What a Recession Could Mean for the Housing Market

Recession concerns are making headlines, and the chances of one occurring this year are increasing. This has many people wondering how a recession might impact the housing market.

To get a clearer picture, let’s examine historical data on housing trends during past recessions, dating back to the 1980s.

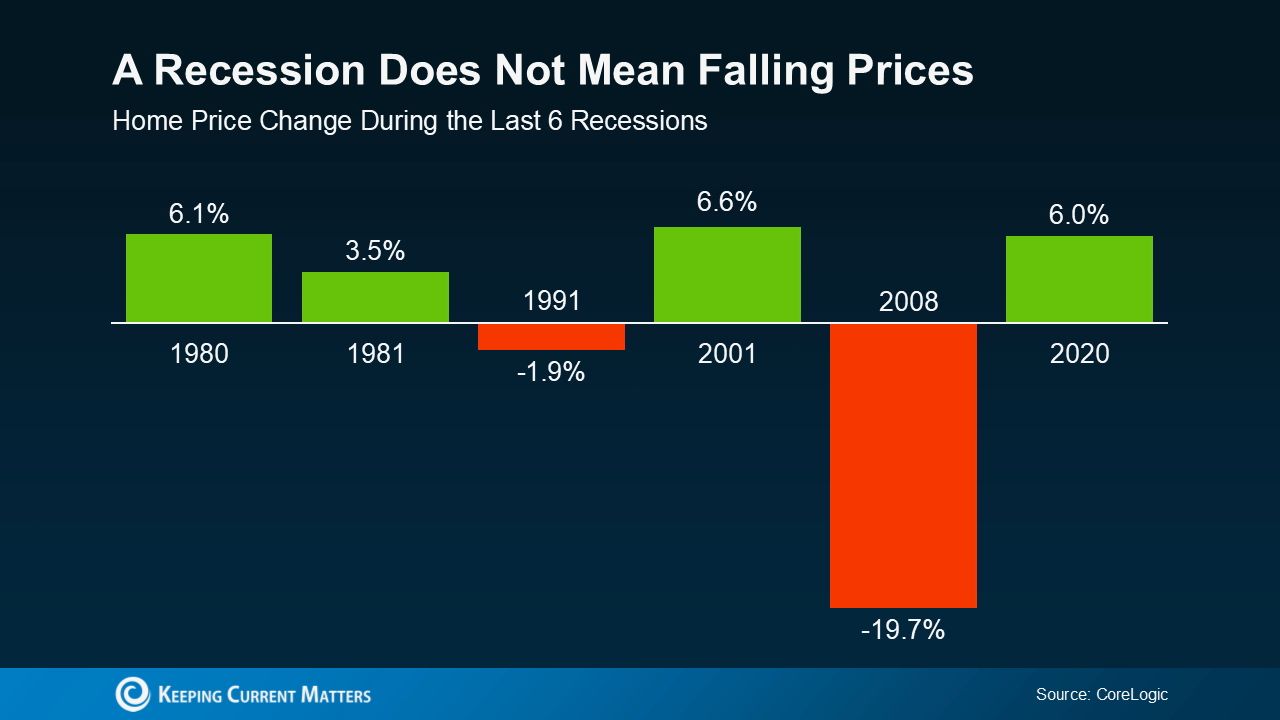

A Recession Doesn’t Always Mean Falling Home Prices

There’s a common belief that home prices will drop in a recession, similar to what happened in 2008. However, that was an anomaly, not the norm. In fact, it was the only time home prices saw such a sharp decline, and we haven’t seen it happen since.

According to CoreLogic data, in four of the last six recessions, home prices actually increased (see graph below):

If you’re considering buying or selling a home, don’t assume a recession will trigger a housing market crash—historical data simply doesn’t support that. Instead, home prices typically continue on their existing trajectory. Right now, on a national level, home prices are still rising at a more typical pace.

