Not a Crash: 3 Graphs Highlighting the Differences Between Today's Inventory and 2008

Even if you didn't own a home during the 2008 housing crisis, you likely recall its widespread impact. Many people still worry about a similar event happening again. However, rest assured that the current situation is different. As Business Insider states:

"While many Americans fear a housing market crash, economists specializing in housing market conditions largely do not anticipate a crash in 2024 or beyond."

Here’s why experts are so confident: For the market (and home prices) to crash, there would need to be an excess of houses for sale, but the data doesn’t support that scenario. Currently, there’s an undersupply rather than an oversupply, even with the inventory growth observed this year. The housing supply primarily comes from three main sources:

- Homeowners choosing to sell their houses (existing homes)

- New home construction (newly built homes)

- Distressed properties (foreclosures or short sales)

When examining these three main sources of inventory, it becomes clear that today's situation is not like 2008.

Homeowners Choosing to Sell Their Homes

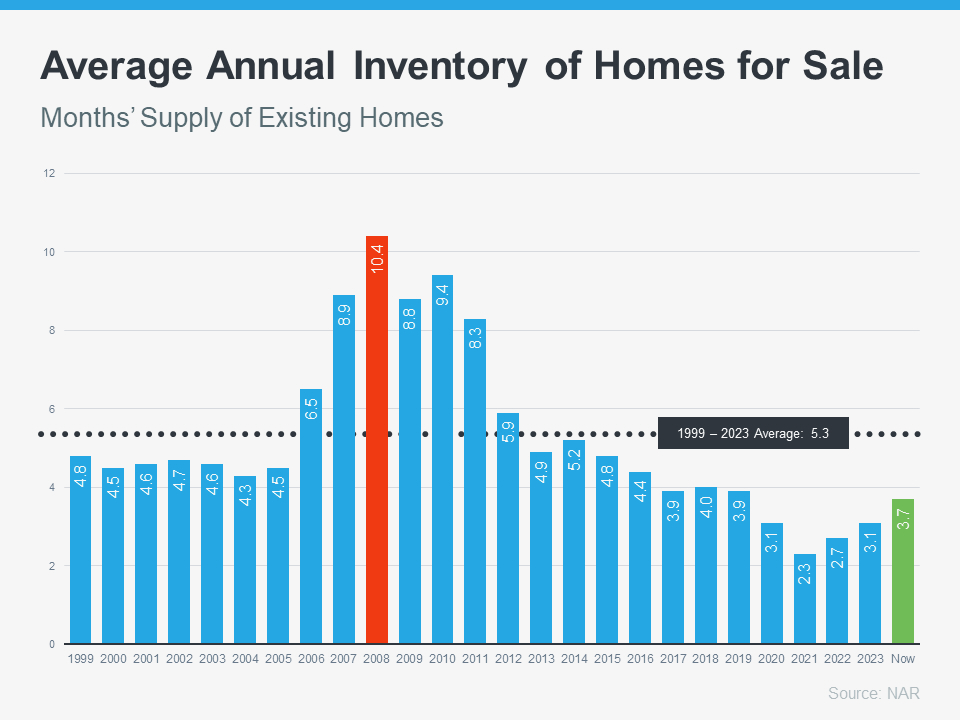

Although the supply of existing (previously owned) homes has increased compared to this time last year, it remains low overall. While this varies by local market, nationally, the current months' supply is significantly below the norm and even further below the levels seen during the crash. The graph below illustrates this more clearly.

If you compare the latest data (shown in green) to 2008 (shown in red), you'll see that today's available inventory is only about one-third of what it was back then.

So, what does this mean? There simply aren't enough homes available to cause values to drop. For a repeat of 2008, there would need to be a significant increase in people selling their houses with very few buyers, which isn't happening currently.

New Home Construction

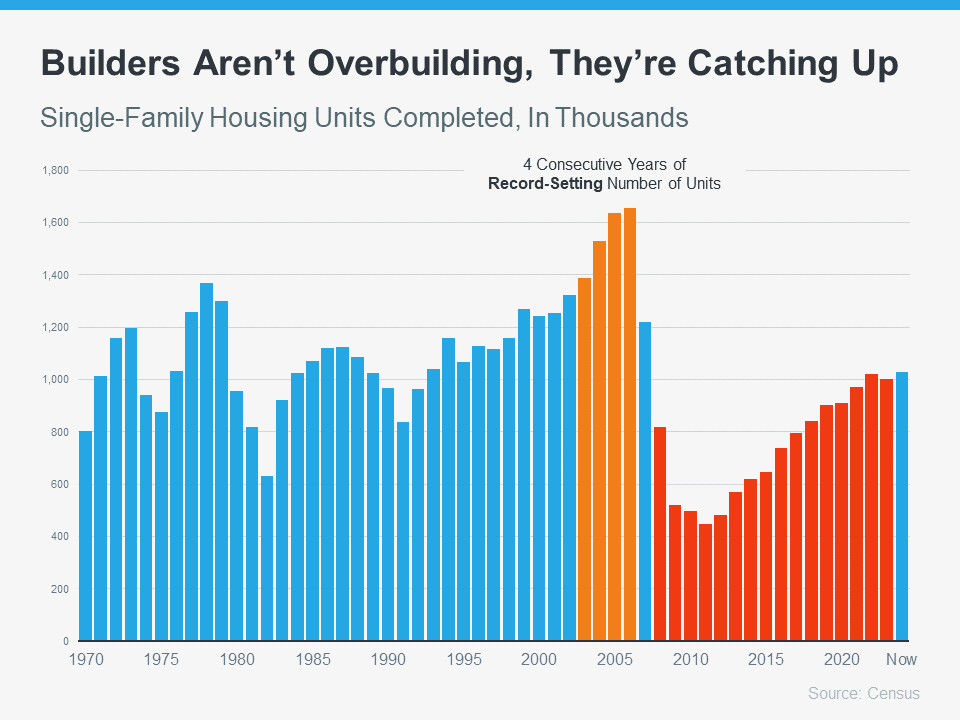

There's a lot of discussion about the current state of newly built houses, which might lead you to wonder if homebuilders are overbuilding. While new homes make up a larger percentage of the total inventory than usual, there's no need for concern. Here's why.

