Maximizing Your Down Payment: The Advantages of Leveraging Home Equity

Did you know? Many homeowners are able to increase their down payment when purchasing their next home. This is because, after selling, they can apply the equity from their current home toward the next down payment. As home equity rises, so does the median down payment.

Recent data from Redfin shows that the typical down payment for U.S. homebuyers is now $67,500—an increase of nearly 15% compared to last year, and the highest on record (see graph below):

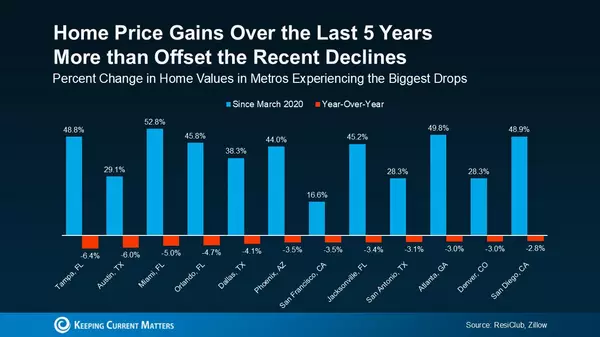

Here’s why equity makes this possible. Over the past five years, home prices have risen significantly, leading to a substantial increase in equity for homeowners like you. When you sell your home, you can use that equity toward a larger down payment on your next home. This presents a great opportunity, especially if you’ve been concerned about affordability.

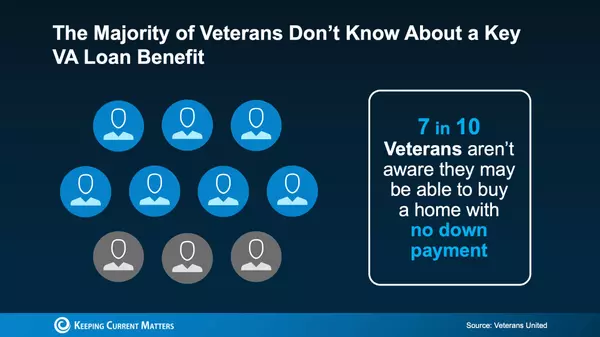

It’s important to note that a large down payment isn’t required to buy your next home—there are loan programs that allow as little as 3%, or even 0%, down. However, many current homeowners are choosing to make larger down payments because of the benefits it provides.

Why a Bigger Down Payment Is a Game Changer:

1. You’ll Borrow Less and Save More Long-Term

Using your equity for a larger down payment means you’ll borrow less. The less you borrow, the less you’ll pay in interest over time, putting more savings in your pocket for the future.

2. You Could Get a Lower Mortgage Rate

A larger down payment signals financial stability to lenders, making you a lower credit risk. With greater confidence in your creditworthiness, lenders are more likely to offer you a lower mortgage rate, increasing your savings.

3. Lower Monthly Payments

A bigger down payment reduces how much you need to borrow, which can lead to smaller monthly mortgage payments. This makes your next home more affordable and offers extra flexibility in your budget.

4. Skip Private Mortgage Insurance (PMI)

If you put down 20% or more, you can avoid paying Private Mortgage Insurance (PMI). As Freddie Mac explains:

"For homeowners who put down less than 20%, Private Mortgage Insurance (PMI) is an additional insurance policy that protects the lender if you're unable to pay your mortgage. It’s rolled into your monthly payment and required for down payments below 20%."

Avoiding PMI means one less expense each month, which adds to your overall savings.

Bottom Line

Down payments are reaching record highs as recent equity gains allow homeowners to put more money down. If you're considering selling and moving, connect with a trusted real estate agent to explore how much equity you have and how it can increase your purchasing power r in today’s market.

Categories

Recent Posts

GET MORE INFORMATION