Being in the Market Outshines Trying to Time It

Are you contemplating whether to purchase a home immediately or wait? There's a lot to evaluate, from current market trends to your personal needs that may change over time. However, generally speaking, attempting to time the market is not a reliable strategy—there are simply too many variables to predict accurately.

This is why experts often recommend that having time in the market is more effective than trying to time it.

In other words, if you're ready to buy a home and the financials align for you, acting sooner rather than later is typically advantageous. As Bankrate explains:

“No matter the direction the real estate market is heading, buying now allows you to start building equity right away.”

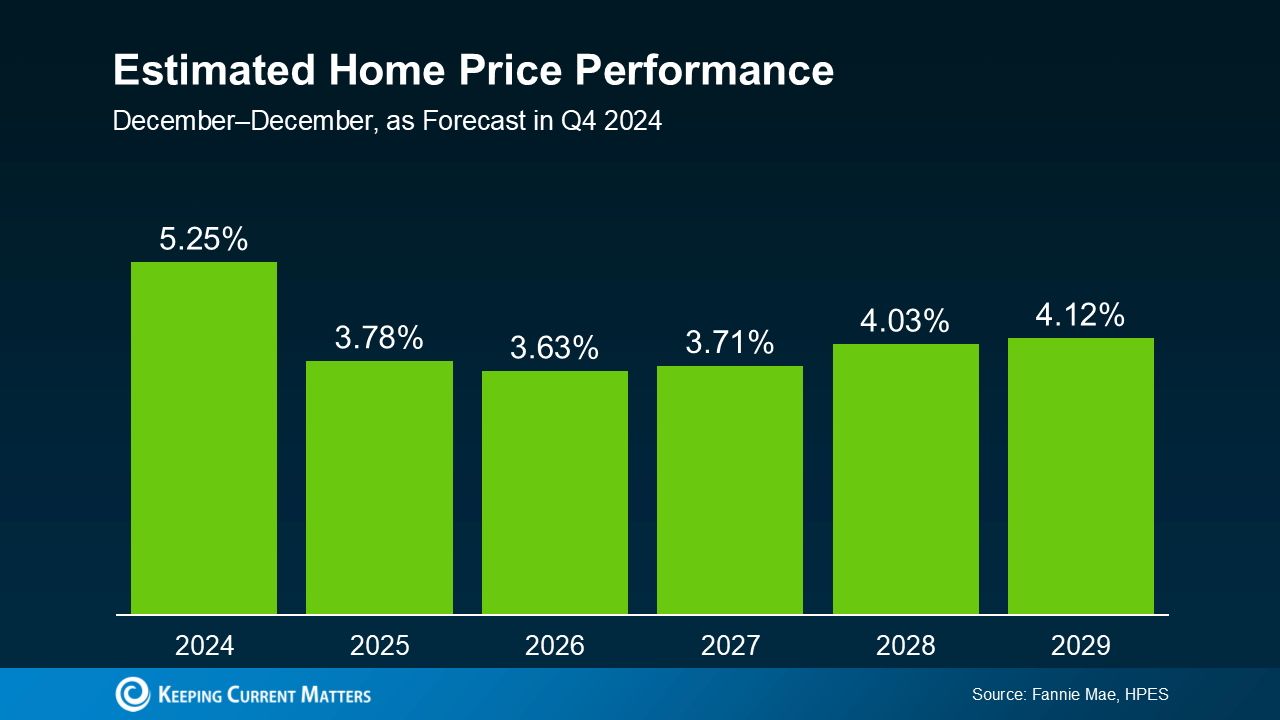

To highlight the benefits of purchasing now versus later, here’s some data for you to consider—if you're in a position to buy. Each quarter, Fannie Mae releases the Home Price Expectations Survey, which gathers predictions from over a hundred economists, real estate experts, and investment and market strategists about home prices over the next five years. In the latest survey, experts forecast that home prices will continue to rise through at least 2029, though at a slower and more typical rate compared to the rapid increases seen in recent years (see the graph below):

But what does that actually mean for you? To put these numbers into perspective, the graph below illustrates how a typical home value could appreciate over the next few years based on the HPES projections. It shows the potential equity you could begin building if you purchase a home in early 2025.

Let’s consider an example: If you purchase a $400,000 home this January, the expert projections from HPES indicate you could build over $83,000 in household wealth within the next five years. That’s a significant gain! On the other hand, continuing to rent means missing out on this opportunity to grow your equity.

Let’s consider an example: If you purchase a $400,000 home this January, the expert projections from HPES indicate you could build over $83,000 in household wealth within the next five years. That’s a significant gain! On the other hand, continuing to rent means missing out on this opportunity to grow your equity.

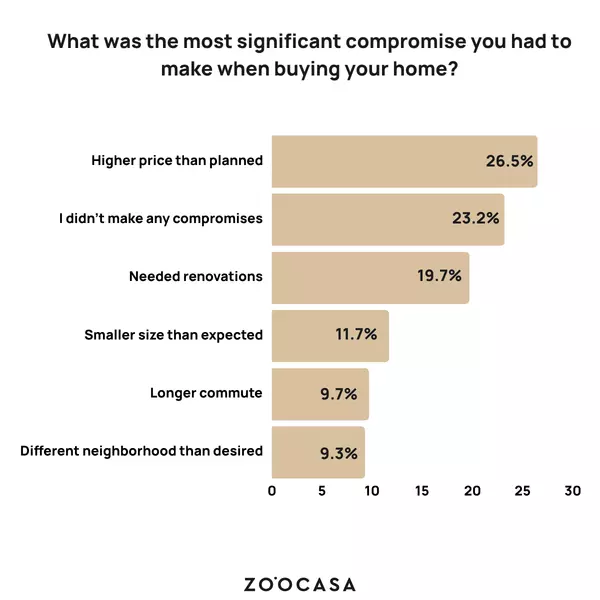

While today’s market does come with its challenges, buying a home now can pay off in the long run. If you’re ready to become a homeowner, don’t lose hope—there are creative solutions to make it happen. From exploring more affordable neighborhoods to considering condos or townhomes, or even taking advantage of down payment assistance programs, there are plenty of options to help you achieve your goal.

Sure, you could choose to wait. But if the reason you’re holding off is to perfectly time the market, this is the equity you’re leaving behind. The choice is yours.

Bottom Line

If you're weighing the decision to buy now or wait, remember this key principle: it’s time in the market, not timing the market, that makes the biggest difference in building long-term wealth. While it’s natural to want to make the most strategic choice, the reality is that starting sooner allows you to benefit from years of equity growth and appreciation.

If you’re ready to explore your options or simply want guidance on how to begin the journey toward homeownership, connecting with a trusted real estate agent can make all the difference. They can help you navigate the process, answer your questions, and develop a plan that fits your unique needs and goals. Reach out today and take the first step toward securing your future.

Categories

Recent Posts

GET MORE INFORMATION