Why Today’s Mortgage Debt Doesn’t Signal a Housing Market Crash

One key reason we’re not facing a foreclosure crisis is the significant equity homeowners hold today. Unlike during the last housing bubble, when many homeowners owed more on their mortgages than their homes were worth, today’s homeowners have far more equity than debt.

This is why, even with mortgage debt at record levels, the current market is nothing like 2008. Housing analyst Bill McBride of Calculated Risk explains:

“With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern . . .”

Homeowners today are in a much stronger financial position than ever before. Let’s take a closer look at why today’s mortgage debt is far from alarming.

More Equity, Lower Foreclosure Risk

Data from the St. Louis Fed shows that total homeowner equity is nearly three times the total mortgage debt (see graph below):

High levels of equity provide homeowners with more flexibility and reduce the risk of foreclosure. If a homeowner faces financial challenges and struggles to make mortgage payments, they often have the option to sell their home and still walk away with a profit due to the equity they’ve built.

Even if home values were to decline, most homeowners would still have a substantial equity cushion. This is a stark difference from the 2008 crisis, when many homeowners were underwater on their mortgages and had limited options to avoid foreclosure.

Delinquency Rates Remain Historically Low

Adding to this reassurance, data from the NY Fed shows that the number of mortgage payments over 90 days past due is still near historic lows (see graph below):

This improvement is partly due to various programs designed to support homeowners through temporary financial challenges. As Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association (MBA), explains:

“Mortgage servicers are actively assisting at-risk homeowners by offering loan workout options that help them navigate short-term difficulties and avoid foreclosure.”

Even if a homeowner falls behind on their payments, these support systems provide a safety net to help prevent foreclosure.

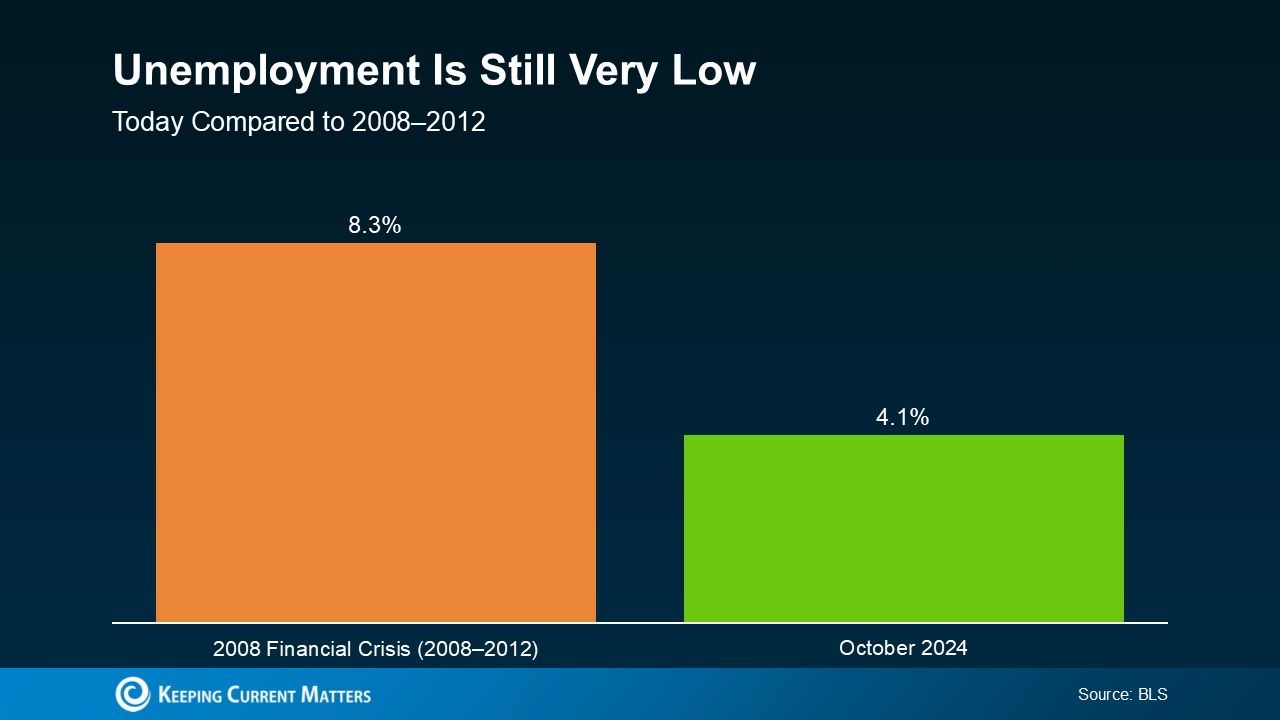

Low Unemployment Provides Market Stability

Another key factor contributing to a stable housing market is today’s low unemployment rate. With more people in steady jobs, homeowners are better positioned to manage their mortgage payments. As Archana Pradhan, Principal Economist at CoreLogic, notes:

“The low unemployment rate has played a crucial role in keeping overall delinquency rates down.”

This is a significant contrast to the last housing crisis, where high unemployment led to widespread foreclosures. Today’s much lower unemployment levels paint a very different picture (see graph below):

The steady employment levels are a key factor in why today’s housing market doesn’t carry the same risks as the last crisis. Unlike 2008, there’s no reason to fear a surge in distressed sales. Most homeowners have stable jobs and benefit from low-interest mortgages, making their payments more manageable.

As housing analyst Bill McBride puts it:

“The key takeaway is that a massive wave of distressed sales, like what occurred after the housing bubble, is simply not on the horizon.”

Bottom Line

Although mortgage debt has reached record levels, there’s no reason to believe the housing market is on the verge of another crash. Unlike the past, most homeowners today are in a solid financial position, with significant equity and manageable mortgage payments. These factors, combined with low unemployment and robust support systems, have created a stable foundation for the market.

If you have any questions about current market trends or concerns about your own situation, don’t hesitate to reach out to a trusted local real estate agent. They can provide the guidance and expertise you need to navigate today’s housing market with confidence.

Categories

Recent Posts

GET MORE INFORMATION