Real Estate Expert Cautions of Imminent Collapse in Housing Market Bubble

On Monday, a real estate analyst suggested that the substantial increase in new home supply across U.S. states could potentially lead to a housing market bubble.

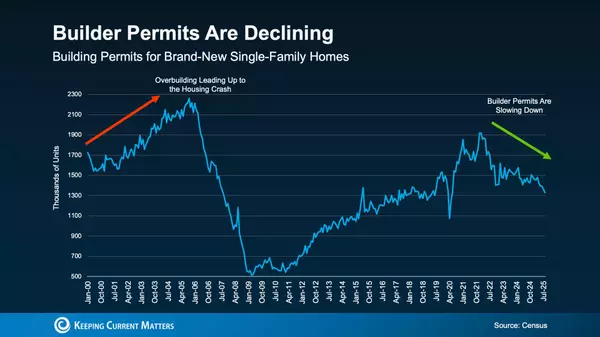

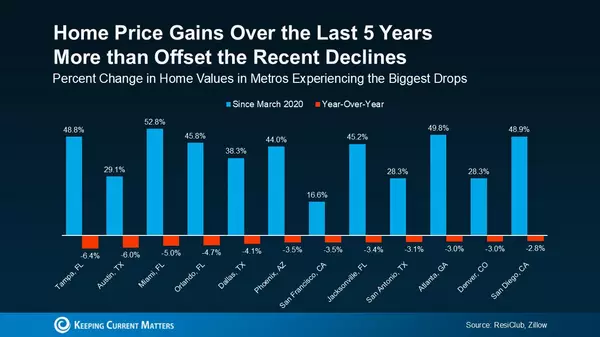

Home builders across the U.S. responded to increased demand for homes during the COVID-19 pandemic by ramping up construction. Many Americans sought more affordable housing options as remote work flexibility grew under stay-at-home orders to curb the virus's spread. However, this trend is now slowing down, resulting in decreased demand for homes.

One analyst suggests that a decline in demand has resulted in an abundance of homes on the market, potentially creating a bubble.

