Prioritize Time Invested in the Market Over Trying to Time It

Should you buy a home now or wait? This is a significant question many people are pondering today. While the right timing for you depends on various personal factors, here's something you might not have considered.

If you can purchase at today's rates and prices, it might be more beneficial to concentrate on your time in the market rather than trying to time it.

The Drawbacks of Attempting to Time the Market

Trying to time the market is not a reliable strategy due to its unpredictability. For example, for most of this year, projections indicated that mortgage rates would decrease. While experts still believe this will happen, changes in various market and economic factors have delayed the expected timing. This has affected homebuyers who have been waiting on the sidelines. As U.S. News states:

“Those who delayed purchasing a home in the past few years, hoping for lower mortgage rates, have found themselves excluded from the market. Mortgage rates have remained higher for longer than anticipated, keeping monthly housing payments elevated. In other words, waiting did not improve affordability for these individuals.”

This is why attempting to time the market might not be beneficial if you are prepared and able to buy now.

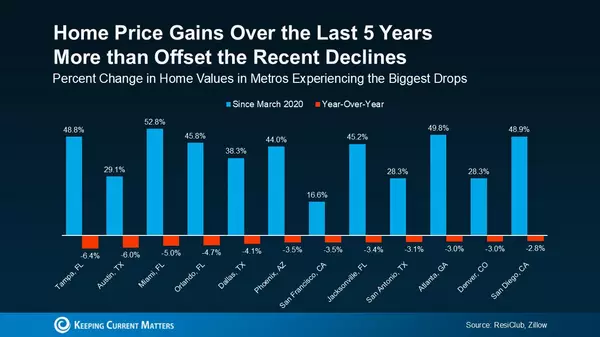

The Evidence Speaks: How Homeowners Gain from Increasing Home Prices

Postponing your plans means missing out on the equity you could start building if you purchase today. The potential equity gains at risk might surprise you.

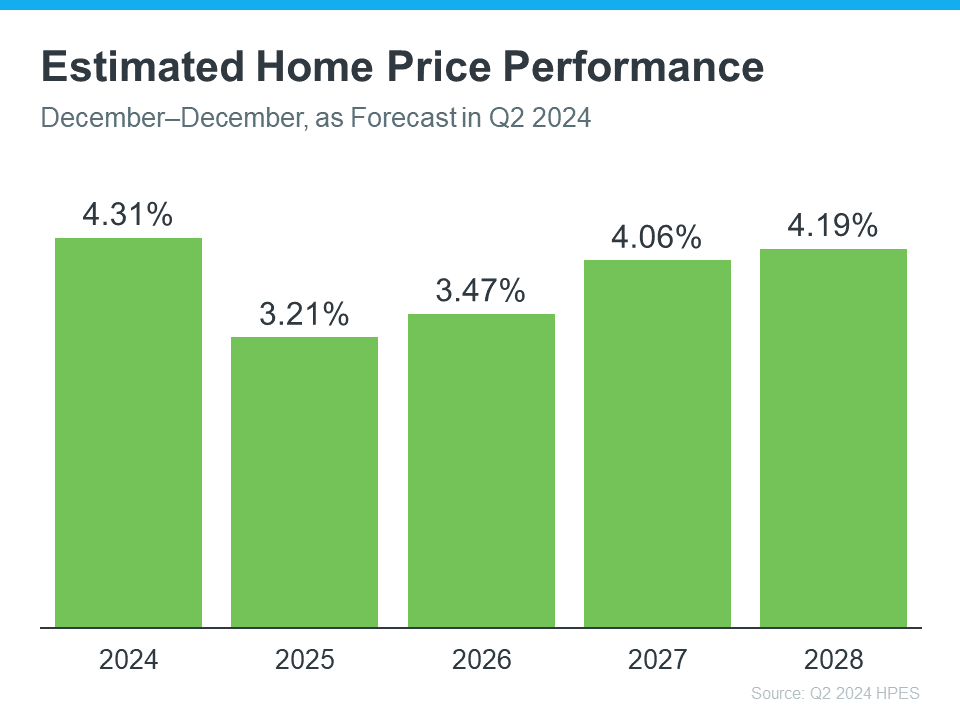

Every quarter, Fannie Mae publishes the Home Price Expectations Survey. This survey gathers forecasts from over one hundred economists, real estate experts, and investment and market strategists about home prices for the next five years. In the most recent release, experts predict that home prices will continue to rise at least through 2028 (see the graph below):

To provide context for these figures, let's examine a breakdown of the potential gains once you make a purchase. The graph below illustrates how the value of a typical home could appreciate over the next few years based on those HPES projections:

For instance, suppose you proceeded with purchasing a $400,000 home earlier this year. According to the expert forecasts from the HPES, you could potentially accumulate over $83,000 in household wealth over the next five years. That's a substantial amount.

This data illustrates why being in the market over time is crucial.

Essential Advice for Those Ready and Able to Buy Now

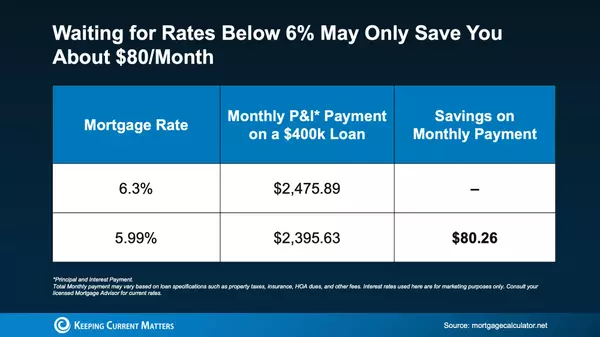

Currently, you might be concentrating on the impact of mortgage rates on your monthly payment, but remember to also consider home prices.

Prices are projected to keep increasing, albeit at a slower rate. While a gradual price increase might not be enjoyable at the moment, owning a home will make that growth a significant advantage. This is where the importance of time in the market comes into play.

Certainly, attempting to time the market is an option, but it's essential to weigh the equity you could forego in the interim. If you're prepared and capable of buying now, the question to ponder is: is waiting truly worthwhile?

Instead of concentrating on timing the market, it's more advantageous to prioritize being in the market over time.

As U.S. News Real Estate sums up:

"There's no universal answer to whether now is the ideal time to purchase a home. . . . Predicting future market movements is uncertain . . . Striving for perfect market timing shouldn't be the objective. Your decision should hinge on your individual requirements, financial capabilities, and the time available to find the right home."

Bottom Line

If you're unsure whether to purchase now or wait, keep in mind the importance of being in the market rather than timing it. If you're eager to initiate the process and position yourself for substantial equity gains, reach out to an agent to get started.

Categories

Recent Posts

GET MORE INFORMATION