Renting vs. Buying: The Eye-Opening Net Worth Gap You Should Know

Deciding whether to rent or buy a home? One key factor that might help with the decision is the impact homeownership can have on your net worth. The potential for wealth-building through homeownership is substantial, making it an option worth considering.

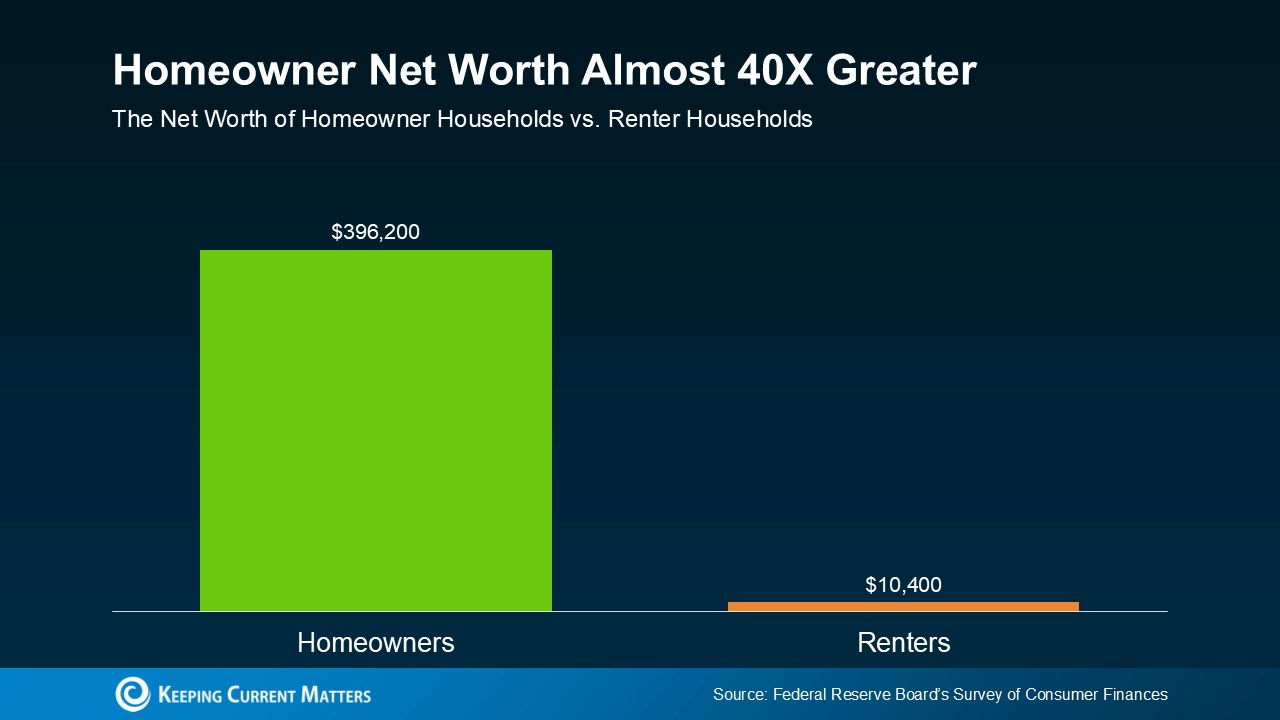

Every three years, the Federal Reserve Board publishes the Survey of Consumer Finances (SCF), which provides a detailed look at the wealth of homeowners compared to renters. The difference is striking—on average, homeowners have nearly 40 times the net worth of renters. Check out the chart below to see this wealth gap for yourself.

