Mortgage Rates Drop by a Full Percent from Recent Peak

Mortgage rates have recently become a hot topic in the housing market due to their significant impact on affordability. If you’re considering a move, you’ve likely been eagerly anticipating a drop in rates for this reason. Well, the past few weeks suggest you may finally be getting your wish.

Mortgage Rates Decline in Recent Weeks

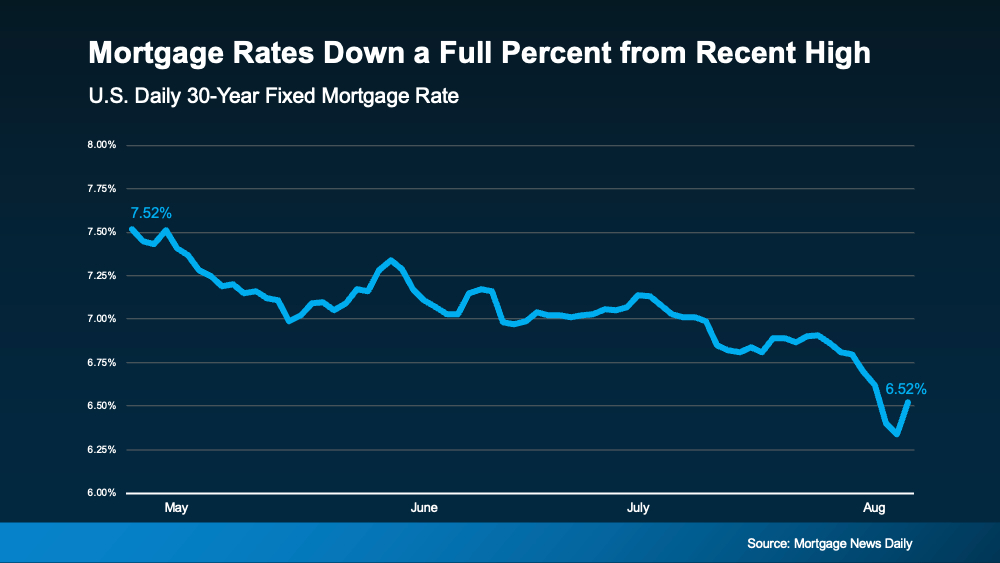

There’s significant news regarding mortgage rates. Following recent reports on the economy, inflation, the unemployment rate, and the Federal Reserve’s latest comments, mortgage rates have begun to decline slightly. According to Freddie Mac, they are now at levels not seen since February. To illustrate this downward trend, take a look at the graph below:

You might be wondering if you should wait to see if mortgage rates will drop even further. Here's an important perspective: the record-low rates from the pandemic are a thing of the past. If you’re hoping for a 3% mortgage rate again, experts agree it’s unlikely. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“The hopes for lower interest rates need the reality check that ‘lower’ doesn’t mean we’re going back to 3% mortgage rates. . . the best we may be able to hope for over the next year is 5.5 to 6%.”

With the recent decrease in rates, you have a significant opportunity right now. It might be just the right time to jump back in.

How Rates Affect Demand

If you wait for mortgage rates to drop further, you might face more competition as other buyers resume their home searches. In the housing market, there's typically a relationship between mortgage rates and buyer demand. Higher rates usually mean lower demand, but when rates start to decline, things change. Buyers hesitant about higher rates often re-enter the market. Here’s what that means for you: a recent article from Bankrate explains,

“If you’re ready to buy, now might be the time to strike. Home prices have been rising primarily because of a longstanding shortage of homes for sale. That’s unlikely to change, and if mortgage rates do fall below 6%, it’s possible buyers would enter the market en masse, further pushing up prices and resurrecting bidding wars.”

Bottom Line

If you’ve been waiting to make your move, the recent downward trend in mortgage rates may be enough to motivate you to act now. Rates have reached their lowest point in months, presenting a prime opportunity for you to jump back in before a wave of other buyers does the same.

If you’re ready and able to start the process, now is an excellent time to reach out to a local real estate professional and get started. Taking advantage of these favorable rates sooner rather than later could put you in a better position in this competitive market.

Categories

Recent Posts

GET MORE INFORMATION