How to Purchase a Home Without Waiting for Interest Rates to Drop

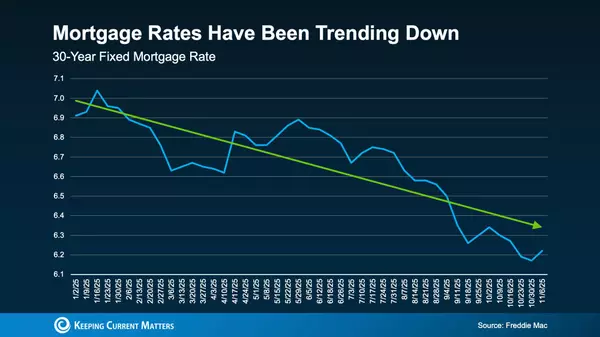

Many prospective homebuyers are waiting for mortgage rates to drop before making a purchase. But will that actually happen? According to recent forecasts, experts predict rates will decline, though not as much as many had hoped.

The good news? Even if rates don’t fall significantly, there are still strategies to make homeownership more affordable.

How Much Will Rates Drop?

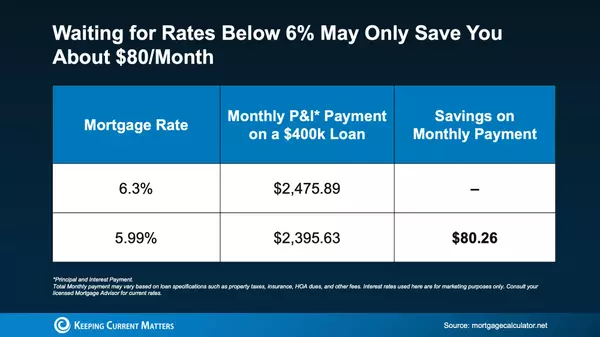

Earlier this year, experts projected mortgage rates could dip below 6% by the end of the year. However, recent updates suggest that may no longer be the case.

