Will Lower Rates Trigger a Sales Surge?

If you're in the market for a home purchase, the current decrease in mortgage rates brings good news by enhancing affordability. Furthermore, this trend might encourage more homeowners to list their properties for sale, providing additional advantages.

The Impact of Mortgage Rate Lock-In

Over the past year, a key factor that has restricted your relocation options is the scarcity of homes on the market. This is a result of many homeowners opting to defer their selling plans when mortgage rates increased, as detailed in an article from Freddie Mac.

"The shortage of housing supply can be attributed, in part, to the rate lock-in phenomenon. As interest rates increased, the motivation for current homeowners to list their properties and transition to new homes significantly dwindled, effectively leaving them locked into their existing rates."

These homeowners chose to remain in their current residence, opting to retain their existing, lower mortgage rate instead of moving and acquiring a higher rate for their next home.

Initial Indicators Suggest Homeowners Are Prepared to Relocate Once More

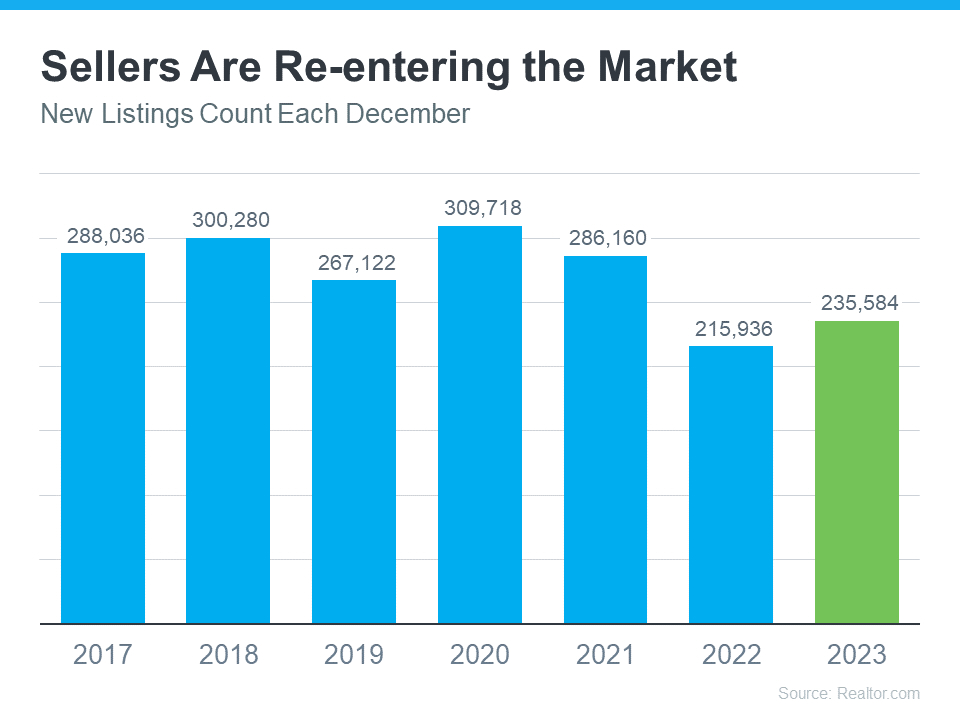

Based on Realtor.com's latest data, December 2023 witnessed a rise in homeowners listing their properties for sale, known in the industry as "new listings," compared to December 2022 (refer to the graph below).

This holds significant importance for the following reason: traditionally, the housing market experiences a slowdown in activity during the later months of the year, as some sellers prefer to postpone their moves until the arrival of January.

This marks the first instance since 2020 that we've observed an increase in new listings during this season. It could be an indication that the rate lock-in effect is showing signs of easing in response to the decline in interest rates.

What This Means for You

While there won't be an immediate surge in choices for your home search, it does suggest that more sellers might be opting to list. As outlined in a recent article by the Joint Center for Housing Studies (JCHS):

"A decrease in interest rates has the potential to alleviate the lock-in effect, consequently boosting homeowner mobility. In fact, interest rates have experienced a notable decline, dropping by a full percentage point from October to November 2023. Continued decreases would lessen the impediment to moving and instill a renewed sense of urgency among homeowners looking to sell."

This indicates that you might notice more homes entering the market, offering you a broader selection of fresh options to consider.

Bottom Line

With the decline in mortgage rates, there's a possibility that more sellers will rejoin the market, providing you with an opportunity to discover the home you desire. Get in touch with a real estate agent to have a local expert by your side, assisting you in staying informed about the latest listings in our area.

Categories

Recent Posts

GET MORE INFORMATION