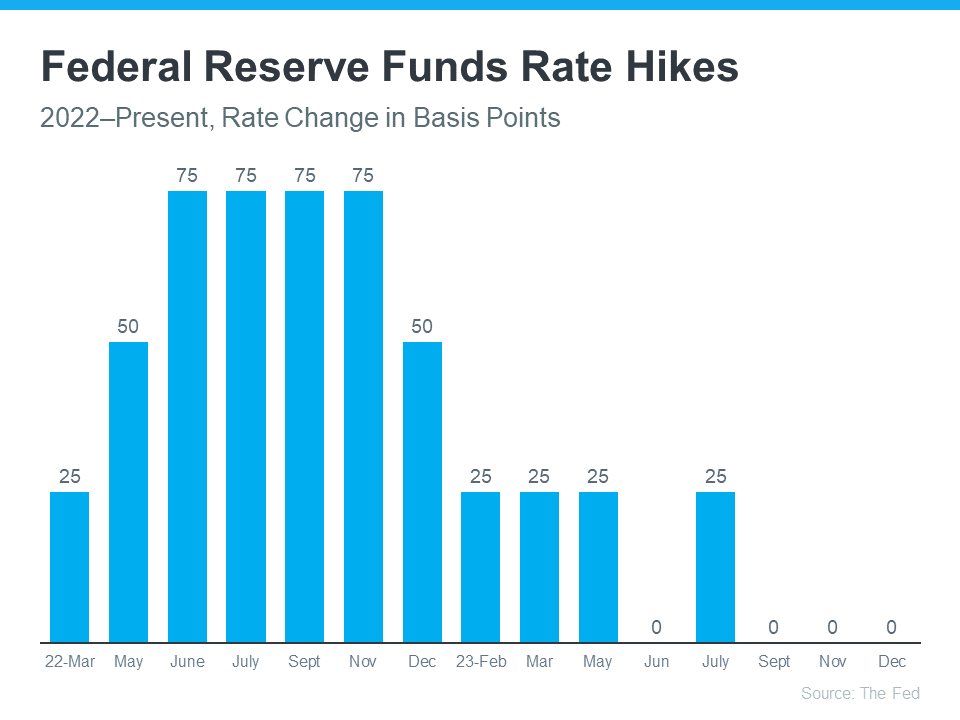

Federal Funds Rate Hike Pace Slows

One of the key objectives of the Fed is to reduce inflation. To achieve this, they initiated an increase in the Federal Funds Rate to moderate economic growth. While this doesn't directly dictate mortgage rates, it does exert an influence.

Inflation has shown signs of easing recently, indicating that the previous rate hikes have been effective in curbing inflation. Consequently, the Federal Reserve's increases have become smaller and less frequent. In fact, there have been no rate hikes since July (refer to the graph below).

Furthermore, during the last three committee meetings, the Federal Reserve not only chose not to increase the Federal Funds Rate but also indicated the possibility of rate cuts in 2024, as reported by the New York Times (NYT).

"In their last policy decision of 2023, Federal Reserve officials opted to keep interest rates unchanged. They anticipate reducing borrowing costs three times in the upcoming year, signaling a shift in the central bank's approach to combatting rapid inflation."

This suggests that the Federal Reserve believes there is improvement in both the economy and inflation. Why is this significant for your homebuying plans? It might result in decreased mortgage rates and enhanced affordability.

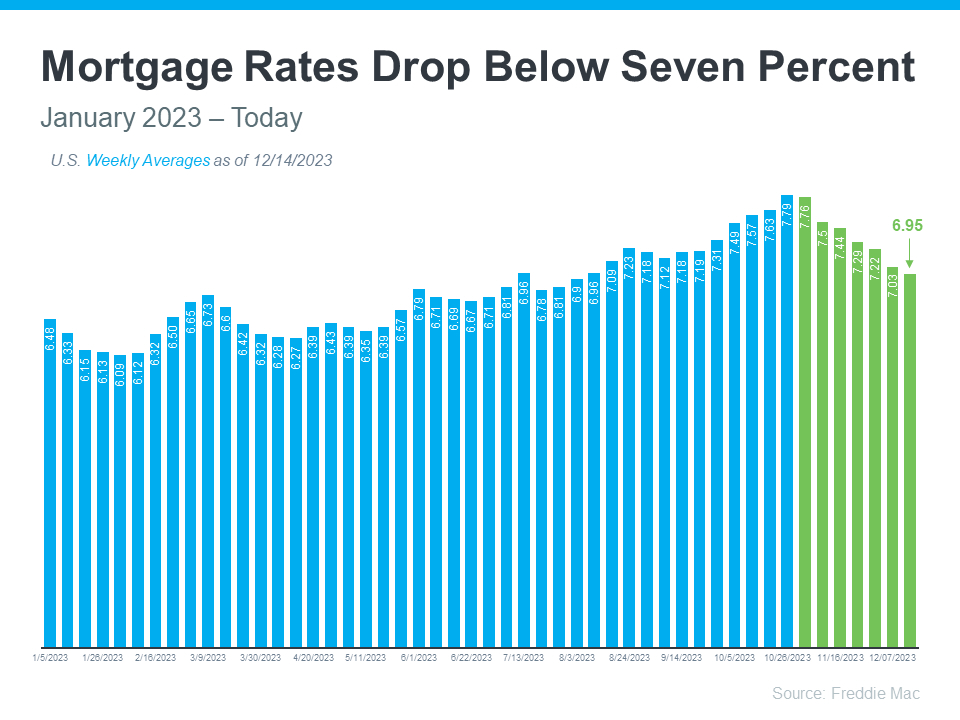

A Decline in Mortgage Rates Is Underway

Various factors contribute to the fluctuations in mortgage rates, with inflation and the Federal Reserve's actions (or lack thereof, as seen recently) playing a significant role. With the Federal Reserve halting increases, there is a greater likelihood that mortgage rates will persist in their downward trajectory (refer to the graph below).

While mortgage rates may exhibit volatility, their current pattern, coupled with predictions from experts, suggests a potential continuation of the downward trend in 2024. This could enhance affordability for buyers and facilitate sellers in making moves, as they won't feel as constrained by their existing, low mortgage rates.

Bottom Line

The Fed hit the brakes on interest rates, and guess what? Mortgage rates are taking a victory lap! This translates to potentially lower monthly payments and better home affordability for you. But navigating the housing market can be tricky, so buckle up and trust a real estate pro to guide you through the twists and turns.

Categories

Recent Posts

GET MORE INFORMATION