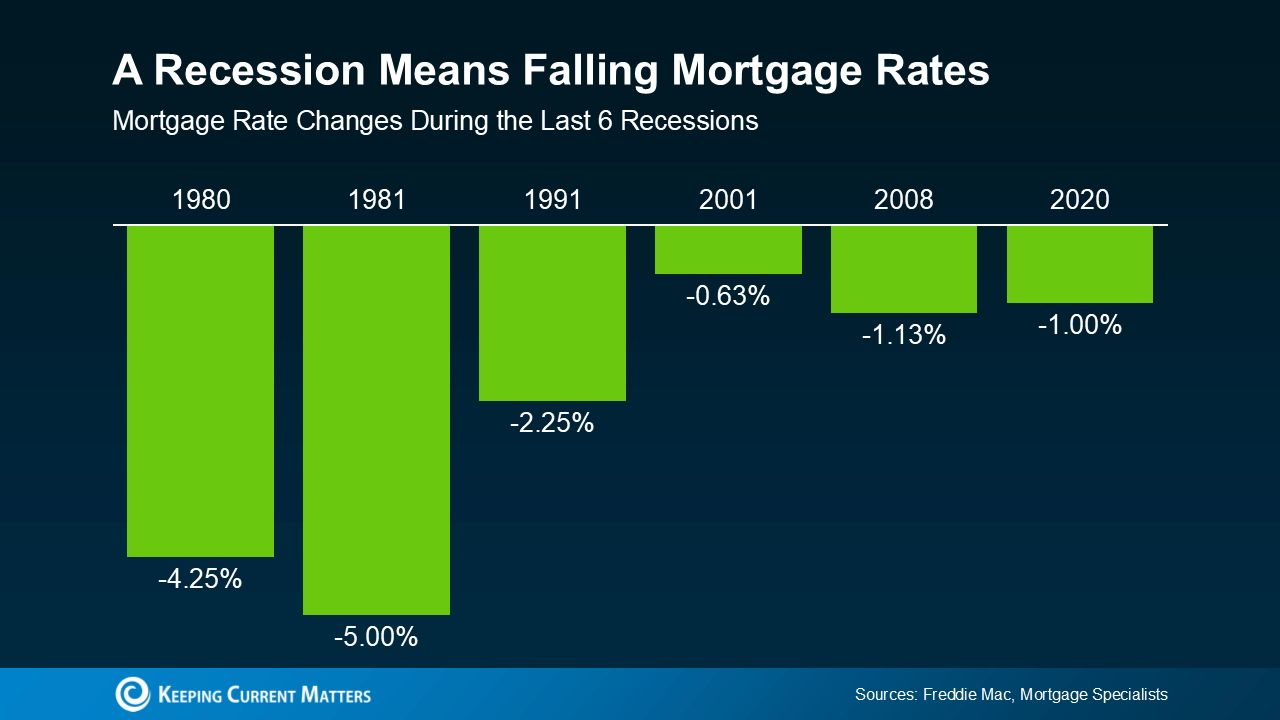

Mortgage Rates Tend to Drop During Recessions

While home prices generally stay on their current course, mortgage rates tend to decline during economic downturns. Looking at data from the past six recessions, mortgage rates fell each time (see graph below):

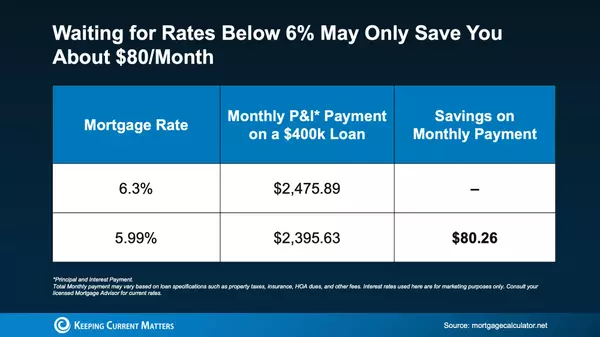

Based on historical data, a recession could lead to lower mortgage rates. While this would improve affordability, it's unlikely we'll see a return to 3% rates.

Bottom Line

The possibility of a recession remains uncertain, but the chances of one occurring have increased. However, that doesn’t mean you have to be left guessing about its potential impact on the housing market—historical data provides valuable insights into what typically happens.

Rather than assuming a downturn will lead to a housing crash, it's important to recognize that past recessions have often seen stable or even rising home prices, along with declining mortgage rates. Understanding these trends can help you make informed decisions about buying or selling a home, regardless of economic uncertainty.

When you hear discussions about a possible recession, what are your biggest concerns or questions about how it could affect your real estate plans?

Categories

Recent Posts

GET MORE INFORMATION