Why a Recession Doesn't Necessarily Mean a Housing Crisis: Insights and Historical Trends

Amidst widespread discussions about a looming recession, individuals contemplating buying or selling a property may be uncertain about the prudence of their decision. However, to alleviate concerns, professionals are assuring that any potential recession would be brief and not severe. In their March meeting, the Federal Reserve provided an explanation to support this viewpoint.

“. . . the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

Although an economic recession may be imminent, it is not expected to be as catastrophic for the housing market as the 2008 crash. It's important to note that a recession doesn't necessarily translate to a housing crisis.

To demonstrate this, let's examine the past trends in real estate during economic recessions. This analysis will help you understand why there is no need to fear the potential impact of a recession on the current housing market.

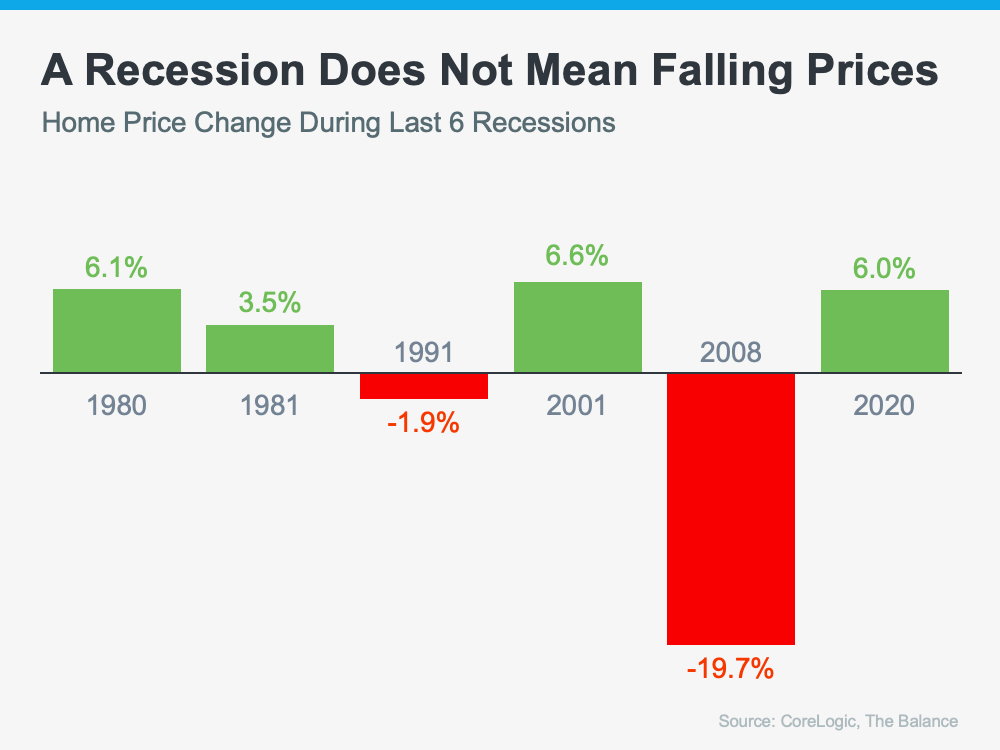

A Recession Doesn’t Mean Falling Home Prices

Examining historical data can provide evidence that home prices do not inevitably decline during every recession. As demonstrated in the graph below, analyzing recessions dating back to 1980 reveals that home prices increased during four out of the last six recessions. Hence, throughout history, when the economy experiences a slowdown, it does not necessarily result in a reduction in home values.

The majority of individuals recollect the 2008 housing crisis (indicated as the larger red bar in the graph above) and assume that another recession will have comparable consequences for the housing market. Nevertheless, the present-day housing market is unlikely to plummet because the market's fundamentals are dissimilar to those of 2008. At that time, one of the primary reasons for the price drop was an excess supply of homes for sale, which coincided with a surge of distressed properties flooding the market. Presently, the inventory of homes for sale is limited, implying that while certain areas may experience minor declines in home prices, others may witness modest gains. A housing market crash is therefore unlikely.

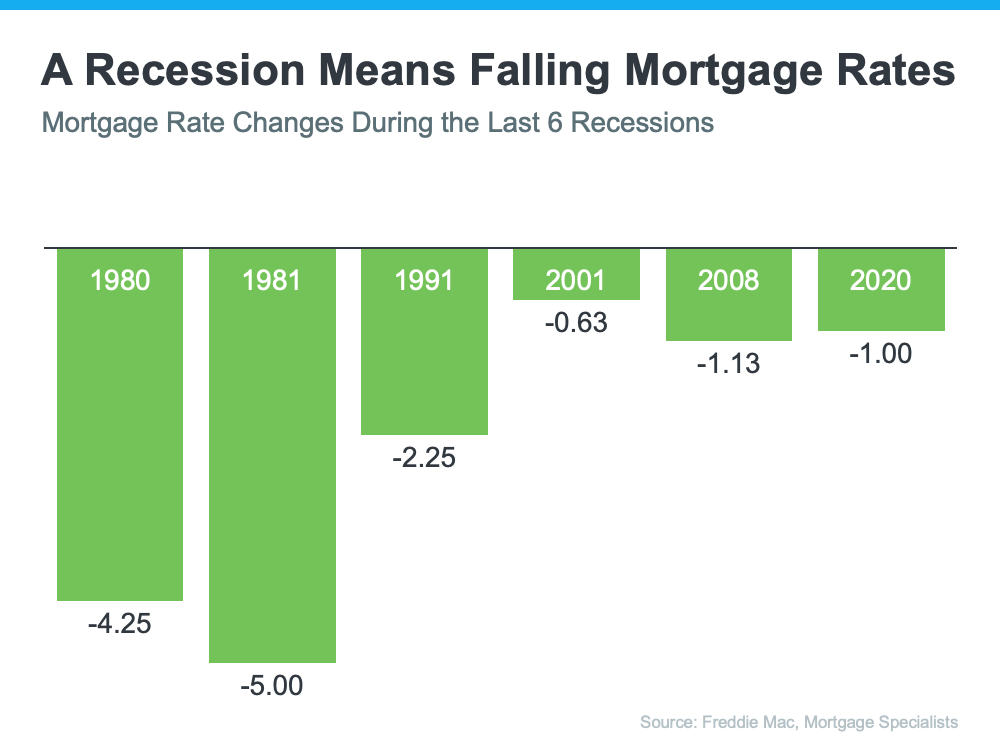

A Recession Means Falling Mortgage Rates

The true impact of a recession on the housing market is reflected in the decline of mortgage rates. As depicted in the graph below, throughout history, during economic downturns, mortgage rates have consistently decreased.

According to Bankrate, during an economic downturn, mortgage rates tend to decline.

“During a traditional recession, the Fed will usually lower interest rates. This creates an incentive for people to spend money and stimulate the economy. It also typically leads to more affordable mortgage rates, which leads to more opportunity for homebuyers.”

In response to high inflation, mortgage rates have exhibited considerable instability this year. The 30-year fixed mortgage rate has fluctuated between approximately 6-7%, influencing affordability for numerous prospective homebuyers.

However, if an economic recession ensues, past occurrences indicate that mortgage rates may drop below this level, although it's improbable that we will see rates as low as 3% again.

Bottom Line

There is no reason to be apprehensive about the potential implications of a recession on the housing market. In case of an economic slowdown, industry professionals predict that it will be brief and not severe. Additionally, historical trends indicate that a recession results in a decrease in mortgage rates.

Categories

Recent Posts

GET MORE INFORMATION