Mortgage Forbearance: A Lifeline for Homeowners in Tough Times

Life can be unpredictable. From job losses to unexpected expenses or natural disasters, financial struggles can impact anyone. But here’s some good news: if you’re a homeowner feeling the pinch, you still have options. One powerful yet often overlooked tool is mortgage forbearance.

What Is Mortgage Forbearance?

Mortgage forbearance allows borrowers to temporarily pause or reduce their mortgage payments during a short-term financial crisis, such as unemployment, illness, or other unexpected setbacks. As explained by Bankrate:

“Mortgage forbearance gives borrowers a chance to pause or lower their payments, providing them time to sort out their finances and regain stability.”

While many associate forbearance with relief programs during the COVID-19 pandemic, it’s important to note this option remains available for qualifying homeowners facing financial challenges today. Forbearance can help prevent delinquency and even foreclosure, making it an essential safety net for those in need.

The Current Landscape of Mortgage Forbearance

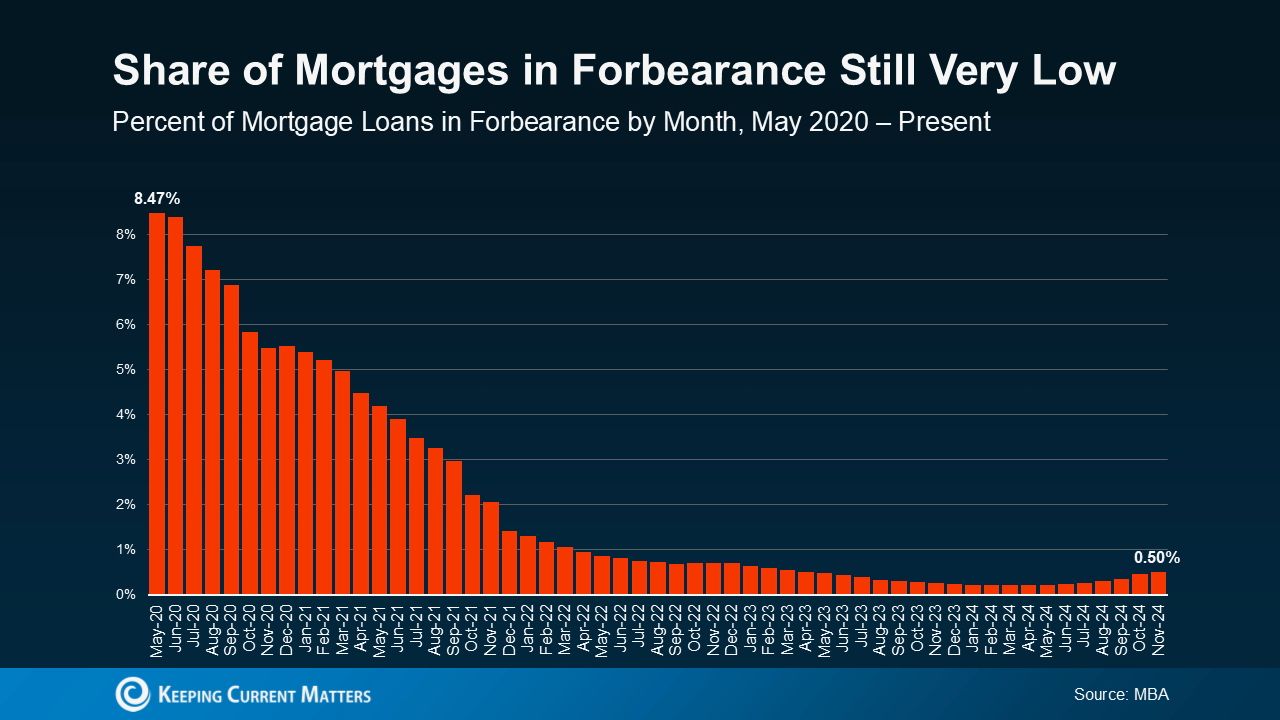

Forbearance continues to be a crucial resource for homeowners navigating temporary hardships. Though there has been a slight uptick in forbearance rates recently, it’s essential to understand the broader context.

According to Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association (MBA):

“The overall mortgage forbearance rate increased three basis points in November and has now risen for six consecutive months.”

While this trend might seem worrisome, historical data offers a clearer perspective. A closer look at the numbers shows how forbearance remains a critical tool for supporting homeowners through life’s unexpected challenges.

While the percentage of mortgages in forbearance has dropped significantly since its peak in mid-2020, there has been a slight uptick in recent months. This increase is primarily linked to the aftermath of two recent hurricanes, Helene and Milton.

Natural disasters like these often cause temporary financial hardships, making mortgage forbearance a critical safety net during the recovery period. In fact, 46% of borrowers currently in forbearance cite natural disasters as the reason for their financial struggles.

If you or someone you know is struggling to make mortgage payments, the first step is to contact your mortgage lender. They can guide you through the process, explain your options, and help you apply for forbearance. Remember, forbearance isn’t automatic—you must initiate the conversation and agree on terms with your lender.

The Importance of Forbearance

Mortgage forbearance plays a vital role in helping borrowers avoid the cycle of missed payments and potential foreclosure. It offers temporary relief, giving homeowners the time and space they need to address their challenges and plan their next steps.

Fortunately, most homeowners today benefit from strong equity and a stable housing market, so forbearance is not a necessity for the majority. However, it remains an essential option for those facing financial difficulties.

If you or someone you know is struggling to make mortgage payments, the first step is to contact your mortgage lender. They can guide you through the process, explain your options, and help you apply for forbearance. Remember, forbearance isn’t automatic—you must initiate the conversation and agree on terms with your lender.

Bottom Line

In challenging times, understanding your options can provide much-needed peace of mind. Mortgage forbearance is more than just a financial solution — it’s a lifeline for those facing hardship. While recent headlines about rising forbearance rates might seem alarming, the reality is that this tool is doing what it’s designed to do: supporting homeowners in need and helping them navigate tough circumstances without the fear of losing their homes.

Categories

Recent Posts

GET MORE INFORMATION