Take Note: Your Monthly Rent Could Be Your Down Payment!

Every month, over 45 million U.S. households pay rent. While renting often costs less than a monthly mortgage payment, the total amount spent over the years adds up to a significant sum—one that renters never get back. But what if that money went toward homeownership instead? Could it be enough for a down payment?

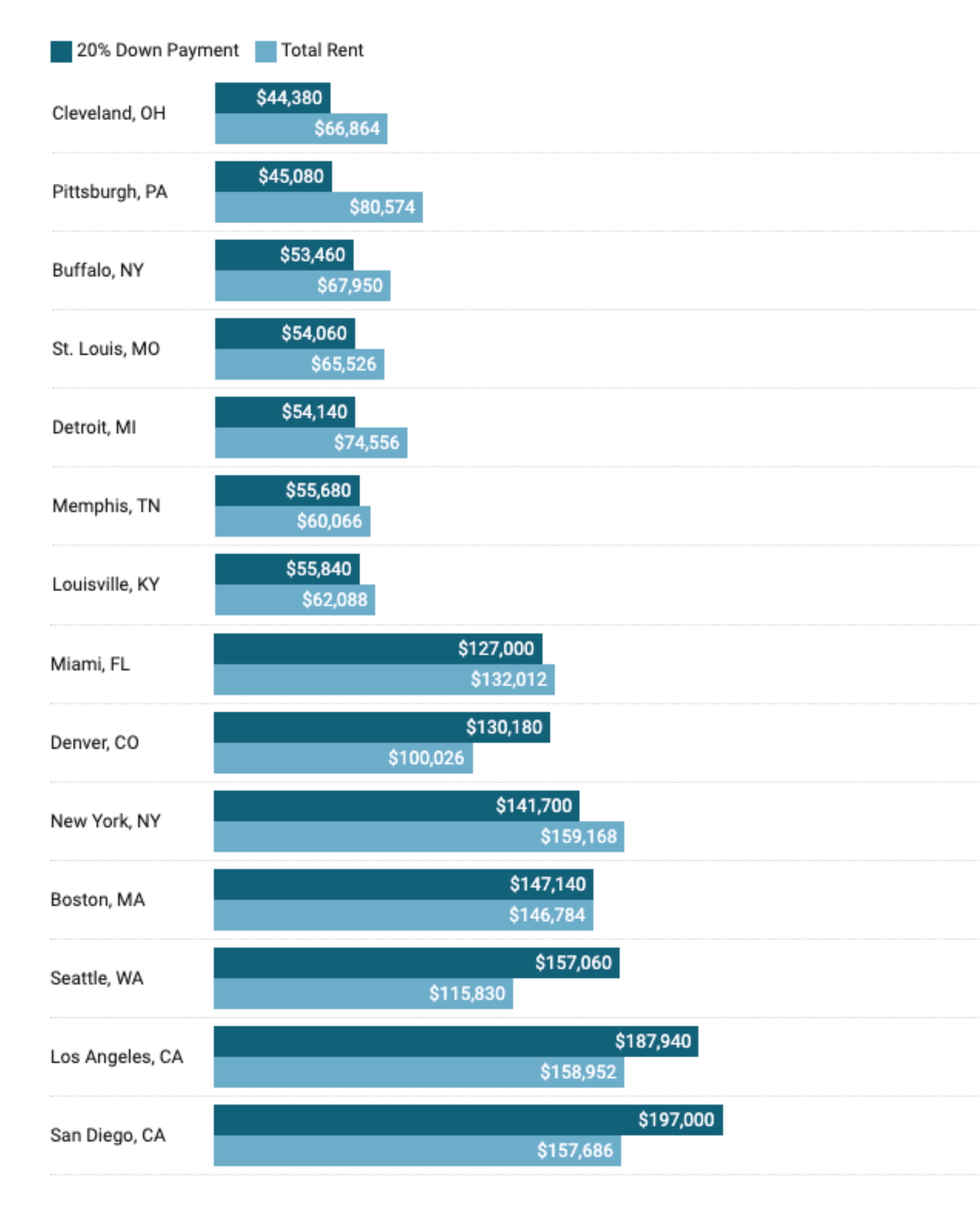

Zoocasa analyzed rental costs in 43 cities from 2020 to 2025 using Rent.com’s average prices and compared the total rent paid over five years to a 20% down payment on a median-priced single-family home, based on data from the National Association of Realtors. The findings reveal that, in many cases, five years of rent could more than cover a down payment—raising a crucial financial question for long-term renters: Could you have bought a home instead?