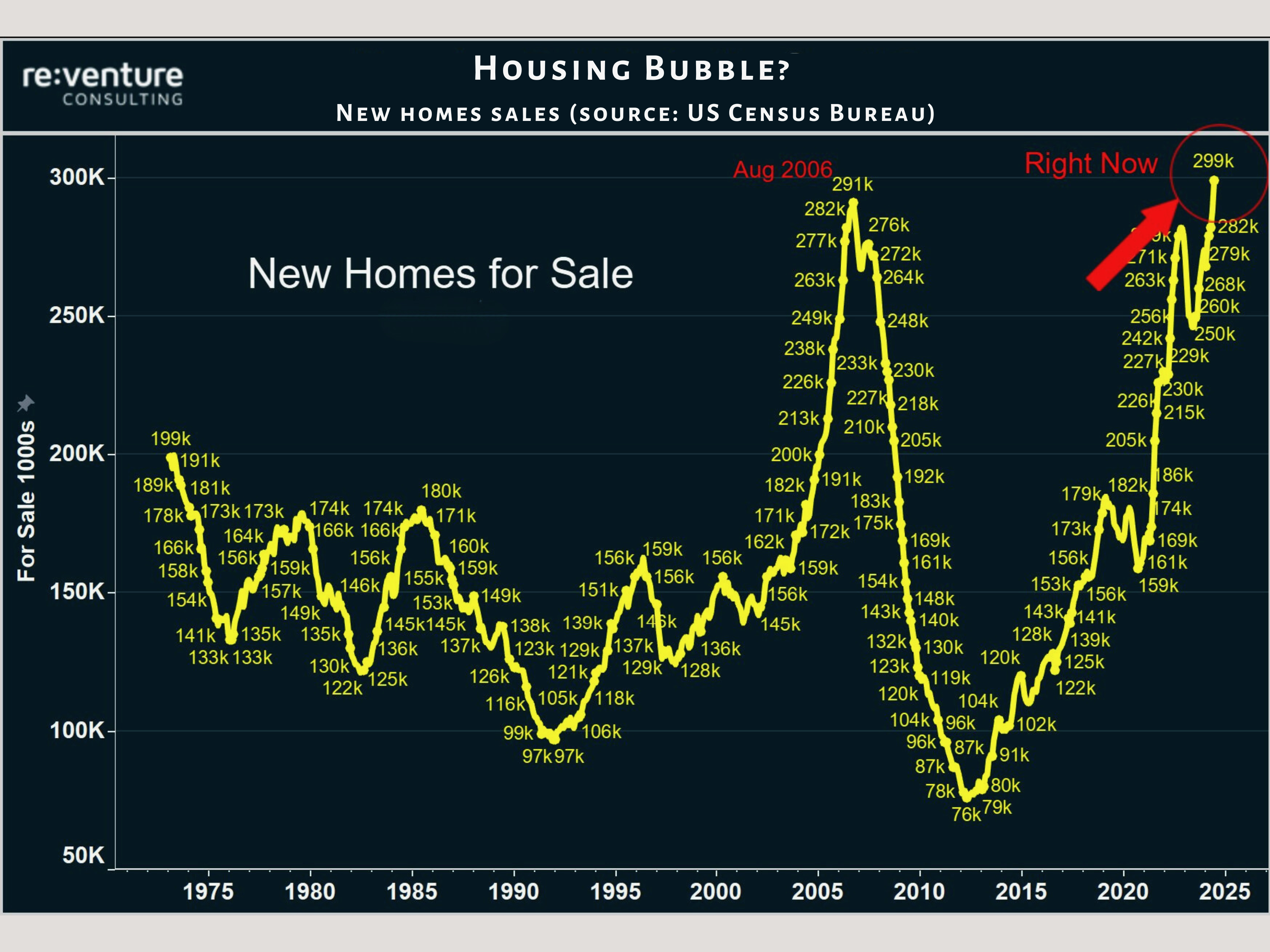

"A significant housing bubble has formed and is on the brink of bursting in various parts of the country. The number of new homes for sale has surged to nearly 300,000," commented Nick Gerli, CEO of Reventure Consulting, on X (formerly Twitter). "This marks the highest level ever recorded, surpassing even the peak of the previous bubble in August 2006, just before the major crash."

"I understand this might seem pessimistic about real estate, but the situation is straightforward. Over the last 3-4 years, home builders and investors speculated heavily in this housing market. Prices soared well beyond what local buyers could sustain, leading to a bubble," he remarked on X. "Now, that bubble is beginning to deflate slowly. If a recession enters the picture, the decline could accelerate significantly."

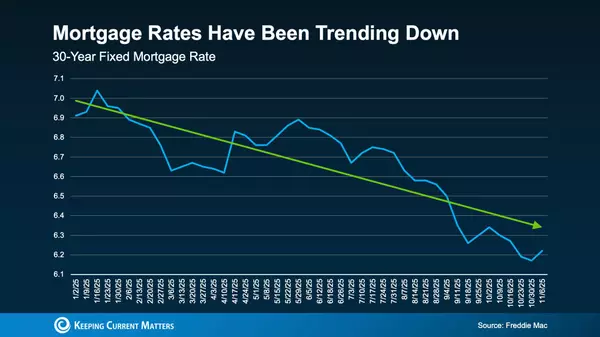

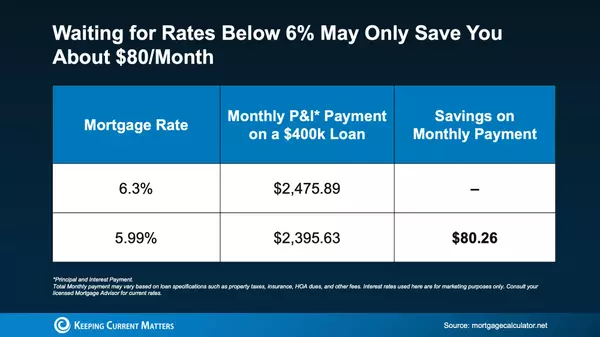

Some housing economists are indicating that the housing market might be stabilizing after the turbulence seen during COVID-19, when low mortgage rates and affordable prices in certain regions attracted buyers to purchase homes.

"In our data, it is clear that certain markets have returned to pre-pandemic levels with more homes now for sale than before," Danielle Hale, chief economist at Realtor.com, told Newsweek. "This increased availability is impacting pricing.”

"The median listing price in various regions, for instance, showed a 3 percent decline compared to the previous year," she noted. "The U.S. still needs to construct enough homes, and certain areas have performed better than others in terms of adding new homes to the market," Hale stated. "This has also attracted numerous households from different parts of the nation due to the ongoing affordability of homes in these regions," she told Newsweek. "I anticipate that this trend will continue to attract people, and that the comparative affordability will remain a distinct advantage."

Hale added, "I don't foresee a crash; however, it is true that the supply of homes for sale is currently less limited compared to recent years." She noted that homeowners currently hold significant equity in their homes, contrasting this with the housing crash seen during the 2008 financial crisis.

"Historically, a considerable proportion of homeowners in certain states, for instance, own their homes outright," Hale noted. "Currently, there is more equity in housing nationwide, which makes it less likely that we will see the kind of price drops that led to trouble in the mid-2000s."

Gerli conceded that some regions in the United States were experiencing fewer challenges than others.

"There won't be a housing crash in the Northeast and Midwest, as home building there is currently very low," he observed on X. "Speculative inventory activity is also minimal in these areas. Prices are also less inflated in these regions, and inventory is significantly lower."

He added, "There may eventually be a housing correction in the Northeast and Midwest. For now, however, these markets remain robust."

Categories

Recent Posts

GET MORE INFORMATION