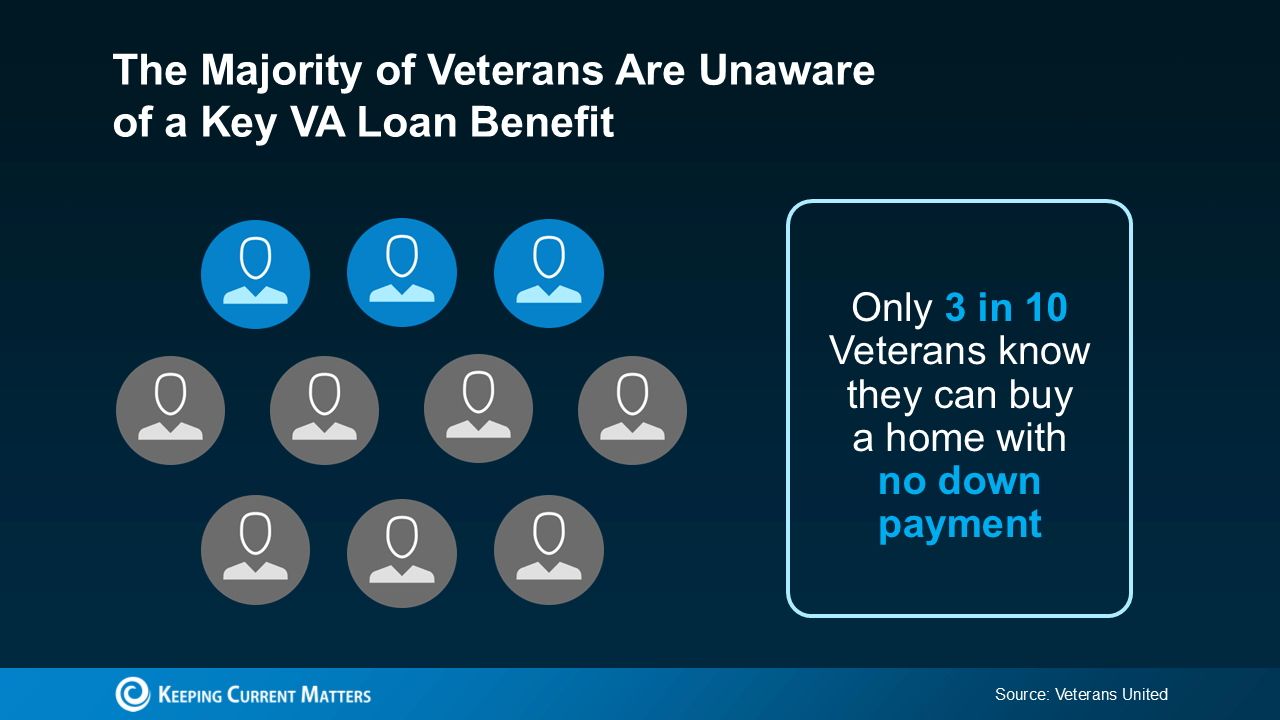

Most Veterans Are Unaware of an Important VA Loan Benefit

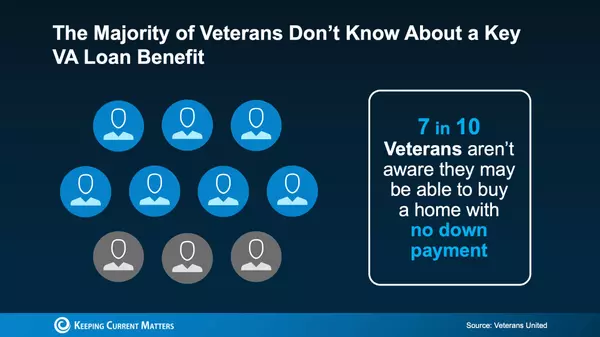

For more than 79 years, Veterans Affairs (VA) home loans have enabled countless Veterans to achieve their dream of homeownership. However, according to Veterans United, only 3 out of 10 Veterans know they may be able to purchase a home with no down payment required (see visual below):

That’s why it’s essential for Veterans—and anyone who supports them—to be informed about this valuable program. Understanding the resources available can make the journey to homeownership smoother and prevent life-changing plans from being delayed. As Veterans United puts it:

“Buying with 0% down is the hallmark benefit of this nearly 80-year-old program. Eligible Veterans can purchase the home they can afford without the need to spend years saving for a down payment.”

The Benefits of VA Home Loans

VA home loans are crafted to help those who served our country become homeowners. Here are some of the benefits, as highlighted by the Department of Veterans Affairs:

- No Down Payment Options: Many Veterans can purchase a home without a down payment, making it easier to start the homebuying process.

- Reduced Closing Costs: VA loans limit the types of closing costs Veterans need to pay, helping keep more money in your pocket at closing.

- No Private Mortgage Insurance (PMI): Unlike other loans, VA loans don’t require PMI, which can mean lower monthly payments and significant savings over time.

To make the most of these advantages, work with a dedicated team of real estate experts, including a knowledgeable local agent and a trusted lender, who can guide you in achieving your homeownership goals.

Bottom Line

Homeownership is a central part of the American Dream, and VA home loans offer a unique opportunity for those who’ve served our country. Partner with a real estate professional to ensure you have the knowledge and support needed to make confident choices in today’s housing market.

Categories

Recent Posts

GET MORE INFORMATION