Utilizing Home Equity to Support Your Retirement Goals

If retirement is approaching, it’s the perfect moment to start planning your next chapter. Ensuring you’re financially prepared to enjoy the lifestyle you desire during retirement is likely a top priority.

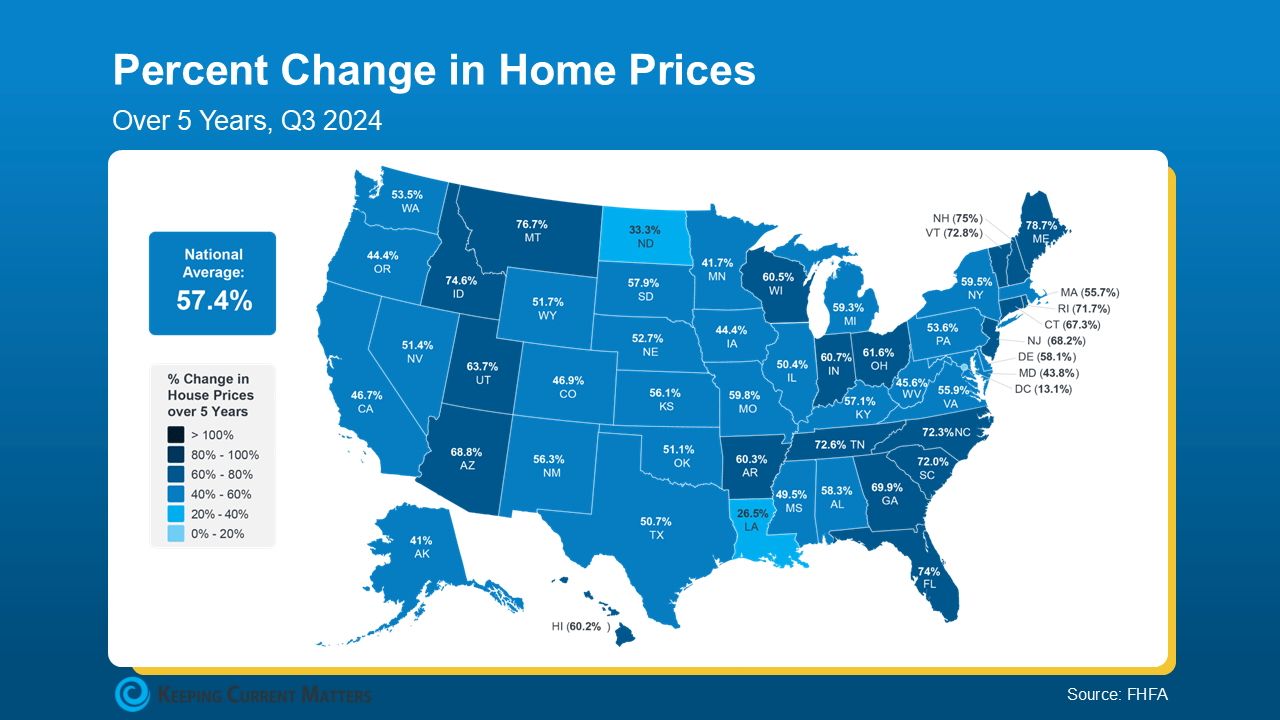

What you might not realize is that you may be sitting on an untapped source of wealth — your home. According to data from the Federal Housing Finance Agency (FHFA), home values have increased by nearly 60% over the past five years (see the graph below):

The rise in home values has significantly boosted your net worth. According to Freddie Mac, over the past five years:

“Over the past five years, Boomer wealth grew by $19 trillion, or approximately $486,000 per household, with half of that growth attributed to house price appreciation.”

If you’ve owned your home for even longer, you probably have even more equity built up. If you’re looking to tap into that wealth, selling your home and downsizing could be a smart move.

Why Downsizing Could Be a Smart Move

Selling your home now to downsize into a smaller property—or one in a more affordable area—can unlock your home equity, giving you greater financial flexibility and confidence as you plan for retirement. Whether your goal is to travel, spend more time with loved ones, or simply feel financially secure, accessing your equity can help make it happen. As Chase explains:

“Retirement is an exciting chapter. Selling your home to leverage the equity or downsize to a more affordable option can provide additional opportunities for your future.”

Here are three key ways downsizing can enhance your retirement lifestyle:

1. Lower Your Cost of Living

According to AARP, the number one reason adults aged 50 and older move is to reduce their cost of living. Downsizing to a smaller home or relocating to a more affordable area can lower monthly expenses like utilities, property taxes, and maintenance costs.

2. Simplify Your Lifestyle

A smaller home means less maintenance and fewer responsibilities, freeing up time and energy to focus on what truly matters to you during retirement.

3. Increase Financial Flexibility

Selling your current home gives you access to your home equity, turning it into cash you can use for various purposes—whether it’s investing, paying off debt, or creating a financial safety net for the future.

The First Step Toward Your Next Chapter

If downsizing feels like the right step for you, connecting with a real estate agent is key. Your agent will help you determine how much equity you’ve built and how best to use it. Beyond that, they’ll guide you through the entire process of selling your current home and finding the perfect new one, ensuring a smooth transition into this exciting new phase of life.

Bottom Line

If retirement is on your horizon in 2025, now could be the ideal time to consider downsizing and tapping into the equity you’ve worked so hard to build in your home. By taking this step, you can position yourself to enjoy greater financial flexibility and peace of mind as you transition into this exciting new chapter. Connecting with a trusted local real estate agent is the first step in creating a thoughtful plan tailored to your goals. They’ll help you navigate the process of selling your current home and finding the perfect next place, so you can start this phase of life feeling confident and prepared. Take the leap today to ensure that every day in retirement feels like a Saturday—relaxed, fulfilling, and truly yours to enjoy.

Categories

Recent Posts