How Does Five Years of Rent Compare to a Down Payment?

In These Cities, Five Years of Rent Could Have Covered a Down Payment

Renting may seem like the more affordable option in the short term, but over time, the costs add up—sometimes exceeding $100,000 in just five years. Unlike homeownership, this money doesn’t build equity, which adds a new layer to the housing affordability conversation. By comparing long-term rental costs to down payments, renters can better assess whether buying makes financial sense for them.

Boston: A Near Break-Even Market

Interestingly, in Boston, a city known for its high home prices, the gap between five-year rent costs and a 20% down payment is remarkably small—just $356. The average Boston renter will have spent $146,784 on rent from 2020 to 2025, while a 20% down payment on a single-family home costs $147,140. Given this near break-even point, Boston renters should strongly consider the long-term benefits of homeownership, where their monthly payments could contribute to building equity instead of covering rent.

What This Means for Renters

While homeownership isn’t feasible for everyone, in many cities, the money spent on rent could have been enough to secure a home. By understanding these long-term financial implications, renters can make more informed decisions about whether to continue renting or take steps toward homeownership.

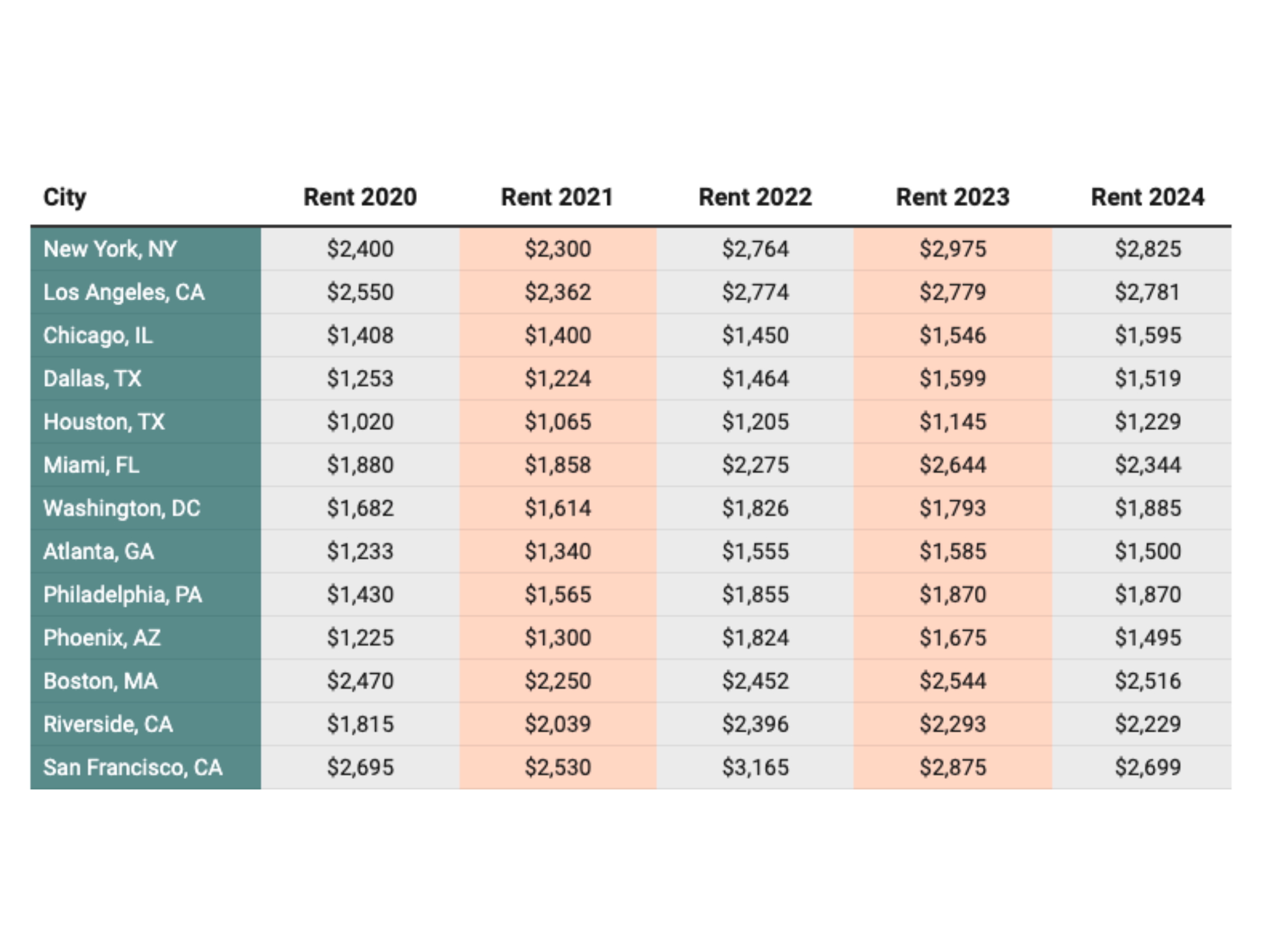

Average Rent Prices From 2020 to 2024

The average cost of rent is based on January data for each year, courtesy of Rent.com

Should You Rent or Buy?

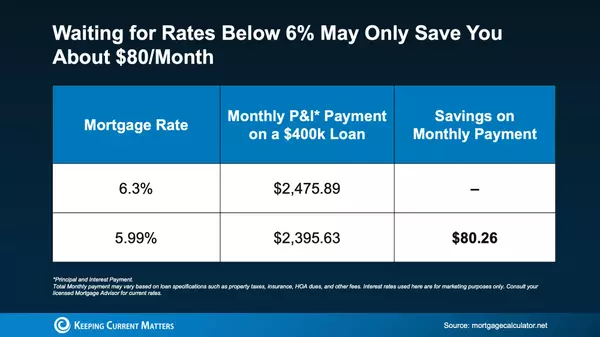

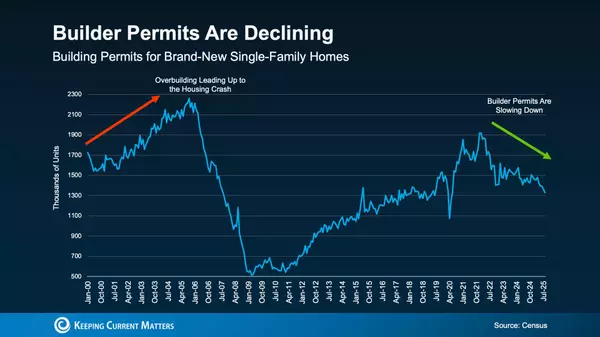

Saving for a down payment while covering monthly rent can be challenging, and in some cities, it may feel nearly impossible depending on your income and cost of living. However, the earlier you enter the housing market and start building equity, the more you stand to save over time.

That said, choosing between renting and buying is a personal decision. Many renters value the flexibility, predictable monthly payments, and amenities—like gyms and maintenance services—that come with renting. For some, these benefits outweigh the financial advantages of homeownership.

If you're unsure which path is right for you, taking a closer look at the long-term costs of renting versus owning can help. Many renters don’t realize just how much they spend on housing each year, making it harder to assess their financial position. If you've built up savings and have a stable income, it may be time to consider whether homeownership is the smarter move.

Thinking about buying a home? Our agents are here to help! Call us today to start planning your next real estate move.

Categories

Recent Posts

GET MORE INFORMATION