The graph below utilizes Census data to illustrate the number of new houses built over the past 52 years. The orange on the graph indicates the overbuilding that occurred leading up to the crash. If you observe the red portion of the graph, you'll notice that builders have consistently been underbuilding since that time.

The gap is simply too large to bridge quickly. Builders today aren't overbuilding; they're playing catch-up. According to a recent article from Bankrate:

"Furthermore, builders vividly recall the Great Recession and have proceeded cautiously with their construction pace. As a result, there continues to be a shortage of homes for sale."

Distressed Properties (Foreclosures and Short Sales)

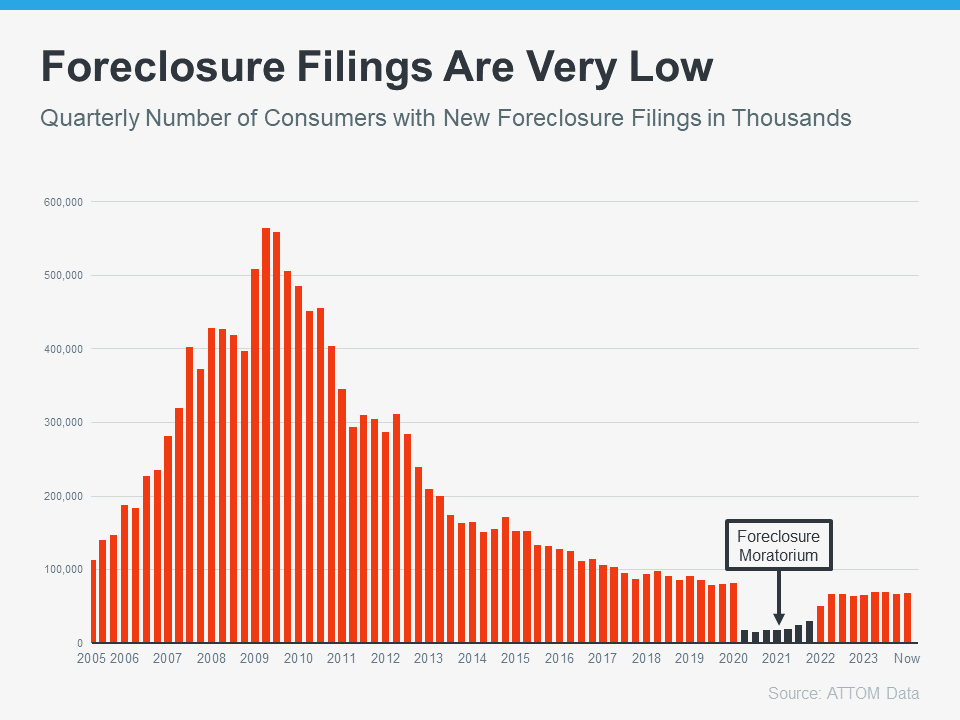

Another potential source of inventory is distressed properties, which include short sales and foreclosures. During the housing crisis, there was a surge in foreclosures due to relaxed lending standards that enabled many people to obtain home loans they couldn't actually afford.

Today, lending standards are significantly stricter, leading to a higher proportion of qualified buyers and a dramatic decrease in foreclosures. The graph below, using data from ATTOM, illustrates these changes since the housing crash:

This graph illustrates how tightening lending standards and an increase in qualified buyers led to a decline in foreclosures. In 2020 and 2021, the moratorium on foreclosures (shown in black) along with the forbearance program helped prevent a resurgence of the foreclosure wave witnessed during the market crash.

Although you might notice headlines about an increase in foreclosure volume, it's important to note that this increase is relative to recent years when very few foreclosures occurred. We are still below the normal level typically seen in a typical year.

What This Means for You

Inventory levels are far from reaching the threshold necessary for significant price drops and a potential housing market crash, as explained by Forbes:

"As home prices, already elevated, continue to rise, there may be concerns about a bubble poised to burst. Nevertheless, the probability of a housing market crash—characterized by a sudden decline in unsustainably high home prices due to reduced demand—remains low for 2024."

Mark Fleming, Chief Economist at First American, cites the principles of supply and demand as a key reason why a crash is unlikely.

"There simply isn't enough supply to meet the demand. It's basic Economics 101."

According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

"We will not see a repeat of the housing market crash from 2008 to 2012. There are no risky subprime mortgages that could collapse, nor an excessive oversupply and overproduction of homes."

Bottom Line

The current housing market lacks the necessary surplus of homes to precipitate a crisis akin to 2008, and there are no indications this situation will shift in the near future. This assurance is supported by housing experts and inventory data, which indicate no imminent crash on the horizon.

Categories

Recent Posts

GET MORE INFORMATION