Are Investors Really Snapping Up All the Homes?

Are you trying to buy a home but feel like you're competing with wealthy Wall Street investors scooping up every listing? Many believe that mega investors are driving up prices and dominating the market, making it harder for everyday buyers like you to find a home.

But here’s the reality—investor activity is actually declining, and the big players aren’t nearly as influential as you might think. Let’s break down the facts and dispel this common myth.

Most Investors Are Small, Not Large Corporations

A widespread misconception is that massive institutional investors are taking over the market. In truth, that’s far from the case. According to The Mortgage Reports:

“On average, small investors account for around 18% of the market, while mega investors represent only about 1%.”

Most real estate investors are everyday individuals—mom-and-pop landlords who own just a few properties, not big corporations buying up entire neighborhoods. These investors could be your neighbors who rent out a second home or own a vacation property.

Investor Home Purchases Are Declining

What about the major investors that make headlines? Recently, institutional investors—those with large-scale portfolios—have significantly reduced their home purchases.

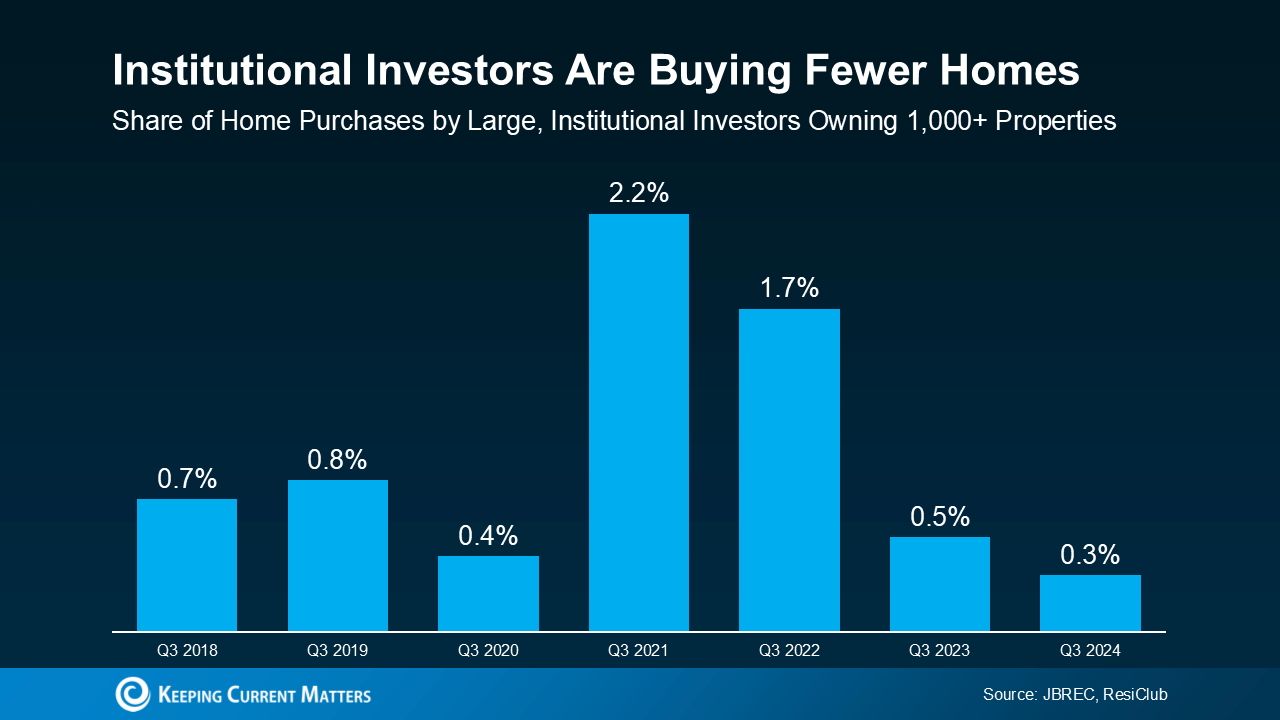

According to John Burns Research and Consulting (JBREC), at their peak in Q2 2022, institutional investors (those owning 1,000+ single-family homes) accounted for just 2.4% of home sales. While investors are part of the market, they’re not the driving force behind rising home prices or limited inventory. By Q3 2024, that number had dropped dramatically to only 0.3% (see graph below).

That’s a significant change, meaning there are far fewer investors competing for homes than just a few years ago.

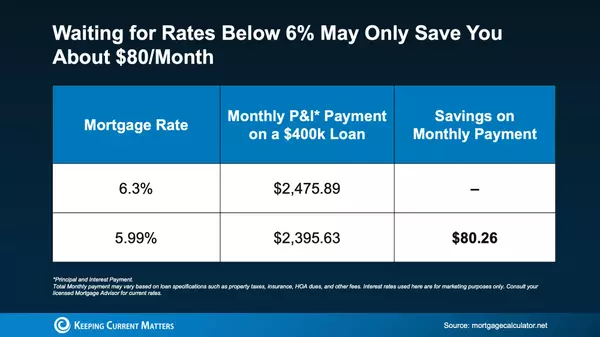

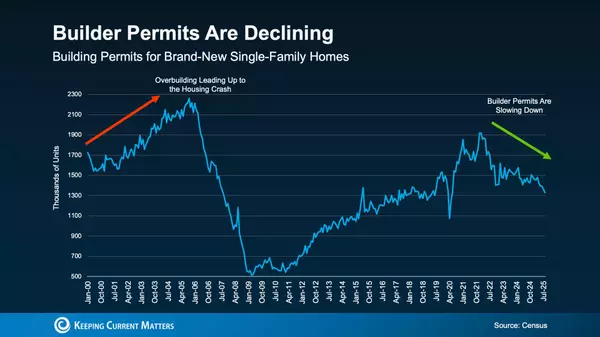

So why are investors pulling back? The main reason is that rising mortgage rates and higher home prices have made purchasing less appealing for them.

The belief that Wall Street investors are buying up all the homes and pricing out regular buyers is simply a myth. While some investors are still active, their presence in the market has significantly declined compared to previous years.

Bottom Line

Large institutional investors aren’t dominating the housing market—in fact, they’re purchasing fewer homes than in previous years. This means the competition from big investors isn’t as intense as many believe, potentially creating more opportunities for everyday buyers like you.

If you’ve been holding back from buying because you thought investors were outbidding everyone, now is a great time to take another look. Partnering with a knowledgeable local real estate agent can help you understand the latest market trends and uncover opportunities you may not have realized were available.

How does knowing that investor activity is declining change your perspective on buying a home in today’s market? Could this be the right time for you to take the next step?

Categories

Recent Posts

GET MORE INFORMATION