Why Homeowner Wealth Is Significant

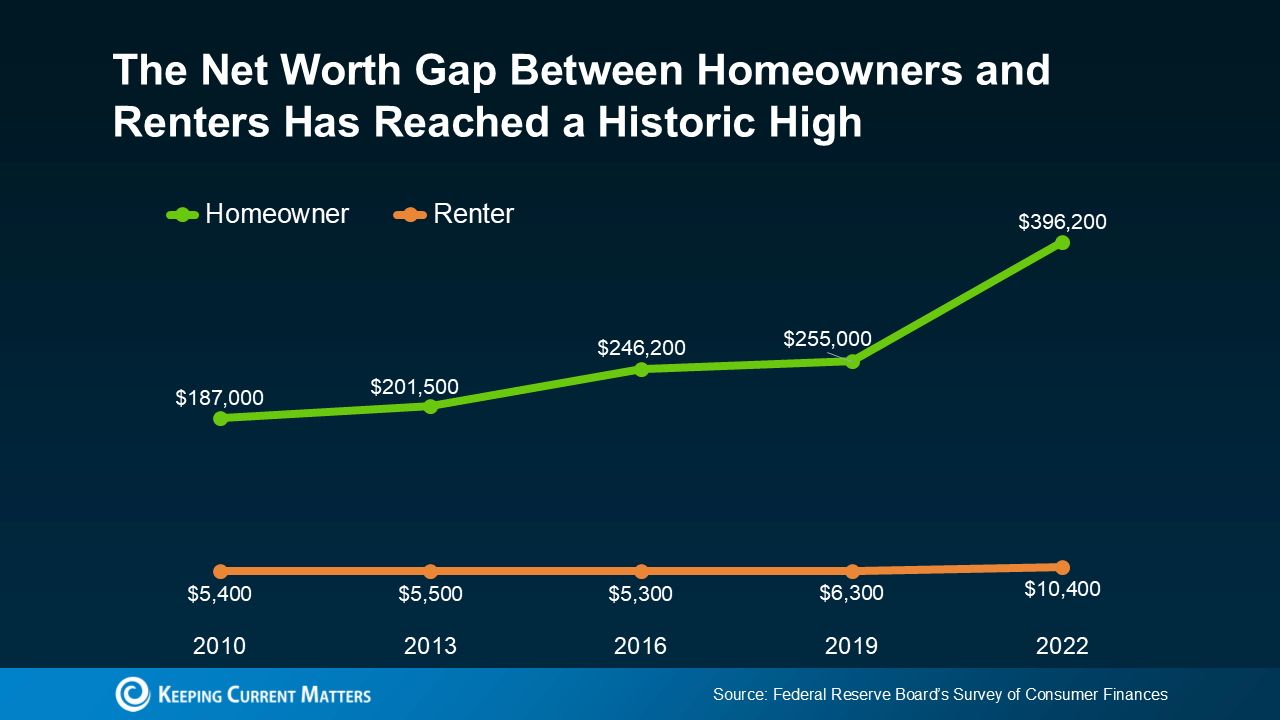

In the last edition of this report, the average homeowner’s net worth was around $255,000, compared to just $6,300 for the average renter—a substantial gap. However, in the latest update, this disparity has widened further as homeowner wealth continues to rise (see graph below):

According to the latest Survey of Consumer Finances (SCF):

"The 2019-2022 growth in median net worth marked the largest three-year increase in the modern SCF's history, more than double the previous record."

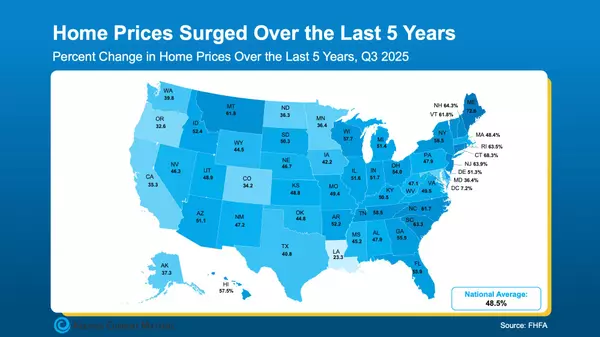

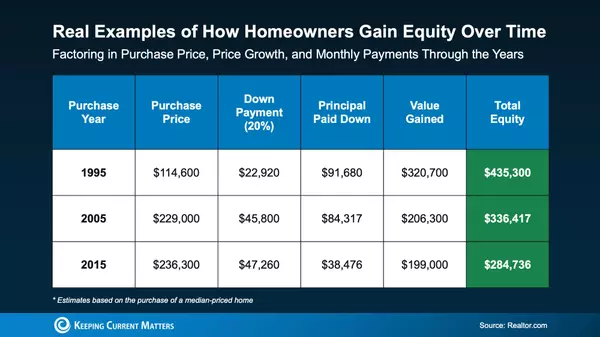

One key reason for this surge in homeowner wealth is home equity. Equity is the difference between your home's value and the amount you owe on your mortgage. You build equity by paying down your loan and through property value appreciation.

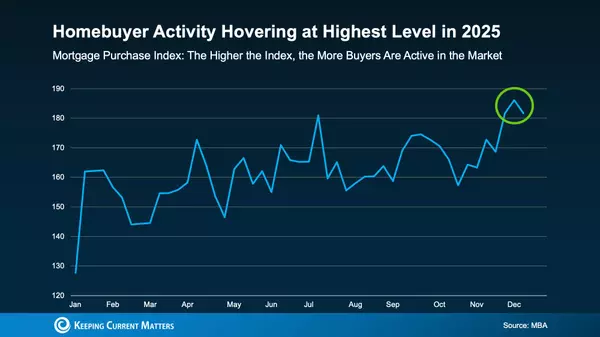

In recent years, limited housing supply and high demand have driven home prices up quickly, leading to even faster equity growth—and more wealth for homeowners. If you’re on the fence about renting or buying, it’s worth noting that, while inventory has increased somewhat this year, most markets remain undersupplied. Experts predict home prices will continue to rise next year, though at a slower pace. While it may not match the pandemic boom, these gains still offer potential for equity growth if you buy now.

As Ksenia Potapov, Economist at First American, points out:

“Despite volatility risks, homeownership continues to be a critical driver of wealth accumulation and remains the largest wealth source for most households.”

But remember, housing prices and inventory vary by location. Relying on a local real estate agent can help you understand current trends and weigh both the financial and lifestyle advantages of owning a home. As Bankrate advises:

“Deciding between renting and buying a home isn’t just about cost — the decision also involves long-term financial strategies and personal circumstances. If you’re on the fence about which is right for you, it may be helpful to speak with a local real estate agent who knows your market well. An experienced agent can help you weigh your options and make a more informed decision.”

Bottom Line

If you’re weighing the decision to rent or buy, remember that homeownership can significantly build wealth over time if it fits within your budget. And if buying a home seems challenging, reach out to a local real estate agent and lender—they can guide you through programs and options that may make homeownership more accessible.

Categories

Recent Posts

GET MORE INFORMATION