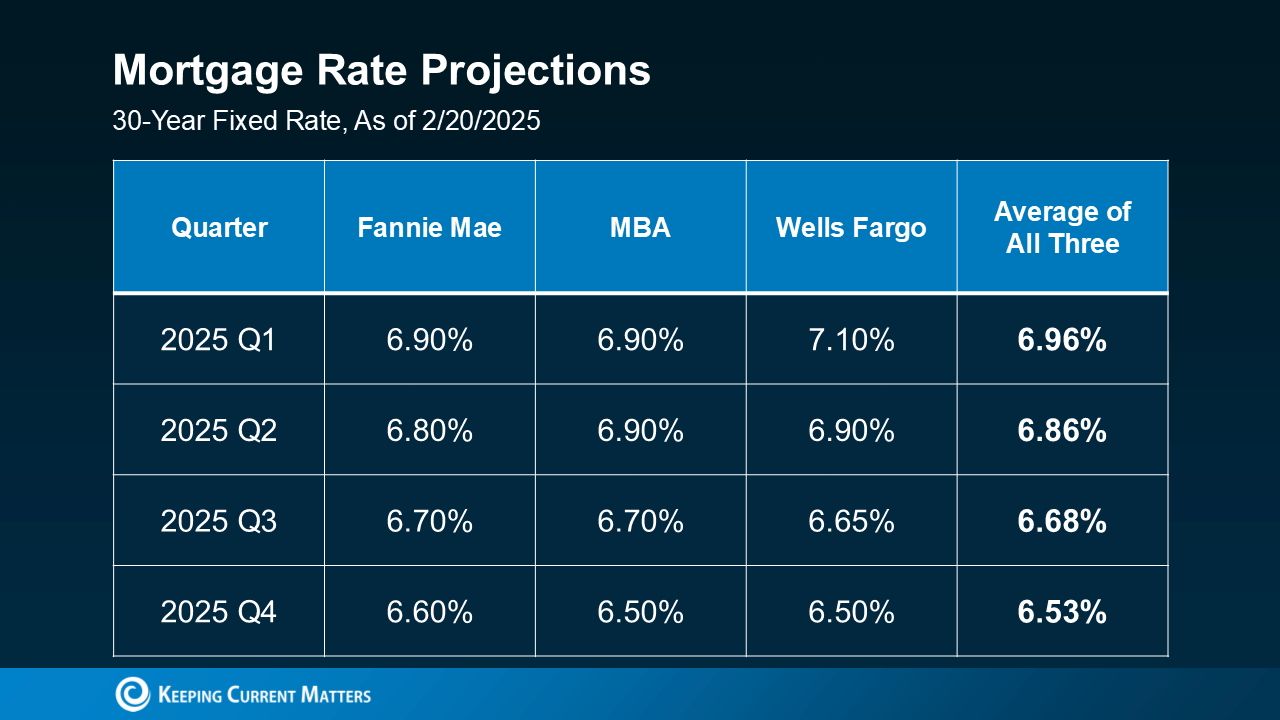

While rates are still expected to decrease somewhat, forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo now indicate they will likely settle between 6.5% and 7% (see below).

If you’re holding off on buying a home in hopes that mortgage rates will drop significantly, you might be waiting longer than expected. And if life changes—like a new job, a growing family, or marriage—are driving your need to move, waiting may not be a practical option.

Exploring Creative Financing Options

Since mortgage rates aren’t projected to decrease as much as initially thought, it’s worth considering alternative financing strategies that could help you buy a home sooner. Here are three options to discuss with your lender:

1. Mortgage Buydowns

A mortgage buydown allows you to pay an upfront fee to temporarily reduce your mortgage rate, lowering your monthly payments for the first few years. This is becoming a popular option, with 27% of agents reporting that first-time buyers are increasingly negotiating buydowns with sellers.

2. Adjustable-Rate Mortgages (ARMs)

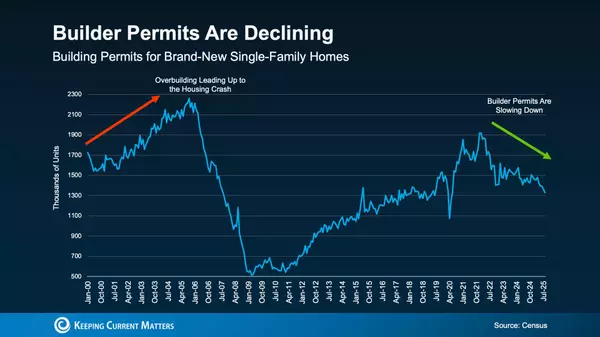

ARMs generally offer lower initial rates compared to traditional 30-year fixed mortgages, making them appealing if you anticipate refinancing in the future. Unlike the risky ARMs of the early 2000s, today’s versions require borrowers to prove they can afford higher future payments.

Lance Lambert, Co-Founder of ResiClub, explains:

"Unlike pre-2008 loans, today’s ARMs require borrowers to qualify for the higher, adjusted rate—not just the initial lower payment. Lenders now verify income, assets, and employment, ensuring buyers can handle future rate adjustments."

Simply put, lenders have stricter guidelines today, reducing the risks associated with ARMs.

3. Assumable Mortgages

With an assumable mortgage, you can take over the seller’s existing loan—including their lower interest rate. According to U.S. News, over 11 million homes qualify for this option, making it a great alternative for buyers looking for better rates.

By exploring these creative financing solutions, you may be able to move forward with your home purchase without waiting for rates to drop further.

Bottom Line

Holding off on buying a home in anticipation of a significant drop in mortgage rates might not be the most effective strategy. Instead of waiting, consider alternative financing options that could make homeownership more affordable in today’s market. Mortgage buydowns, adjustable-rate mortgages (ARMs), and assumable mortgages are three strategies that could help you secure a better rate and lower your monthly payments.

To determine which option best suits your needs, connect with a local lender who can walk you through the possibilities and tailor a solution to your financial situation.

How do these factors influence your homebuying plans for this year?

Categories

Recent Posts

GET MORE INFORMATION