The Market Shift: Buyers Finally Catch Their Breath

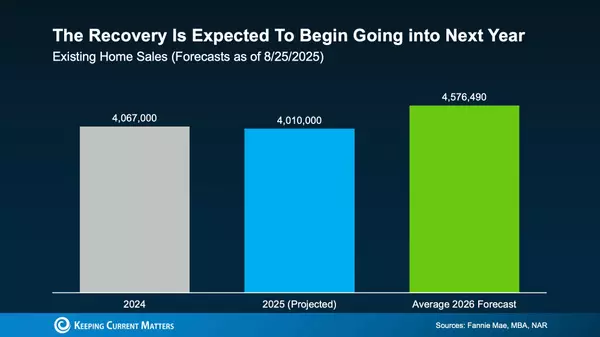

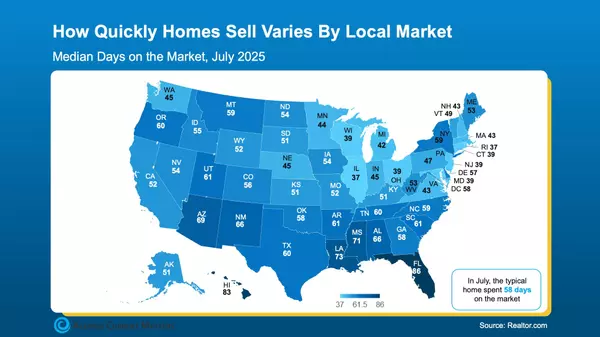

A few years back, trying to buy a home felt like chaos. Listings hit the market and disappeared within hours. Buyers were rushing out the door the second something popped up—because if you paused for even a moment, someone else was already making an offer, often without ever stepping foot inside. T

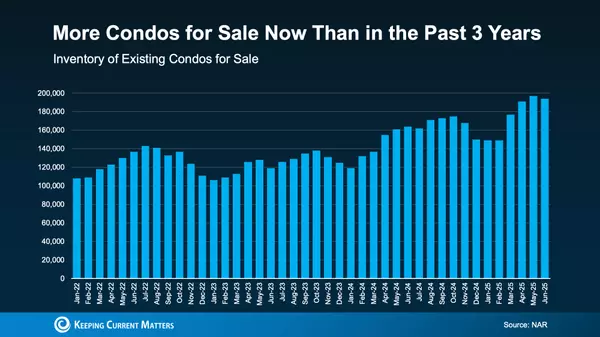

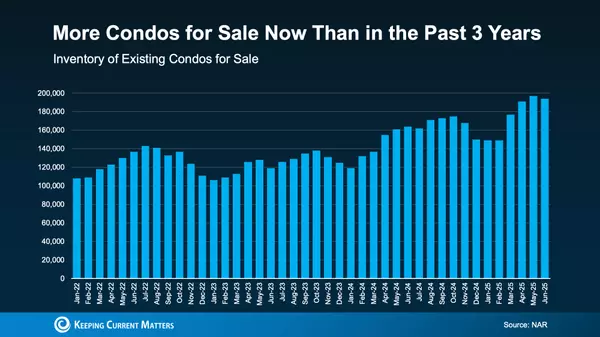

Today’s Market Could Make Condos a Win

Not every buyer is looking for the biggest house on the block. Many want something more practical—simpler, affordable, and easier to maintain. In today’s market, where every dollar matters, condos check those boxes. For first-time buyers, a condo can be a smart entry point into homeownership witho

Eco-Friendly Home Improvements Buyers Love in 2025

In today’s competitive market, homeowners are always looking for ways to boost property value, cut utility costs, and stand out to buyers. One of the smartest strategies? Investing in green home improvements. The National Association of Home Builders (NAHB) reports that nearly 80% of buyers now fac

Categories

Recent Posts