Thinking of Buying? October Might Be the Perfect Time

If you’ve been holding back, this is your moment to act. October is expected to bring the most favorable buying conditions of 2025. Realtor.com notes that by mid-October, buyers in many markets could finally see the rare mix of more homes to choose from, fairer prices, and stronger leverage at the

What Homebuyers Want Most — And How the Market Is Adapting

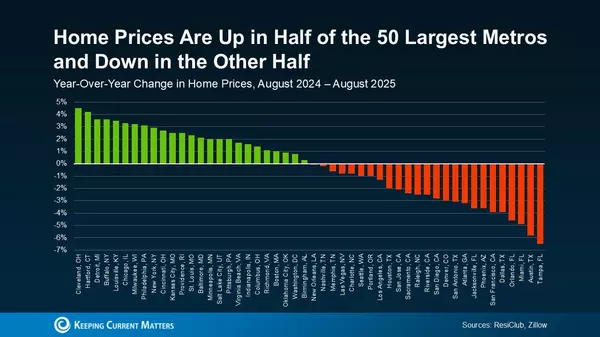

According to a recent Bank of America survey, prospective buyers say the biggest boost to their confidence would come from improved affordability — particularly when it comes to prices and interest rates (see below). The outlook isn’t all gloomy. Despite some lingering economic uncertainty, there

The Best Time To Buy a Home

The national housing market has been shifting in favor of buyers this fall — and for Greater Boston, the sweet spot comes later than the U.S. average.While nationally the week of October 12–18, 2025 is projected to be the most buyer-friendly, the Boston, Cambridge, Newton metro hits its prime bet

Categories

Recent Posts